Question: B H A 1 Problem 8-12 2 3 OpenSeas, Inc., is evaluating the purchase of a new cruise ship. The ship will cost $500 million,

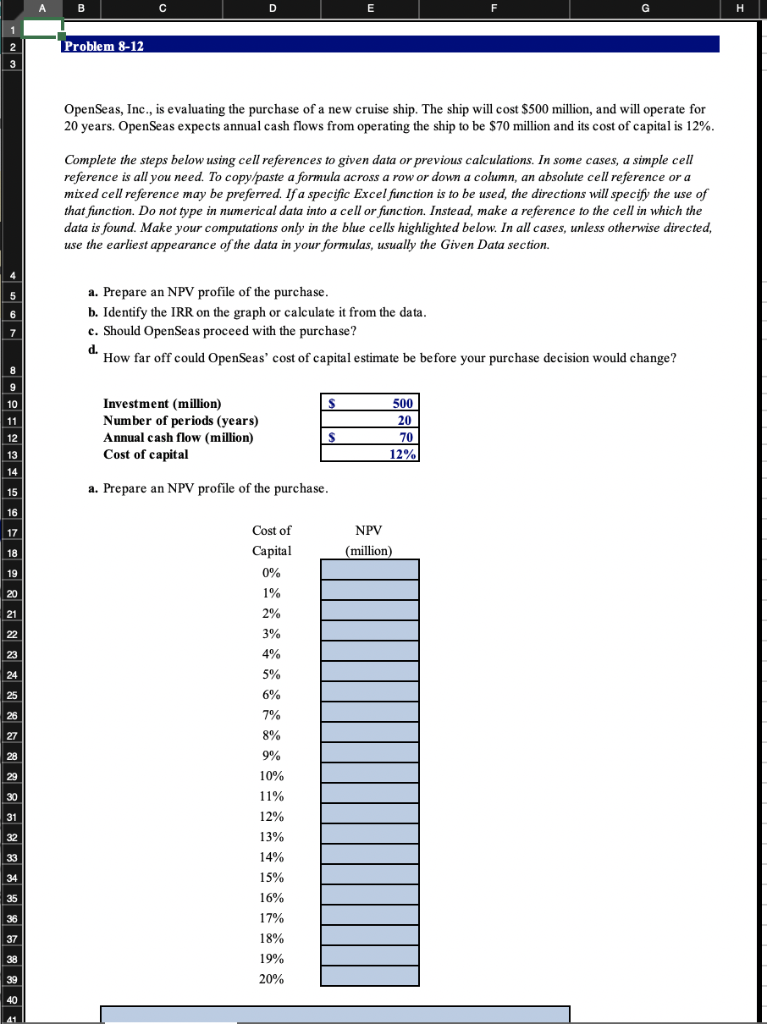

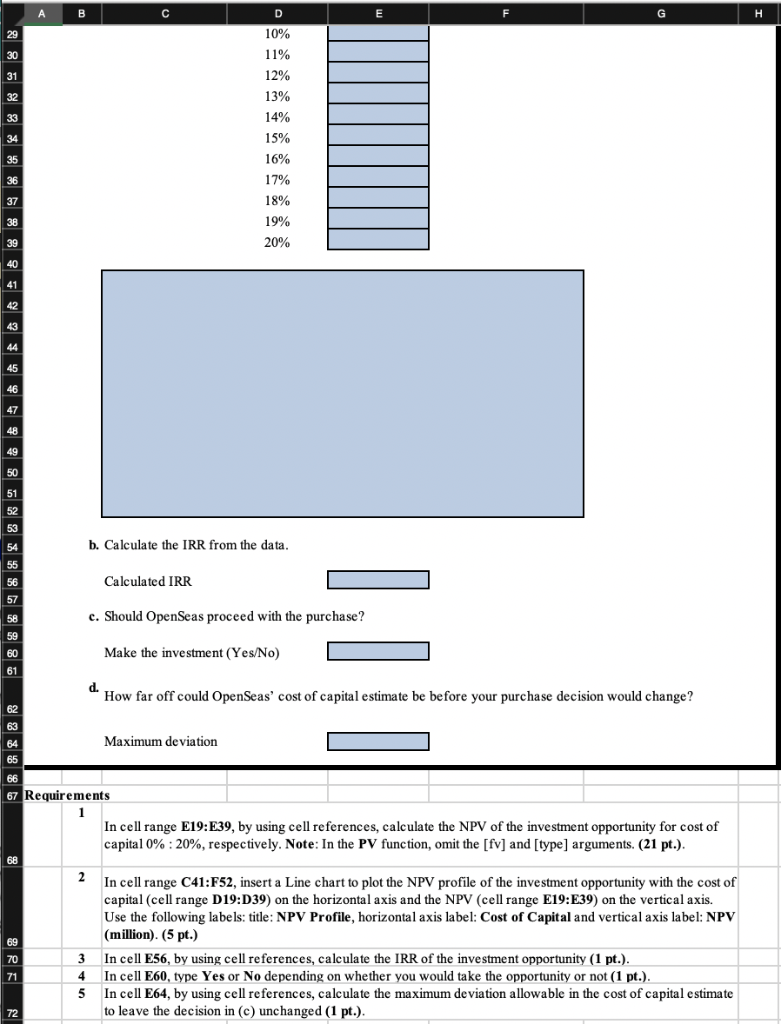

B H A 1 Problem 8-12 2 3 OpenSeas, Inc., is evaluating the purchase of a new cruise ship. The ship will cost $500 million, and will operate for 20 years. OpenSeas expects annual cash flows from operating the ship be $70 million and its cost of capital is 12 %. Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usualy the Given Data section. Prepare an NPV profile of the purchase a. 5 b. Identify the IRR on the graph or calculate it from the data. 6 c. Should OpenSeas proceed with the purchase? 7 d. How far off could OpenSeas' cost of capital estimate be before your purchase decision would change? S 10 Investment (million) Number of perio ds (years) Annual cash flow (million) Cost of capital 500 20 11 70 12 12% 13 14 a. Prepare an NPV profile of the purchase. 15 16 Cost of NPV 17 Capital (million) 18 0% 19 1% 20 2% 21 3% 22 4% 23 5% 24 6% 25 7% 26 8% 27 9% 28 10% 29 11% 12% 31 13% 14% 33 15% 34 16% 35 17% 36 18% 37 19% 38 20% 39 C D G B H 10% 29 11% 30 12% 31 13% 32 14% 33 15% 16% 35 17% 36 18% 37 19% 38 20% 39 40 41 42 43 45 46 47 48 49 51 52 53. b. Calculate the IRR from the data. 54 55 Calculated IRR 56 57 c. Should OpenSeas proceed with the purchase? 58 59 Make the investment (Yes/No) 60 61 d. How far off could OpenSeas' cost of capital estimate be before your purchase decision would change? 62 63 Maximum deviation 64 65 66 67 Requirements In cell range E19:E39, by using cell references, calculate the NPV of the investment opportunity for cost of capital 0% : 20%, respectively. Note: In the PV function, omit the [fv] and [type] arguments. (21 pt.). 68 2 In cell range C41: F52, insert a Line chart to plot the NPV profile of the investment opportunity with the cost of capital (cell range D19: D39) on the horizontal axis and the NPV (cell range E19: E39) on the vertic al axis. Use the following labe ls: title: NPV Profile, horizontal axis label: Cost of Capital and vertical axis label: NPV (million). (5 pt. 69 In cell E56, by using cell references, caleulate the IRR of the investment opportunity (1 pt.). In cell E60, type Yes or No depending on whether you would take the opportunity or not (1 pt.). 3 70 4 71 5 In cell E64, by using cell references, calculate the maximum deviation allowable in the cost of capital estimate to leave the decision in (e) unchanged (1 pt.). 72 B H A 1 Problem 8-12 2 3 OpenSeas, Inc., is evaluating the purchase of a new cruise ship. The ship will cost $500 million, and will operate for 20 years. OpenSeas expects annual cash flows from operating the ship be $70 million and its cost of capital is 12 %. Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usualy the Given Data section. Prepare an NPV profile of the purchase a. 5 b. Identify the IRR on the graph or calculate it from the data. 6 c. Should OpenSeas proceed with the purchase? 7 d. How far off could OpenSeas' cost of capital estimate be before your purchase decision would change? S 10 Investment (million) Number of perio ds (years) Annual cash flow (million) Cost of capital 500 20 11 70 12 12% 13 14 a. Prepare an NPV profile of the purchase. 15 16 Cost of NPV 17 Capital (million) 18 0% 19 1% 20 2% 21 3% 22 4% 23 5% 24 6% 25 7% 26 8% 27 9% 28 10% 29 11% 12% 31 13% 14% 33 15% 34 16% 35 17% 36 18% 37 19% 38 20% 39 C D G B H 10% 29 11% 30 12% 31 13% 32 14% 33 15% 16% 35 17% 36 18% 37 19% 38 20% 39 40 41 42 43 45 46 47 48 49 51 52 53. b. Calculate the IRR from the data. 54 55 Calculated IRR 56 57 c. Should OpenSeas proceed with the purchase? 58 59 Make the investment (Yes/No) 60 61 d. How far off could OpenSeas' cost of capital estimate be before your purchase decision would change? 62 63 Maximum deviation 64 65 66 67 Requirements In cell range E19:E39, by using cell references, calculate the NPV of the investment opportunity for cost of capital 0% : 20%, respectively. Note: In the PV function, omit the [fv] and [type] arguments. (21 pt.). 68 2 In cell range C41: F52, insert a Line chart to plot the NPV profile of the investment opportunity with the cost of capital (cell range D19: D39) on the horizontal axis and the NPV (cell range E19: E39) on the vertic al axis. Use the following labe ls: title: NPV Profile, horizontal axis label: Cost of Capital and vertical axis label: NPV (million). (5 pt. 69 In cell E56, by using cell references, caleulate the IRR of the investment opportunity (1 pt.). In cell E60, type Yes or No depending on whether you would take the opportunity or not (1 pt.). 3 70 4 71 5 In cell E64, by using cell references, calculate the maximum deviation allowable in the cost of capital estimate to leave the decision in (e) unchanged (1 pt.). 72

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts