Question: B Number helppppp Question-6: [5+5+51 a) An investor develops a portfolio with 25% in a risk-free asset with a return of 6% and the rest

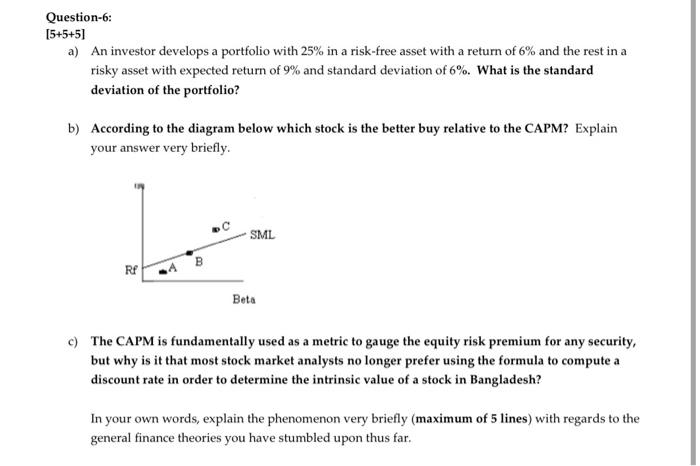

Question-6: [5+5+51 a) An investor develops a portfolio with 25% in a risk-free asset with a return of 6% and the rest in a risky asset with expected return of 9% and standard deviation of 6%. What is the standard deviation of the portfolio? b) According to the diagram below which stock is the better buy relative to the CAPM? Explain your answer very briefly. SML B RE Beta c) The CAPM is fundamentally used as a metric to gauge the equity risk premium for any security, but why is it that most stock market analysts no longer prefer using the formula to compute a discount rate in order to determine the intrinsic value of a stock in Bangladesh? In your own words, explain the phenomenon very briefly (maximum of 5 lines) with regards to the general finance theories you have stumbled upon thus far

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts