Question: b. How would you answer part a. if the correlation coefficient between Funds A and B were 1? Could these expected returns and standard deviations

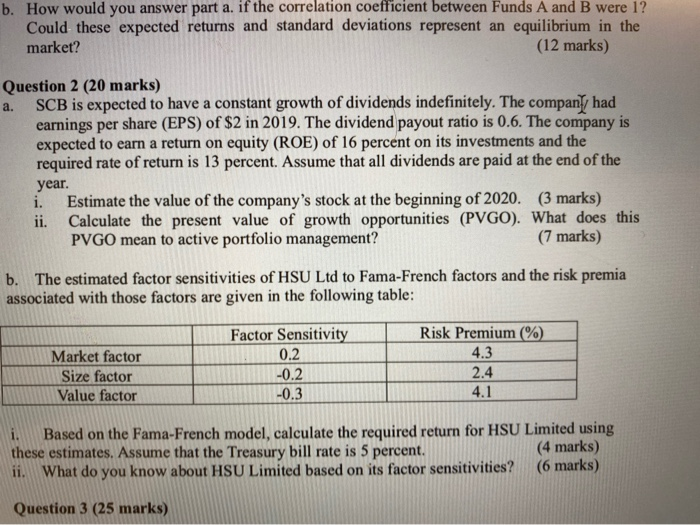

b. How would you answer part a. if the correlation coefficient between Funds A and B were 1? Could these expected returns and standard deviations represent an equilibrium in the market? (12 marks) a. Question 2 (20 marks) SCB is expected to have a constant growth of dividends indefinitely. The company had earnings per share (EPS) of $2 in 2019. The dividend payout ratio is 0.6. The company is expected to earn a return on equity (ROE) of 16 percent on its investments and the required rate of return is 13 percent. Assume that all dividends are paid at the end of the year. i. Estimate the value of the company's stock at the beginning of 2020. (3 marks) ii. Calculate the present value of growth opportunities (PVGO). What does this PVGO mean to active portfolio management? (7 marks) b. The estimated factor sensitivities of HSU Ltd to Fama-French factors and the risk premia associated with those factors are given in the following table: Market factor Size factor Value factor Factor Sensitivity 0.2 -0.2 -0.3 Risk Premium (%) 4.3 2.4 4.1 i. Based on the Fama-French model, calculate the required return for HSU Limited using these estimates. Assume that the Treasury bill rate is 5 percent. (4 marks) ii. What do you know about HSU Limited based on its factor sensitivities? (6 marks) Question 3 (25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts