Question: B. MULTIPLE CHOICE QUESTIONS For each question, select the best answer and write the letter of the response you have chosen in the blank preceding

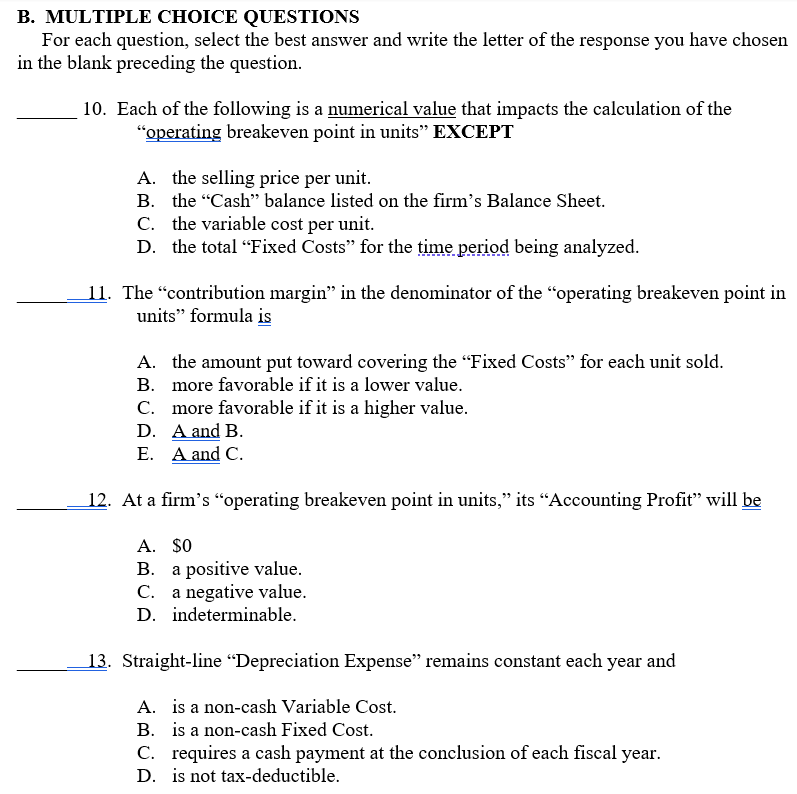

B. MULTIPLE CHOICE QUESTIONS For each question, select the best answer and write the letter of the response you have chosen in the blank preceding the question. 10. Each of the following is a numerical value that impacts the calculation of the "operating breakeven point in units" EXCEPT A. the selling price per unit. B. the "Cash" balance listed on the firm's Balance Sheet. C. the variable cost per unit. D. the total "Fixed Costs" for the time period being analyzed. 11. The "contribution margin" in the denominator of the "operating breakeven point in units" formula is A. the amount put toward covering the "Fixed Costs" for each unit sold. B. more favorable if it is a lower value. C. more favorable if it is a higher value. D. A and B. E. A and C. 12. At a firm's "operating breakeven point in units," its "Accounting Profit" will be A. $0 B. a positive value. C. a negative value. D. indeterminable. 13. Straight-line "Depreciation Expense" remains constant each year and A. is a non-cash Variable Cost. B. is a non-cash Fixed Cost. C. requires a cash payment at the conclusion of each fiscal year. D. is not tax-deductible. B. MULTIPLE CHOICE QUESTIONS For each question, select the best answer and write the letter of the response you have chosen in the blank preceding the question. 10. Each of the following is a numerical value that impacts the calculation of the "operating breakeven point in units" EXCEPT A. the selling price per unit. B. the "Cash" balance listed on the firm's Balance Sheet. C. the variable cost per unit. D. the total "Fixed Costs" for the time period being analyzed. 11. The "contribution margin" in the denominator of the "operating breakeven point in units" formula is A. the amount put toward covering the "Fixed Costs" for each unit sold. B. more favorable if it is a lower value. C. more favorable if it is a higher value. D. A and B. E. A and C. 12. At a firm's "operating breakeven point in units," its "Accounting Profit" will be A. $0 B. a positive value. C. a negative value. D. indeterminable. 13. Straight-line "Depreciation Expense" remains constant each year and A. is a non-cash Variable Cost. B. is a non-cash Fixed Cost. C. requires a cash payment at the conclusion of each fiscal year. D. is not tax-deductible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts