Question: b. Prepare a balance sheet for Smith Corporation upon its emergence from reorganization SMITH CORPORATION Balance Sheet December 31, 2017 ASSETS Current Assets: Land, Buildings,

b. Prepare a balance sheet for Smith Corporation upon its emergence from reorganization

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

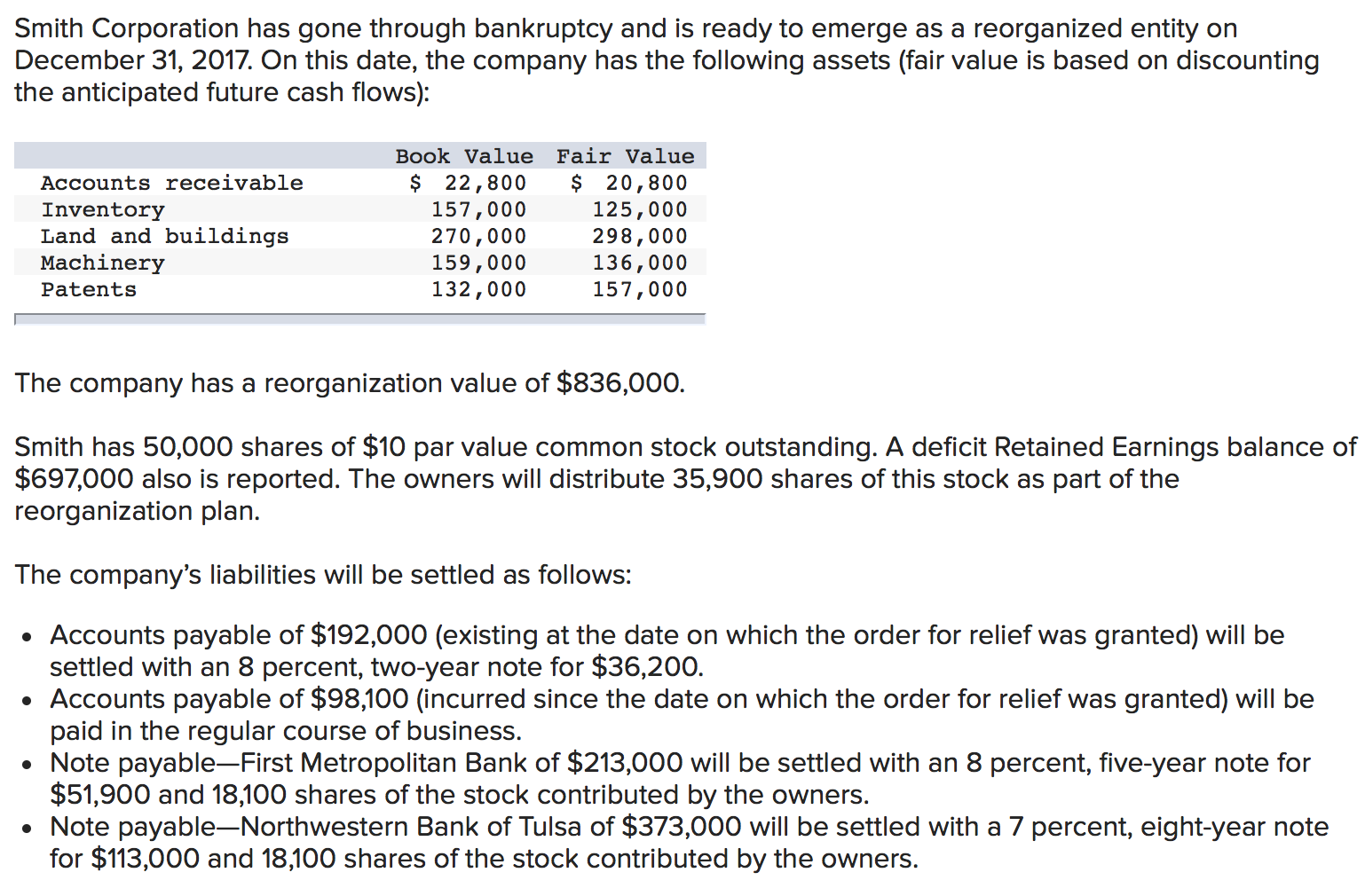

Smith Corporation has gone through bankruptcy and is ready to emerge as a reorganized entity on December 31, 2017. On this date, the company has the following assets (fair value is based on discounting the anticipated future cash flows): Accounts receivable Inventory Land and buildings Machinery Patents Book Value $ 22,800 157,000 270,000 159,000 132,000 Fair Value $ 20,800 125,000 298,000 136,000 157,000 The company has a reorganization value of $836,000. Smith has 50,000 shares of $10 par value common stock outstanding. A deficit Retained Earnings balance of $697,000 also is reported. The owners will distribute 35,900 shares of this stock as part of the reorganization plan. The company's liabilities will be settled as follows: Accounts payable of $192,000 (existing at the date on which the order for relief was granted) will be settled with an 8 percent, two-year note for $36,200. Accounts payable of $98,100 (incurred since the date on which the order for relief was granted) will be paid in the regular course of business. Note payableFirst Metropolitan Bank of $213,000 will be settled with an 8 percent, five-year note for $51,900 and 18,100 shares of the stock contributed by the owners. Note payable-Northwestern Bank of Tulsa of $373,000 will be settled with a 7 percent, eight-year note for $113,000 and 18,100 shares of the stock contributed by the owners

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts