Question: b If your spouse itemizes on a separate refum or you were a dual-status alien, check 396 40 Itemized deductions (from Schedule A) or your

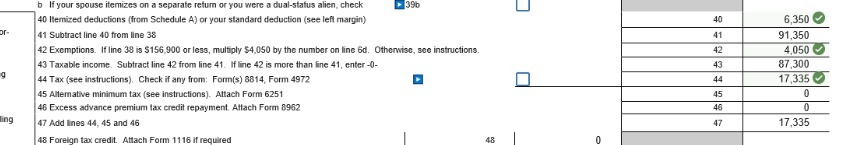

b If your spouse itemizes on a separate refum or you were a dual-status alien, check 396 40 Itemized deductions (from Schedule A) or your standard deduction (see left margin) 40 6,350 or- 41 Subtract line 40 from line 33 41 91,350 42 Exemptions. If line 38 is $156.900 or less, multiply $4,050 by the number on line 6d. Otherwise, see instructions. 42 4,050 43 Taxable income. Subtract line 42 from line 41. If line 42 is more than line 41, enter -0- 43 87.300 44 Tax (see instructions). Check if any from: Form(s) 8814, Form 4972 F 44 17,335 45 Allemative minimum tax (see instructions). Attach Form 6251 45 0 46 Excess advance premium tax credit repayment Attach Form 8962 46 ling 17 Add lines 44, 45 and 46 47 17,335 43 Foreign tax credit. Attach Form 1116 if required 48 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts