Question: B I-CLI BELECT B EXER Bb Micro Bb INCL Grande Gnoise f ( Q tudi Chap S Chap Chap Q Finar HW3C Solve + -

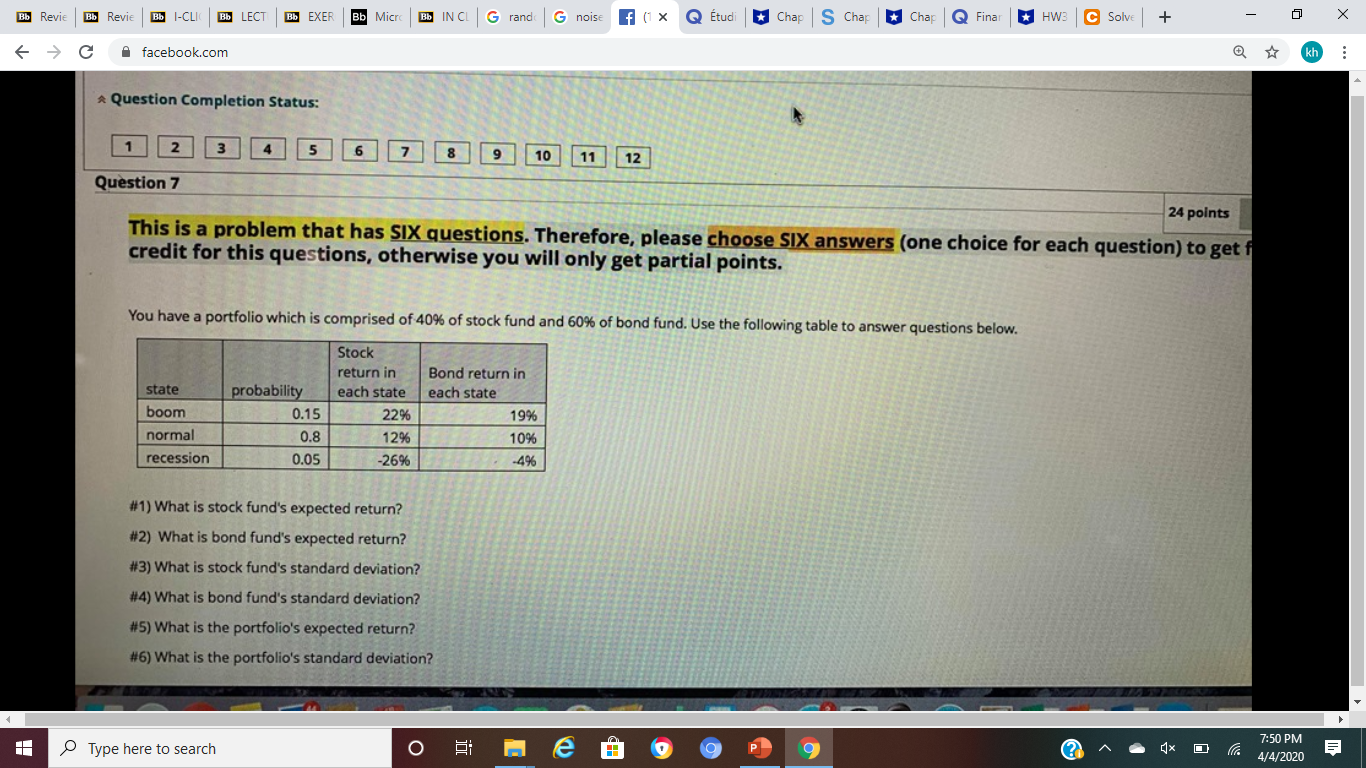

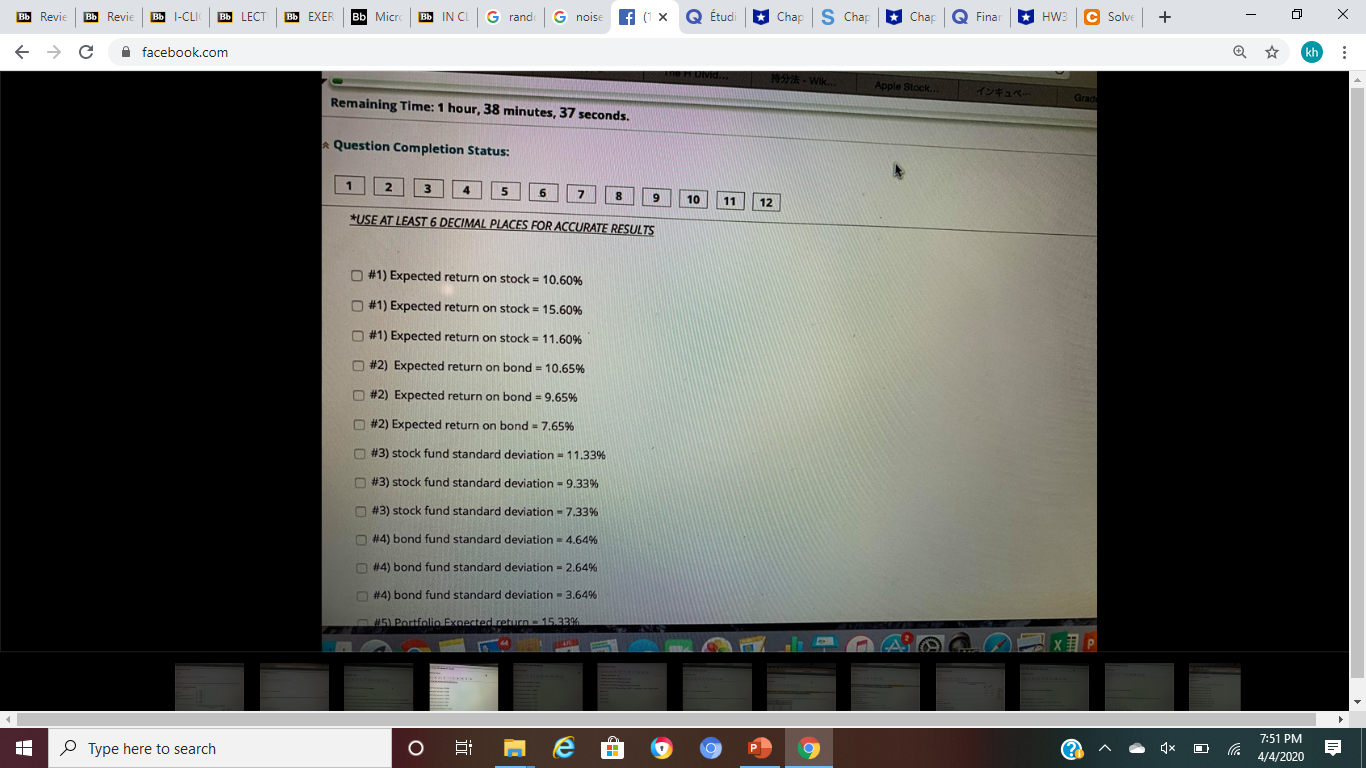

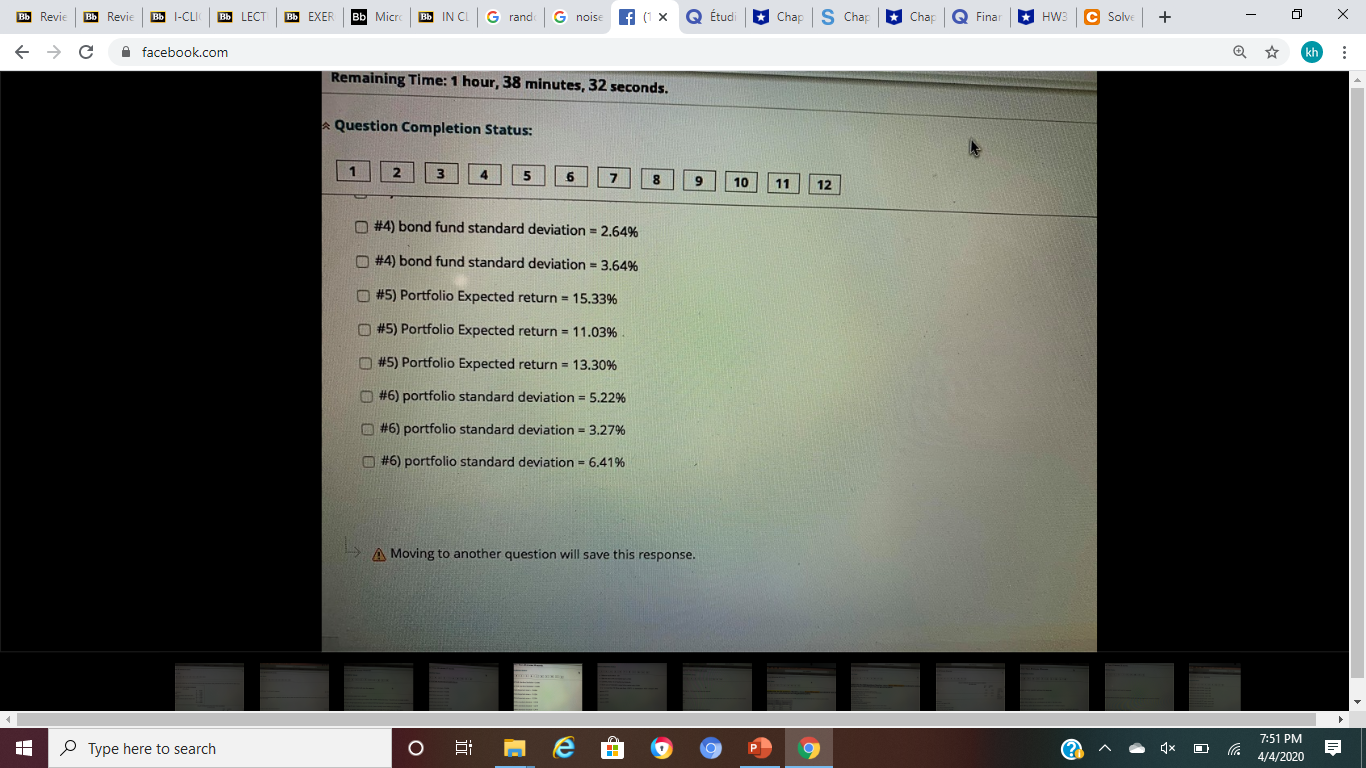

B I-CLI BELECT B EXER Bb Micro Bb INCL Grande Gnoise f ( Q tudi Chap S Chap Chap Q Finar HW3C Solve + - 0 X Bb Revie B Revie E C facebook.com Question Completion Status: 1 2 3 4 5 6 7 8 9 10 11 12 Question 7 24 points This is a problem that has SIX questions. Therefore, please choose Six answers (one choice for each question) to get f credit for this questions, otherwise you will only get partial points. You have a portfolio which is comprised of 40% of stock fund and 60% of bond fund. Use the following table to answer questions below. Bond return in each state 19% state boom normal recession Stock return in each state 2 2% 12% -26% probability 0. 15 0.8 0.05 10% . #1) What is stock fund's expected return? #2) What is bond fund's expected return? #3) What is stock fund's standard deviation? #4) What is bond fund's standard deviation? #5) What is the portfolio's expected return? #6) What is the portfolio's standard deviation? 7:50 PM Type here to search @ ^ . 4x o le 4/4/2020 E EXER Bb Micro Bb INC Grande Gnoise f ( Q tudi Chap S Chap Chap Q Finar HW3 C Solve + - 0 X Bb Revie B Revie B I-CLI BS LECT + C facebook.com Apple Stock... 1 Remaining Time: 1 hour, 38 minutes, 37 seconds. Question Completion Status: 1 2 3 4 5 6 8 *USE AT LEAST 6 DECIMAL PLACES FOR ACCURATE RESULTS 10 11 12] #1) Expected return on stock = 10.60% #1) Expected return on stock = 15.60% #1) Expected return on stock = 11.60% #2) Expected return on bond = 10.65% #2) Expected return on bond = 9.65% #2) Expected return on bond = 7.65% #3) stock fund standard deviation - 11.33% #3) stock fund standard deviation - 9.33% #3) stock fund standard deviation - 7.33% #4) bond fund standard deviation - 4.64% #4) bond fund standard deviation - 2.64% #4) bond fund standard deviation - 3.64% 5 Dordfolio Expected return - 151220 7:51 PM Type here to search ^ 1x D l 4/4/2020 E EXER Bb Micro Bb INC Grande Gnoise f ( Q tudi Chap S Chap Chap Q Finar HW3 C Solve + - 0 X Bb Revie B Revie B I-CLI BS LECT + C facebook.com Remaining Time: 1 hour, 38 minutes, 32 seconds. Question Completion Status: 1 2 3 4 5 6 7 8 9 10 11 12 #4) bond fund standard deviation = 2.64% #4) bond fund standard deviation - 3.64% #5) Portfolio Expected return = 15.33% #5) Portfolio Expected return = 11.03% #5) Portfolio Expected return = 13.30% #6) portfolio standard deviation = 5.22% #6) portfolio standard deviation = 3.27% #6) portfolio standard deviation - 6.41% > A Moving to another question will save this response. 7:51 PM Type here to search o & @ @ @ ^ 1x D l 4/4/2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts