Question: b. Intel used the Black-Scholes formula to estimate fair value of options granted each year. How did the change in volatility from 2009 y=to 2010

b. Intel used the Black-Scholes formula to estimate fair value of options granted each year. How did the change in volatility from 2009 y=to 2010 affect share-based compensation in 2010? What about the change in risk-free rate?

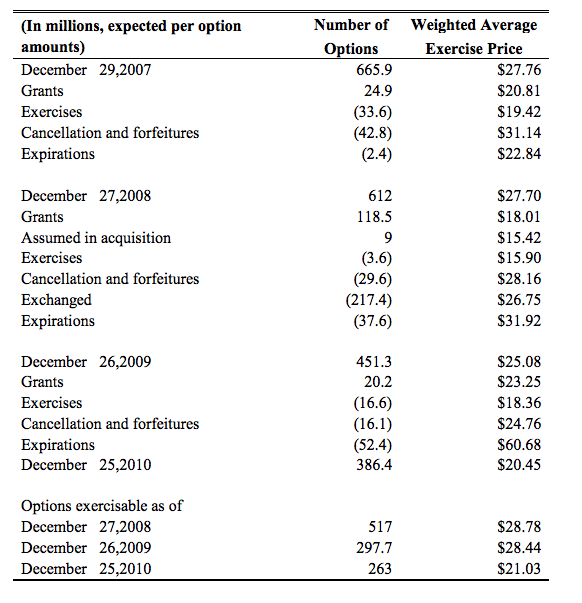

c. How many options were exercised during 2010? Estimate the cash that Intel received from its employees when these options were exercised?

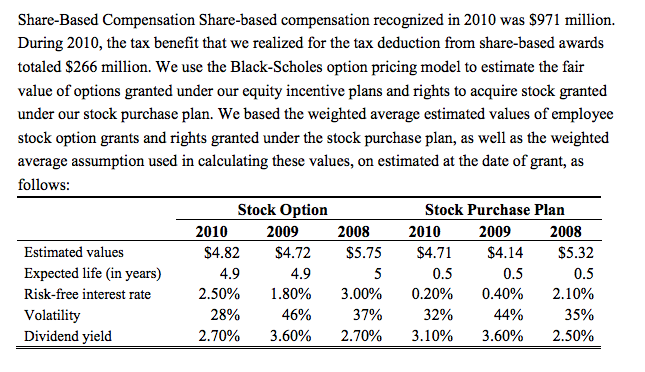

Share-Based Compensation Share-based compensation recognized in 2010 was S971 million. During 2010, the tax benefit that we realized for the tax deduction from share-based awards totaled S266 million. We use the Black-Scholes option pricing model to estimate the fair value of options granted under our equity incentive plans and rights to acquire stock granted under our stock purchase plan. We based the weighted average estimated values of employee stock option grants and rights granted under the stock purchase plan, as well as the weighted average assumption used in calculating these values, on estimated at the date of grant, as follows: Stock Purchase Plan Stock option 2010 2009 2008 2010 2009 2008 Estimated values $4.82 $4.72 $5.75 $4.71 $4.14 $5.32 Expected life (in years) 4.9 4.9 0.5 0.5 0.5 Risk-free interest rate 2.50% 1.80% 3.000% 0.20% 0.40% 2.10% 28% 46 37% 32% 44% 35% Volatility Dividend yield 2.70% 3.60% 2.70% 3.10% 3.60% 2.50% Share-Based Compensation Share-based compensation recognized in 2010 was S971 million. During 2010, the tax benefit that we realized for the tax deduction from share-based awards totaled S266 million. We use the Black-Scholes option pricing model to estimate the fair value of options granted under our equity incentive plans and rights to acquire stock granted under our stock purchase plan. We based the weighted average estimated values of employee stock option grants and rights granted under the stock purchase plan, as well as the weighted average assumption used in calculating these values, on estimated at the date of grant, as follows: Stock Purchase Plan Stock option 2010 2009 2008 2010 2009 2008 Estimated values $4.82 $4.72 $5.75 $4.71 $4.14 $5.32 Expected life (in years) 4.9 4.9 0.5 0.5 0.5 Risk-free interest rate 2.50% 1.80% 3.000% 0.20% 0.40% 2.10% 28% 46 37% 32% 44% 35% Volatility Dividend yield 2.70% 3.60% 2.70% 3.10% 3.60% 2.50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts