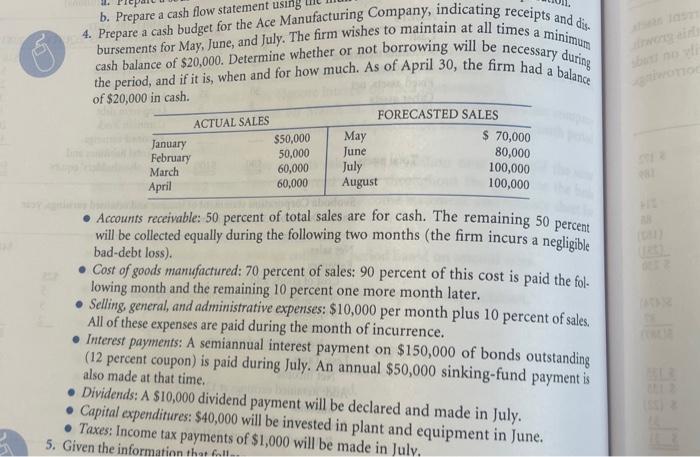

Question: b. Prepare a cash flow statementipating receipts and dis. bursements for May, June, and July. The firm wishes to maintain at all times a minimum

b. Prepare a cash flow statementipating receipts and dis. bursements for May, June, and July. The firm wishes to maintain at all times a minimum cash balance of $20,000. Determine whether or not borrowing will be necessary during the period, and if it is, when and for how much. As of April 30, the firm had a balance of $20,00n:m meh - Accounts receivable: 50 percent of total sales are for cash. The remaining 50 percent will be collected equally during the following two months (the firm incurs a negligible bad-debt loss). - Cost of goods manufactured: 70 percent of sales: 90 percent of this cost is paid the fol. lowing month and the remaining 10 percent one more month later. - Selling general, and administrative expenses: $10,000 per month plus 10 percent of sales. All of these expenses are paid during the month of incurrence. - Interest payments: A semiannual interest payment on $150,000 of bonds outstanding (12 percent coupon) is paid during July. An annual $50,000 sinking-fund payment is also made at that time. - Dividends: A \$10,000 dividend payment will be declared and made in July. - Capital expenditures: $40,000 will be invested in plant and equipment in June. - Taxes: Income tax payments of $1,000 will be made in July. b. Prepare a cash flow statement using wufacturing Company, indicating receipt 4. Prepare a cash budget for the Ace Manufacturin wishes to maintain at all times a mids bursements for May, June, and July. The firm wisher or not borrowing will be necess anitify cash balance of $20,000. Determine whether or huch. As of April 30, the firm haly des the period. and if it is, when and for how. me of $20,0 - Accounts receivable: 50 percent of total sales are for cash. The remaining 50 petcete will be collected equally during the following two months (the firm incurs a negligeb bad-debt loss). - Cost of goods manufactured: 70 percent of sales: 90 percent of this cost is paid the 6 . - Selling general, and administrative expenses: $10,000 per month plus 10 percent of 5 all 2 - Interest parments: A semiannual interest payment on $150,000 of bonds outstanding (12 percent coupon) is paid during July. An annual $50,000 sinking-fund payment if also made at that time. - Dividends: A $10,000 dividend payment will be declared and made in July. - Capital expenditures: $40,000 will be invested in plant and equipment in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts