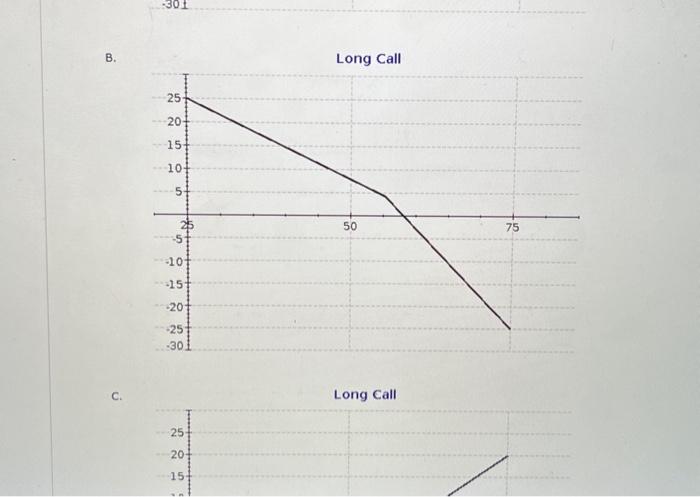

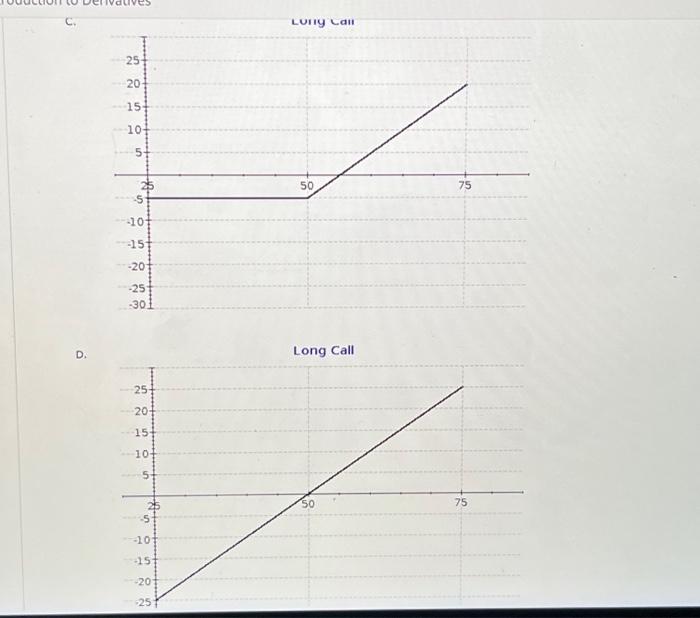

Question: B. Long Call c. Long Call c. Long Forward D. Long Forward The breakeven (i.e, zero profit) point is $ 3. A short position in

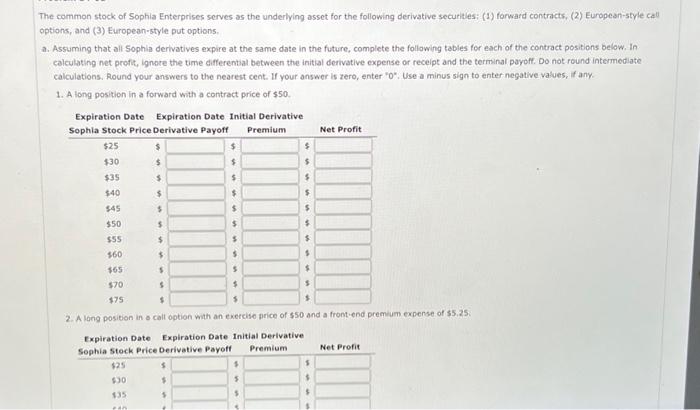

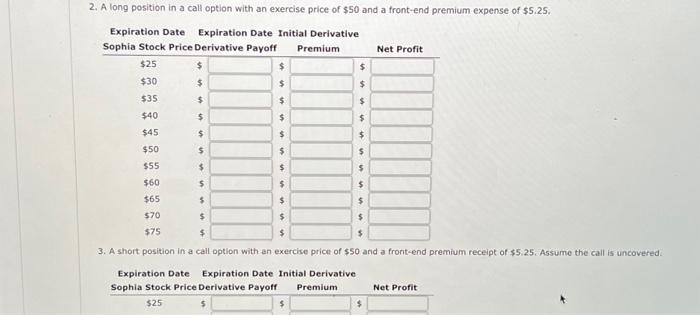

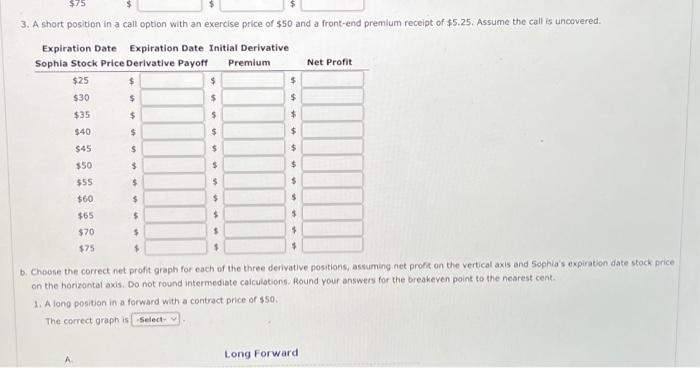

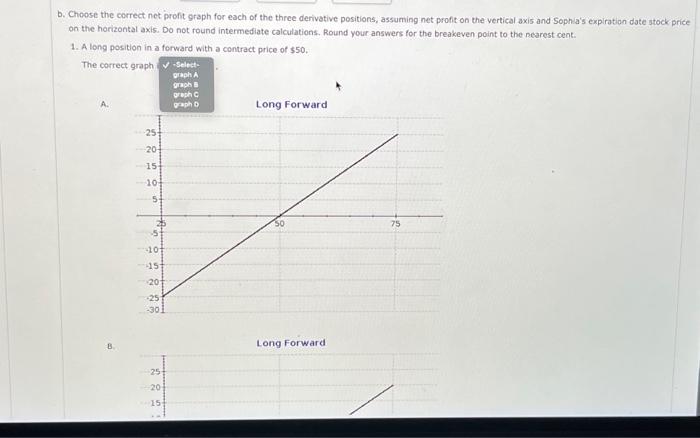

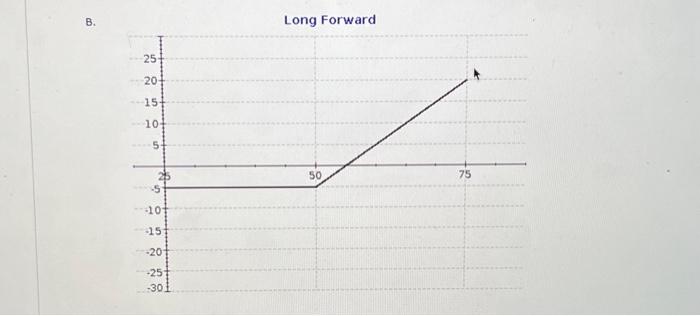

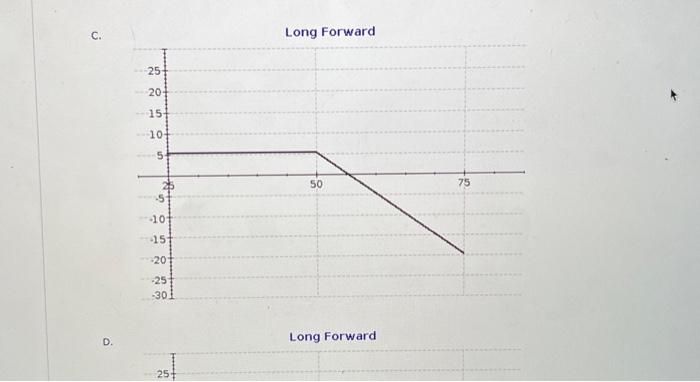

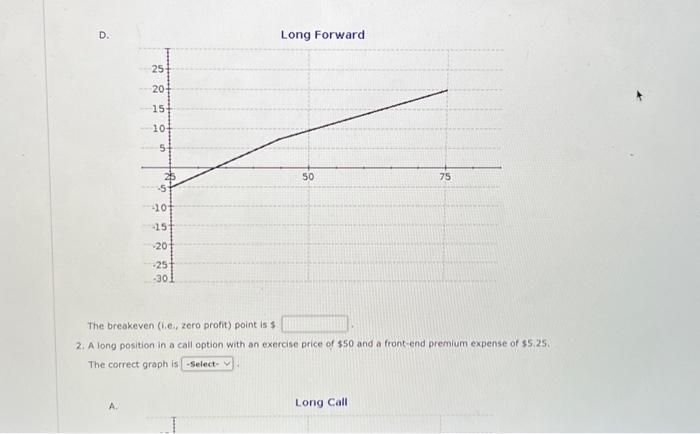

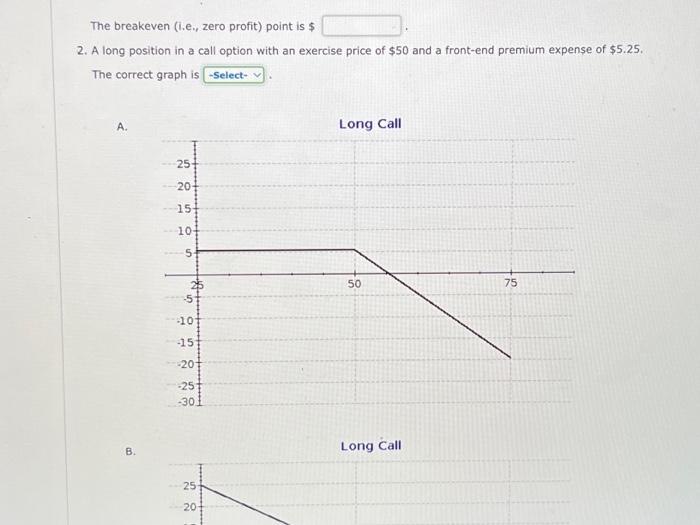

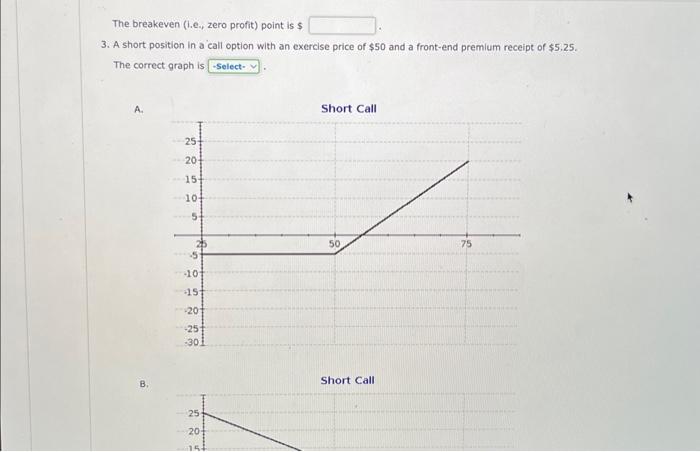

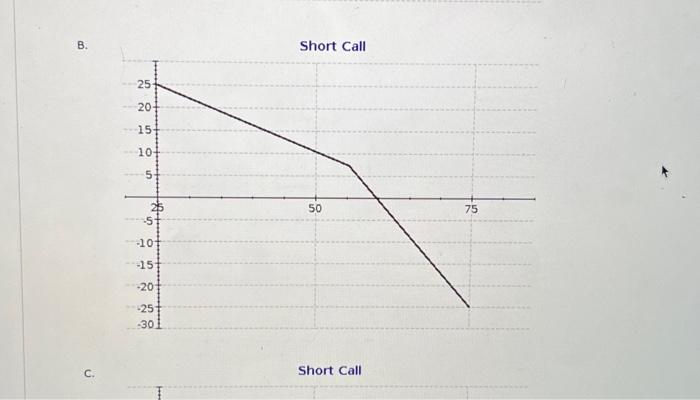

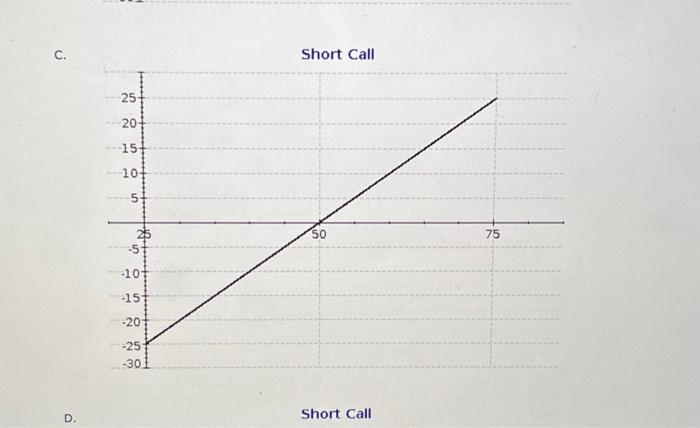

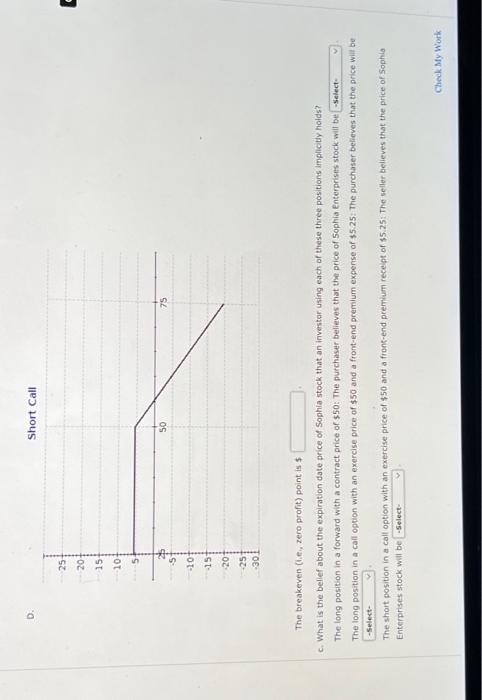

B. Long Call c. Long Call c. Long Forward D. Long Forward The breakeven (i.e, zero profit) point is $ 3. A short position in a 'ealt option with an exercise price of $50 and a front-end premium receipt of $5.25. The correct graph is The common stock of Sophia Enterprises serves as the underlying asset for the following derivative securities; (1) forward contracts, (2) European-style call options, and (3) Europenn-styfe put options. a. Assuming that all Sophia derivatives expire at the same date in the future, complete the following tables for each of the contract positions below. In calculating net profit, ignore the time differential between the initial derivative expense or receipt and the terminal payoff. Do not round intermediate calculations. Round your answers to the nearest cent, If your answer is zero, enter " 0 ". Use a minus sign to enter negative values, if any. 1. A long position in a forward with a contract price of $50. 2. A long position in a call option with an exercise price of $50 and a front-end premium expense of $5.25. Expiration Date Expiration Date Initial Derivative 3. A short position in a call option with an exercise price of $50 and a front-end premium receipt of $5,25. Assume the call is uncovered. Expiration Date Expiration Date Initial Derivative Sophia Stock Price Derivative Payoff Premium Net Profit $25 5 $ $ 3. A short position in a call option with an exercise price of $50 and a front-end premium receipt of $5.25. Assume the call is uncovered. b. Choose the correct net profit graph for each of the three derivative positions, assuming net profit on the vertical axis and 5 ophia's expiratien date stock price on the horizontal axis. Do not round intermediate caiculations. Round your answers for the breakeven point to the nearest cent. 1. A long position in a forward with a contract price of $50. The correct graph is The breakeven (1.ei, zero profit) point is $ c. What is the bellef about the expiration date price of Sophia stock that an investar using each of these three positions implictiv holds? The long position in a forward with a contract price of $50 : The purchaser believes that thet price of sophia Enterprises stock will be The long position in a call option with an exercise price of $50 and a front-end premium expense of $5.25 : The purchaser believes that the price will be The shart position in a call option with an exercise price of $50 and a front-end premium recelpt of $5.25 : The seller believes that the price of Sophla Enterprises stock. wul be The breakeven (i.e., zero profit) point is $ 2. A long position in a call option with an exercise price of $50 and a front-end premium expense of $5.25. The correct graph is C. Lurly Lail D. Long Call The breakeven (i.e., zero proht) point is \$ 2. A long position in a call option with an exercise price of $50 and a front-end premium expense of $5.25. The correct groph is B. Long Forward b. Choose the correct net profit graph for each of the three derivative positions, assuming net profit on the vertical axis and Sophia's expiration date atock price on the horizontal axis. Do not round intermediate calculations. Round your answers for tho breakeven point to the pearest cent. 1. A long position in a forward with a contract price of $50. B. Short Call c. Short Call

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts