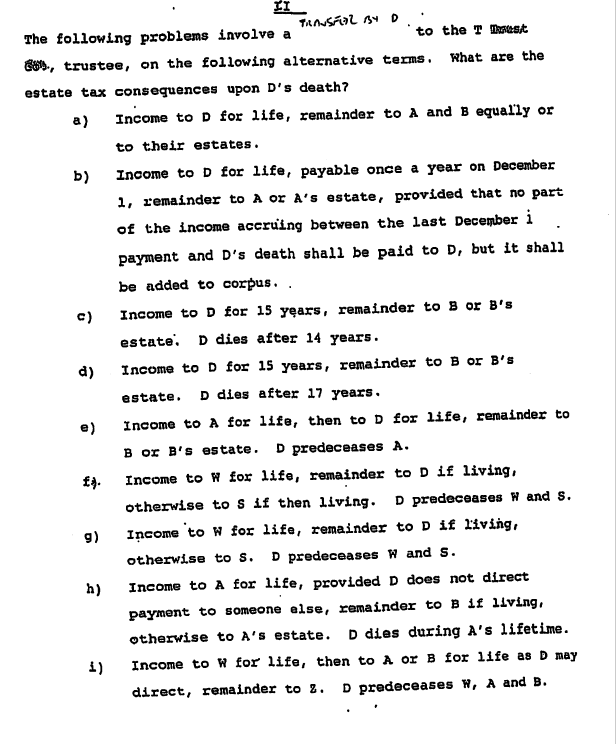

Question: b) II TRANSFER BY D The following problems involve a to the Thaust 881., trustee, on the following alternative terms. What are the estate tax

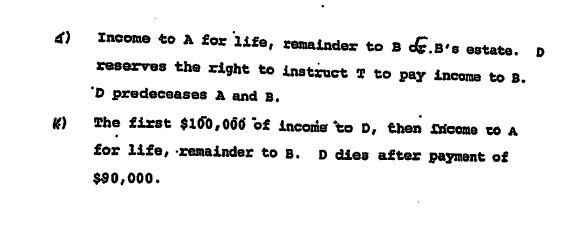

b) II TRANSFER BY D The following problems involve a to the Thaust 881., trustee, on the following alternative terms. What are the estate tax consequences upon D's death? a) Income to D for life, remainder to A and B equally or to their estates. Income to D for 11fe, payable once a year on December 1, remainder to A or A's estate, provided that no part of the income accruing between the last December i payment and D's death shall be paid to D, but it shall be added to corpus. . c) Income to D for 15 years, remainder to B or B's estate D dies after 14 years. d) Income to D for 15 years, remainder to B or B's estate. D dies after 17 years. Income to A for 11fe, then to D for life, remainder to Bor B's estate. D predeceases A. fy. Income to W for life, remainder to D if living, otherwise to s if then living. D predeceases H and s. 9) Income to w for life, remainder to D 1f living otherwise to s. D predeceases W and s. h) Income to A for life, provided D does not direct payment to someone else, remainder to B 1. living, otherwise to A's estate. D dies during A's lifetime. i) Income to W for life, then to A Or B for life as D may direct, remainder to 2. D predeceases W, A and B. Income to A for life, remaindex to B 0.B's estate. D reserves the right to instruct I to pay income to B. 'D predeceases A and B. The first $100,000 of Income to D, then tricome to A for life, remainder to B. D dies after payment of $90,000 K) b) II TRANSFER BY D The following problems involve a to the Thaust 881., trustee, on the following alternative terms. What are the estate tax consequences upon D's death? a) Income to D for life, remainder to A and B equally or to their estates. Income to D for 11fe, payable once a year on December 1, remainder to A or A's estate, provided that no part of the income accruing between the last December i payment and D's death shall be paid to D, but it shall be added to corpus. . c) Income to D for 15 years, remainder to B or B's estate D dies after 14 years. d) Income to D for 15 years, remainder to B or B's estate. D dies after 17 years. Income to A for 11fe, then to D for life, remainder to Bor B's estate. D predeceases A. fy. Income to W for life, remainder to D if living, otherwise to s if then living. D predeceases H and s. 9) Income to w for life, remainder to D 1f living otherwise to s. D predeceases W and s. h) Income to A for life, provided D does not direct payment to someone else, remainder to B 1. living, otherwise to A's estate. D dies during A's lifetime. i) Income to W for life, then to A Or B for life as D may direct, remainder to 2. D predeceases W, A and B. Income to A for life, remaindex to B 0.B's estate. D reserves the right to instruct I to pay income to B. 'D predeceases A and B. The first $100,000 of Income to D, then tricome to A for life, remainder to B. D dies after payment of $90,000 K)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts