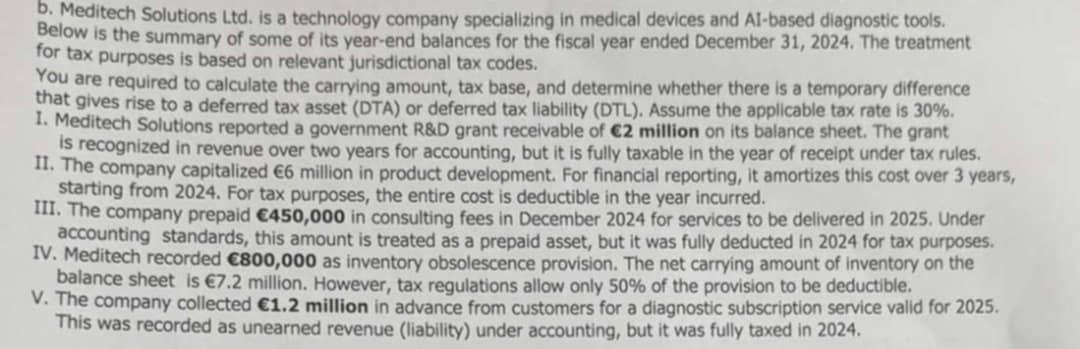

Question: b . Meditech Solutions Ltd . is a technology company specializing in medical devices and AI - based diagnostic tools. Below is the summary of

b Meditech Solutions Ltd is a technology company specializing in medical devices and AIbased diagnostic tools. Below is the summary of some of its yearend balances for the fiscal year ended December The treatment for tax purposes is based on relevant jurisdictional tax codes. You are required to calculate the carrying amount, tax base, and determine whether there is a temporary difference that gives rise to a deferred tax asset DTA or deferred tax liability DTL Assume the applicable tax rate is Meditech Solutions reported a government R&D grant receivable of mathbfC million on its balance sheet. The grant is recognized in revenue over two years for accounting, but it is fully taxable in the year of receipt under tax rules. II The company capitalized million in product development. For financial reporting, it amortizes this cost over years, starting from For tax purposes, the entire cost is deductible in the year incurred. III. The company prepaid mathbf in consulting fees in December for services to be delivered in Under accounting standards, this amount is treated as a prepaid asset, but it was fully deducted in for tax purposes. IV Meditech recorded mathbf as inventory obsolescence provision. The net carrying amount of inventory on the balance sheet is million. However, tax regulations allow only of the provision to be deductible. V The company collected mathbf million in advance from customers for a diagnostic subscription service valid for This was recorded as unearned revenue liability under accounting, but it was fully taxed in

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock