Question: B only! ox in a while. Do you want to clean it up for a fresh, like-new experience? And by the way, month the return

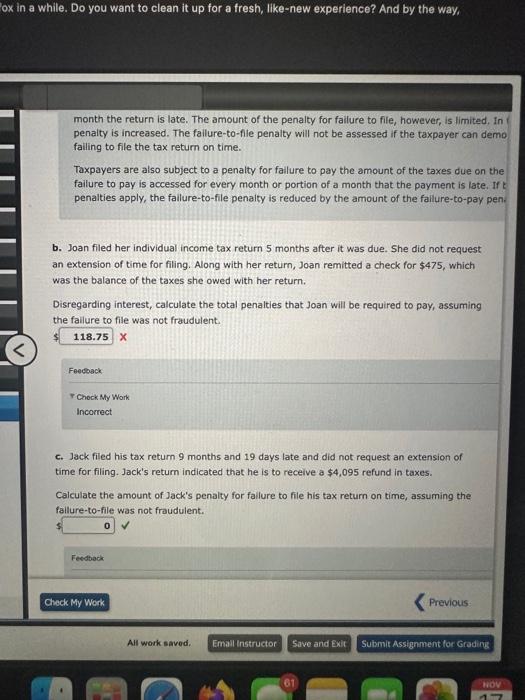

ox in a while. Do you want to clean it up for a fresh, like-new experience? And by the way, month the return is late. The amount of the penalty for failure to file, however, is limited, In penaity is increased. The fallure-to-file penalty will not be assessed if the taxpayer can demo failing to file the tax return on time. Taxpayers are also subject to a penalty for fallure to pay the amount of the taxes due on the failure to pay is accessed for every month or portion of a month that the payment is late. If b penalties apply, the failure-to-file penalty is reduced by the amount of the fallure-to-pay pen. b. Joan filed her individual income tax return 5 months after it was due. She did not request an extension of time for filing. Along with her return, Joan remitted a check for $475, which was the balance of the taxes she owed with her return. Disregarding interest, calculate the total penalties that Joan will be required to pay, assuming the failure to file was not fraudulent. Feedaack T Chock My Work Incorrect c. Jack filed his tax retum 9 months and 19 days late and did not request an extension of time for filing. Jack's retum indicated that he is to receive a $4,095 refund in taxes. Calculate the amount of Jack's penalty for fallure to file his tax return on time, assuming the fallure-to-file was not fraudulent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts