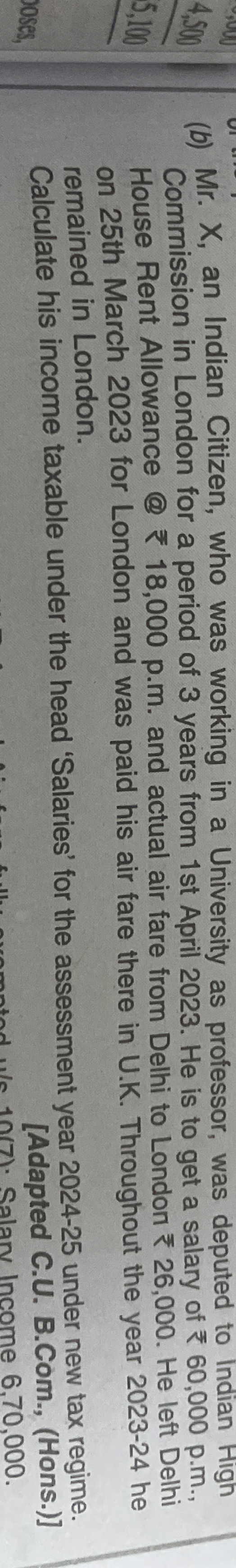

Question: ( b ) Mr . X , an Indian Citizen, who was working in a University as professor, was deputed to Indian High Commission in

b Mr X an Indian Citizen, who was working in a University as professor, was deputed to Indian High Commission in London for a period of years from st April He is to get a salary of pm House Rent Allowance @ pm and actual air fare from Delhi to London He left Delhi on th March for London and was paid his air fare there in UK Throughout the year he remained in London.

Calculate his income taxable under the head 'Salaries' for the assessment year under new tax regime.

Adapted CU

BCom., Hons Detail solution

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock