Question: * * * B is the only one I really need help with but if you could do A , C and D as well

B is the only one I really need help with but if you could do A C and D as well id appreciate it I'll also provide a screenshot of the trial balance to make that part more readable

This case compares two companies, Alpha Company and Bravo Company, that have

identical business transactions during their fiscal year, but because of the use of

different accounting methods and estimates their financial results are not the same.

The fiscal year ends on December for both companies.

Accounting methods and estimates:

Uncollectible Accounts Estimate

Alpha estimates that of Accounts Receivable is uncollectible, while Bravo

estimates that of Accounts Receivable is uncollectible.

Inventory Cost Flow Method

Alpha uses the FIFO method to value inventory, while Bravo uses the LIFO method.

Alpha calculated an ending inventory value of $ while Bravo's ending inventory

value is $

Depreciation Method

Both companies have estimated a useful life of years for their building and

years for equipment. Alpha uses the straightline depreciation method and they do

not estimate salvage value. Bravo uses the straightline method to depreciate their

building, but they use the doubledeclining balance method to depreciate their

equipment.

Income Taxes

The income tax rate is for both companies. Assume that income taxes will be

paid in the following March.

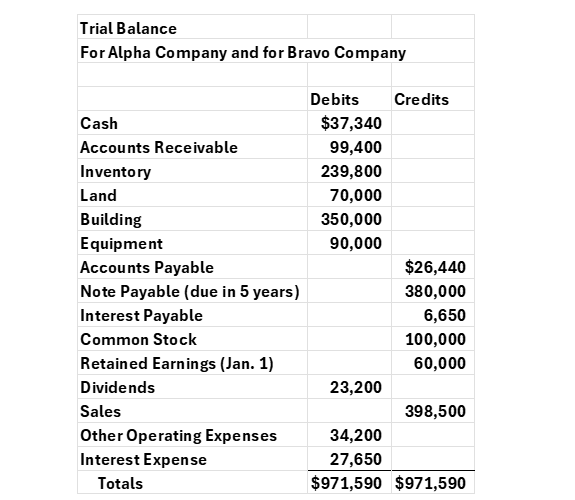

Prior to making the journal entries based on the information in and the

Trial Balance for each company is the same, as follows:

Trial Balance For Alpha Company and for Bravo Company Debits Credits Cash $ Accounts Receivable Inventory Land Building Equipment Accounts Payable $ Note Payable due in years Interest Payable Common Stock Retained Earnings Jan Dividends Sales Other Operating Expenses Interest Expense Totals $ $

a Prepare the journal entries for each company to record the information provided

above in items and

b Prepare a multiplestep Income Statement and a classified Balance Sheet for each

company.

c Calculate the following three ratios for each company

Current Ratio

Quick Ratio

Profit Margin on Sales

d Which company is more conservative in their accounting methods and estimates?

As a creditor or an investor, which company would you prefer to lend money to or

to invest in

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock