Question: ( B is correct, I need assistance with A and C please! Thank you! Bowman Corporation is considering an investment in special-purpose equipment to enable

| ( B is correct, I need assistance with A and C please! Thank you! Bowman Corporation is considering an investment in special-purpose equipment to enable the company to obtain a four-year government contract for the manufacture of a special item. The equipment costs $226,000 and would have no salvage value when the contract expires at the end of the four years. Estimated annual operating results of the project are as follows:

|

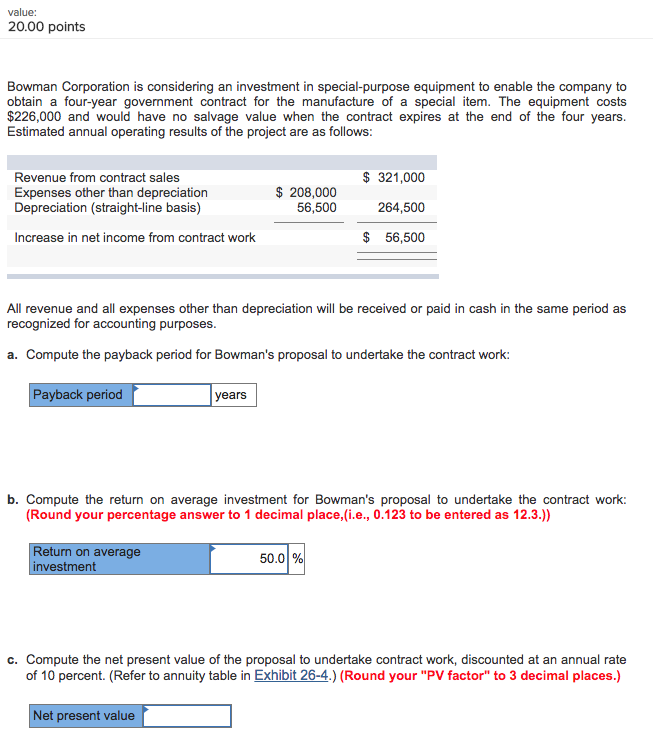

value: 20.00 points Bowman Corporation is considering an investment in special-purpose equipment to enable the company to obtain a four-year government contract for the manufacture of a special item. The equipment costs $226,000 and would have no salvage value when the contract expires at the end of the four years Estimated annual operating results of the project are as follows Revenue from contracts Expenses other than depreciation Depreciation (straight-line basis) $ 321,000 264,500 $ 56,500 208,000 56,500 Increase in net income from contract work All revenue and all expenses other than depreciation will be received or paid in cash in the same period as reco gnized for accounting purposes a. Compute the payback period for Bowman's proposal to undertake the contract work: Payback period years b. Compute the return on average investment for Bowman's proposal to undertake the contract work: (Round your percentage answer to 1 decimal place,(i.e., 0.123 to be entered as 12.3.)) eturn on average vestme 50.0 c. Compute the net present value of the proposal to undertake contract work, discounted at an annual rate of 10 percent. (Refer to annuity table in Exhibit 26-4.) (Round your "PV factor" to 3 decimal places.) Net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts