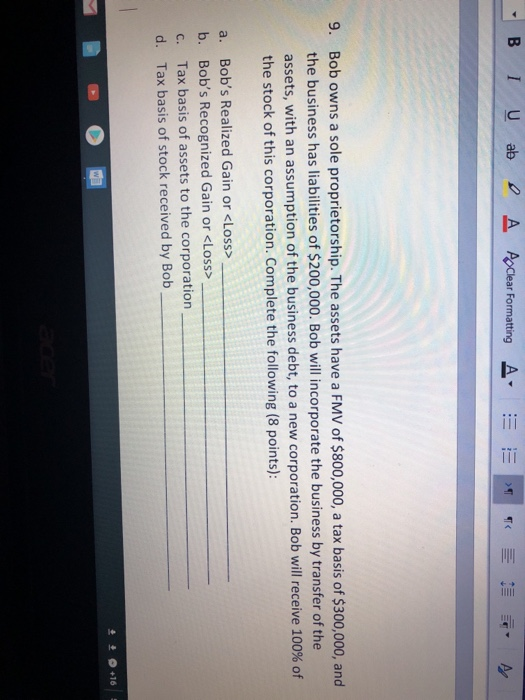

Question: B I U ab Aoclear Formatting -- 9. Bob owns a sole proprietorship. The assets have a FMV of $800,000, a tax basis of $300,000,

B I U ab Aoclear Formatting -- 9. Bob owns a sole proprietorship. The assets have a FMV of $800,000, a tax basis of $300,000, and the business has liabilities of $200,000. Bob will incorporate the business by transfer of the assets, with an assumption of the business debt, to a new corporation. Bob will receive 100% of the stock of this corporation. Complete the following (8 points): a. Bob's Realized Gain or

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts