Question: B. How would your answer in Part A change it the expecteu saies grumu 4. (Sustainable Sales Growth Rates and Additional Funds Needed) The Minoso

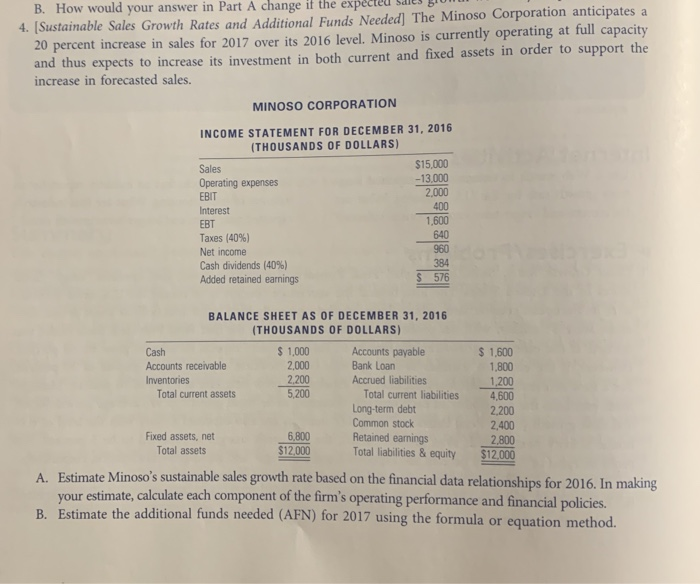

B. How would your answer in Part A change it the expecteu saies grumu 4. (Sustainable Sales Growth Rates and Additional Funds Needed) The Minoso Corporation anticipates a 20 percent increase in sales for 2017 over its 2016 level. Minoso is currently operating at full capacity and thus expects to increase its investment in both current and fixed assets in order to support the increase in forecasted sales. MINOSO CORPORATION INCOME STATEMENT FOR DECEMBER 31, 2016 (THOUSANDS OF DOLLARS) Sales $15,000 Operating expenses -13,000 EBIT 2.000 Interest 400 EBT 1,600 Taxes (40%) 640 Net income Cash dividends (40%) Added retained earnings $ 576 384 $ 1,600 1.800 BALANCE SHEET AS OF DECEMBER 31, 2016 (THOUSANDS OF DOLLARS) Cash $ 1,000 Accounts payable Accounts receivable 2,000 Bank Loan Inventories 2.200 Accrued liabilities Total current assets 5.200 Total current liabilities Long-term debt Common stock Fixed assets, net 6.800 Retained earnings Total assets $12,000 Total liabilities & equity 1 200 4,600 2,200 2,400 2,800 $12,000 A. Estimate Minoso's sustainable sales growth rate based on the financial data relationships for 2016. In making your estimate, calculate each component of the firm's operating performance and financial policies. B. Estimate the additional funds needed (AFN) for 2017 using the formula or equation method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts