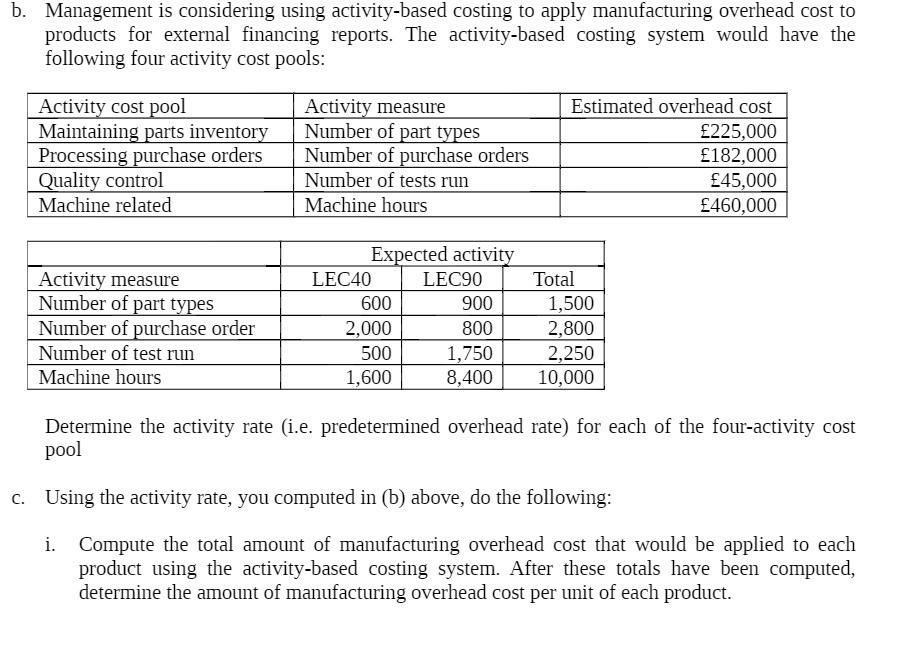

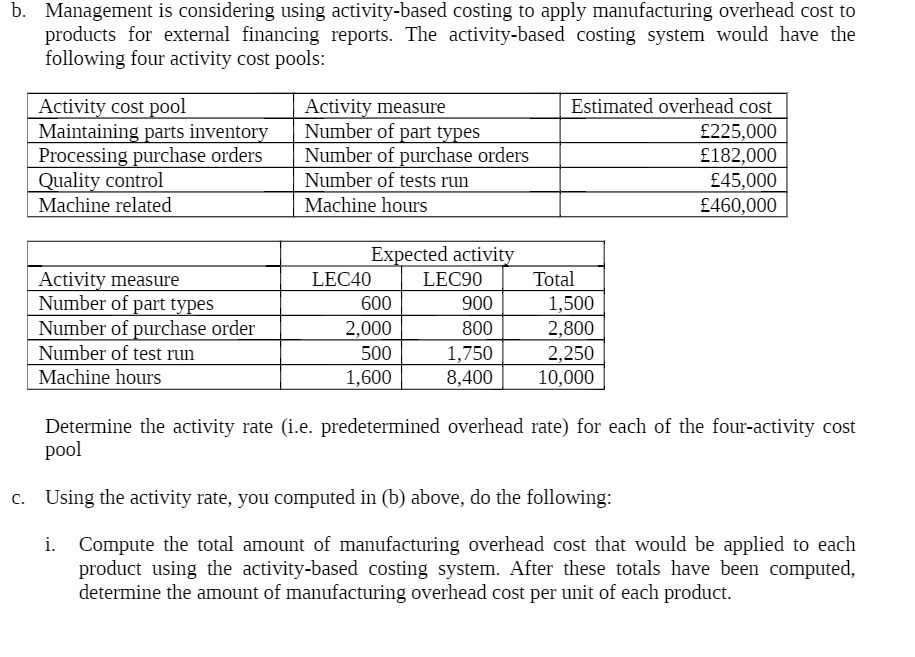

Question: b. Management is considering using activity-based costing to apply manufacturing overhead cost to products for external nancing reports. The activity-based costing system would have the

b. Management is considering using activity-based costing to apply manufacturing overhead cost to products for external nancing reports. The activity-based costing system would have the following four activity cost pools: Estimated overhead cost Number of -art -es 225,000 Processing purchase orders Number of purchase orders 182,000 Quali control Number of tests run 45,000 Machine related 460,000 - mm Number of test run 500 1,750 2,250 Machine hours 1,600 8,400 10,000 Determine the activity rate (i.e. predetermined overhead rate) for each of the four-activity cost pool c. Using the activity rate, you computed in (b) above, do the following: i. Compute the total amount of manufacturing overhead cost that would be applied to each product using the activity-based costing system. After these totals have been computed, determine the amount of manufacturing overhead cost per unit of each product

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts