Question: b . Prepare a consolidation worksheet for 2 0 8 . Assume the company prepares the optional Accumulated Depreciation Consolidation Entry. Note: Values in the

b Prepare a consolidation worksheet for Assume the company prepares the optional Accumulated Depreciation Consolidation Entry.

Note: Values in the first two columns the "parent" and "subsidiary" balances that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.

tablePEANUT COMPANY AND SUBSIDIARYConsolidated Financial Statement WorksheetDecember XtablePeanutCompanytableSnoopyCompanyConsolidation Entries,ConsolidatedDebit,CreditIncome StatementSales$ $ $ Less: COGS,Less: Depreciation expense,Less: Selling & Administrative Expense,Income from Snoopy Company,Consolidated net income,Noncontrolling interest in net income,,,times Controlling Interest in Net Income,$$ $ $ $ Statement of Retained EarningsBeginning balance,$ $ $ $ Net income,Less: Dividends declared,Ending Balance,$$ $ $ $ Balance SheetAssetsCash$ $ $ Accounts receivable,InventoryInvestment in Snoopy Company,LandBuildings and equipment,Accumulated depreciation,Total Assets,table$$ $ $ $ tableLiabilities & Stockholders' EquityAccounts payable,$ $ $Bonds payable,Common stock,Retained earnings,Noncontrolling interest in net assets of Snoopy Company,,,times Total Liabilities & Stockholders' Equity,tabletable$$ $ $ $

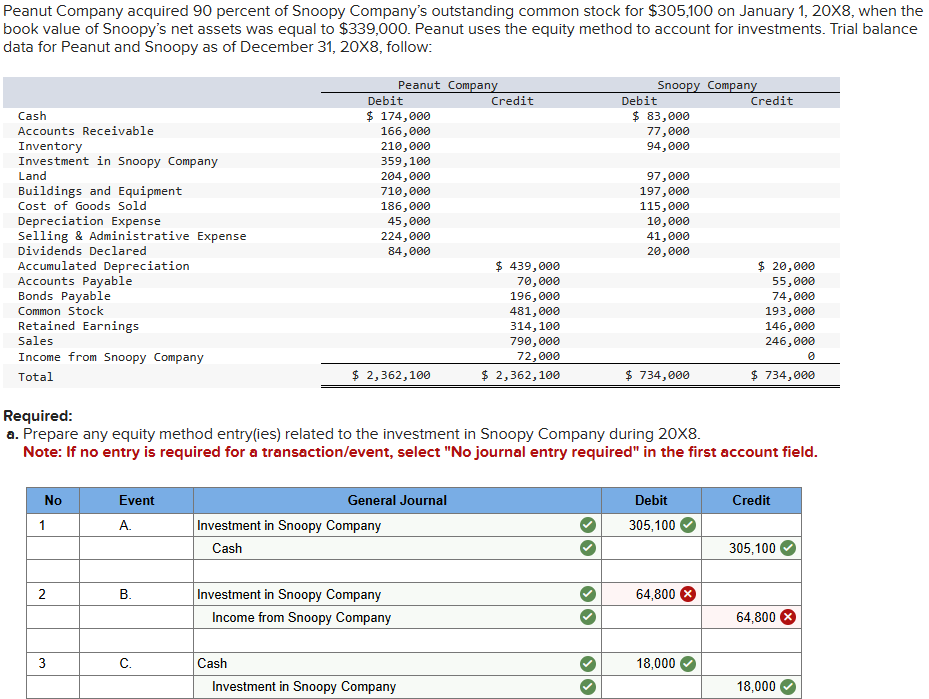

"Red text indicates no response was expected in a cell or a formulabased calculation is incorrect; no points deducted.Peanut Company acquired percent of Snoopy Company's outstanding common stock for $ on January X when the book value of Snoopy's net assets was equal to $ Peanut uses the equity method to account for investments. Trial balance data for Peanut and Snoopy as of December X follow:

tablePeanut Company,Snoopy CompanyDebit,Credit,Debit,CreditCash$ $ Accounts Receivable,InventoryInvestment in Snoopy Company,LandBuildings and Equipment,Cost of Goods Sold,Depreciation Expense,Selling & Administrative Expense,Dividends Declared,Accumulated Depreciation,,$$Accounts Payable,,Bonds Payable,,Common Stock,,Retained Earnings,,SalesIncome from Snoopy Company,,Total$$$$

Required:

a Prepare any equity method entryies related to the investment in Snoopy Company during X

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

tableNoEvent,General Journal,Debit,CreditAInvestment in Snoopy Company,Cash,BInvestment in Snoopy Company,times Income from Snoopy Company,times CCash,Investment in Snoopy Company,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock