Question: b. Is there any difficulty associated with using the number of funds as the weights in computing the weighted average total return in part (a)?

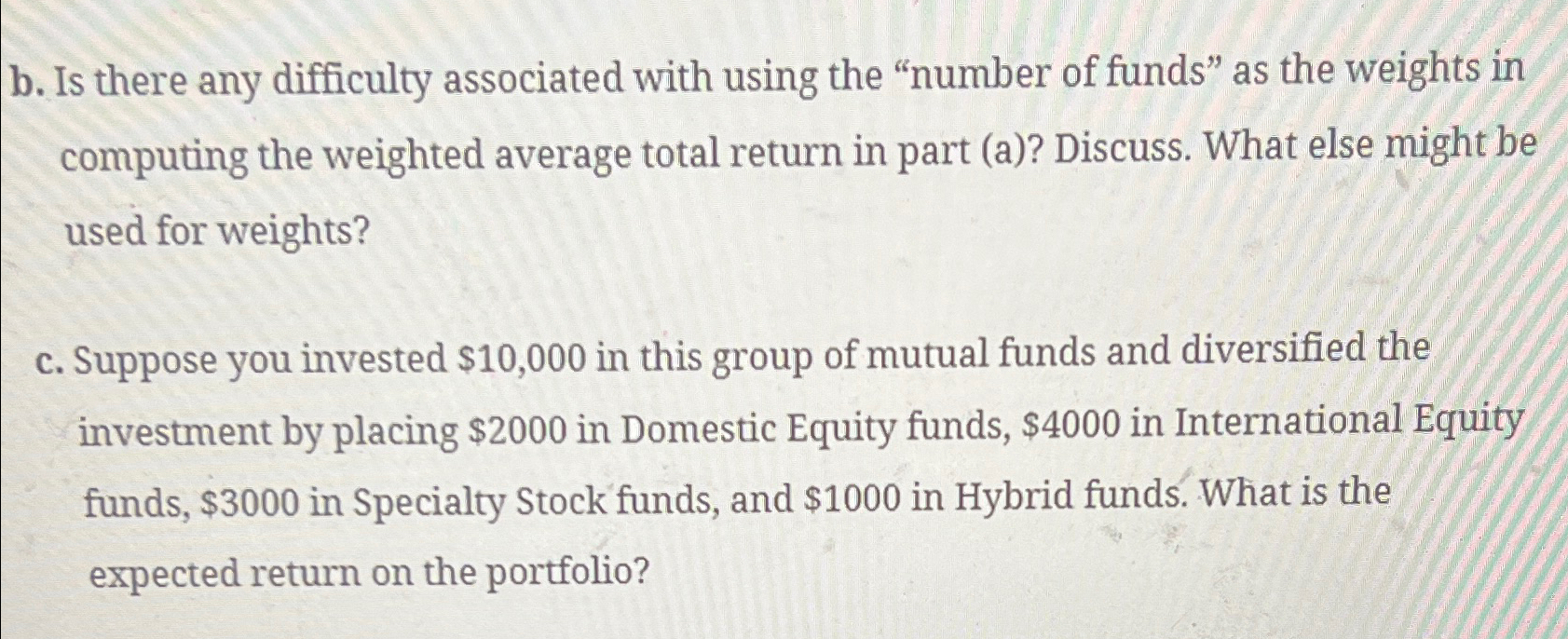

b. Is there any difficulty associated with using the "number of funds" as the weights in computing the weighted average total return in part (a)? Discuss. What else might be used for weights?\ c. Suppose you invested

$10,000in this group of mutual funds and diversified the investment by placing

$2000in Domestic Equity funds,

$4000in International Equity funds,

$3000in Specialty Stock funds, and

$1000in Hybrid funds. What is the expected return on the portfolio?

b. Is there any difficulty associated with using the "number of funds" as the weights in computing the weighted average total return in part (a)? Discuss. What else might be used for weights? c. Suppose you invested $10,000 in this group of mutual funds and diversified the investment by placing $2000 in Domestic Equity funds, $4000 in International Equity funds, $3000 in Specialty Stock funds, and $1000 in Hybrid funds. What is the expected return on the portfolio? b. Is there any difficulty associated with using the "number of funds" as the weights in computing the weighted average total return in part (a)? Discuss. What else might be used for weights? c. Suppose you invested $10,000 in this group of mutual funds and diversified the investment by placing $2000 in Domestic Equity funds, $4000 in International Equity funds, $3000 in Specialty Stock funds, and $1000 in Hybrid funds. What is the expected return on the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts