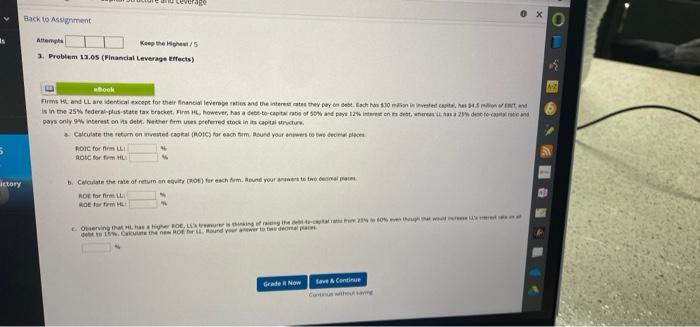

Question: b ox Back to Assignment Attempts Keep the Highest/5 3. Problem 13.05 (Financial Leverage Effects) Book Firms HL and LL are identical except for their

ox Back to Assignment Attempts Keep the Highest/5 3. Problem 13.05 (Financial Leverage Effects) Book Firms HL and LL are identical except for their financial leverage ratios and the interest rates they pay on debt. Each has $30 mason in invested capital, hes 34.5 mon of ERIT, and is in the 25% federal-plus-state tax bracket, Firm HL, however, has a debt-to-capital ratio of 50% and pays 12% interest on its debt, whereas LL has a 25% deseto-cart and pays only 9% interest on its debt. Neither firm uses preferred stock in its capital structure. a Calculate the return on invested capital (ROIC) for each firm. Round your answers to two decal places ROIC for frm LL ROIC for frm HL ictory b. Calculate the rate of return on equity (ROE) for each firm. Round your answers to two decimal pla RDE for firm LL ROE for frm HL Observing that HL has a higher BOE, L's treasurer is thing of raising the debt-caparat 25% to 60% me through that would se debt to 15% Calculate the new ROE for LL. Round your anewer to the decimal places Grade Now Save & Continue s

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts