Question: B IC U 5 > C IM IM 68 Clipboard 5 Font 5 Alignment a Numt D2 B D E F G H 1 BF435

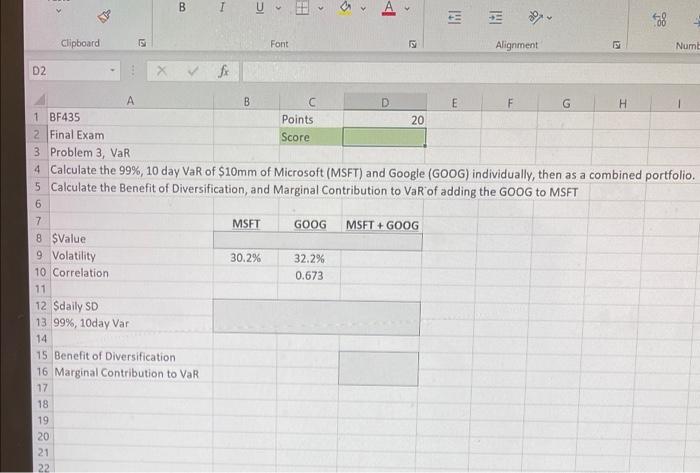

B IC U 5 > C IM IM 68 Clipboard 5 Font 5 Alignment a Numt D2 B D E F G H 1 BF435 Points 20 2 Final Exam Score 3 Problem 3, VaR 4 Calculate the 99%, 10 day VaR of $10mm of Microsoft (MSFT) and Google (GOOG) individually, then as a combined portfolio. 5 Calculate the Benefit of Diversification, and Marginal Contribution to VaR of adding the GOOG to MSFT 6 7 MSFT GOOG MSFT + GOOG 8 Value 9 Volatility 30.2% 32.2% 10 Correlation 0.673 11 12 Sdaily SD 13 99%, 10day Var 14 15 Benefit of Diversification 16 Marginal Contribution to VaR 17 18 19 20 21 22 B IC U 5 > C IM IM 68 Clipboard 5 Font 5 Alignment a Numt D2 B D E F G H 1 BF435 Points 20 2 Final Exam Score 3 Problem 3, VaR 4 Calculate the 99%, 10 day VaR of $10mm of Microsoft (MSFT) and Google (GOOG) individually, then as a combined portfolio. 5 Calculate the Benefit of Diversification, and Marginal Contribution to VaR of adding the GOOG to MSFT 6 7 MSFT GOOG MSFT + GOOG 8 Value 9 Volatility 30.2% 32.2% 10 Correlation 0.673 11 12 Sdaily SD 13 99%, 10day Var 14 15 Benefit of Diversification 16 Marginal Contribution to VaR 17 18 19 20 21 22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts