Question: b. Prepare a variable costing income statement for the three products. Enter a net loss as a negative number using a minus sign. Winslow Inc.

b. Prepare a variable costing income statement for the three products. Enter a net loss as a negative number using a minus sign.

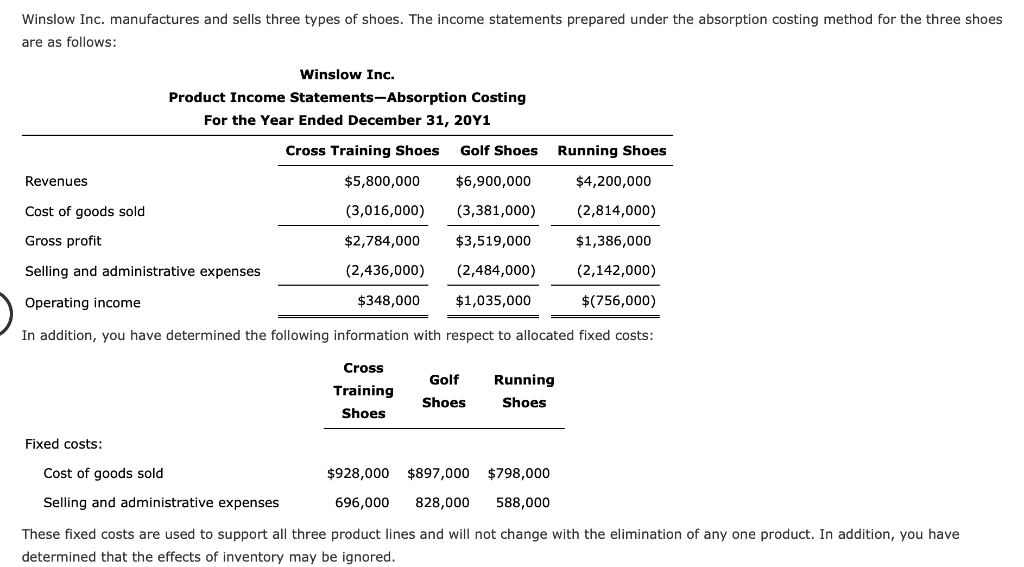

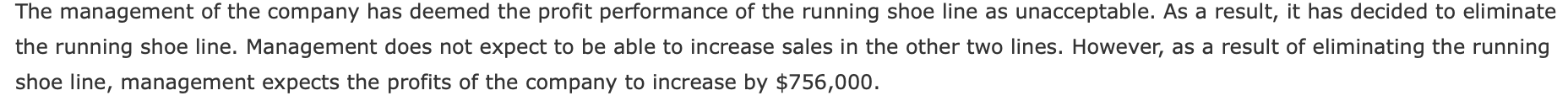

Winslow Inc. manufactures and sells three types of shoes. The income statements prepared under the absorption costing method for the three shoes are as follows: Winslow Inc. Product Income Statements-Absorption Costing For the Year Ended December 31, 2041 Cross Training Shoes Golf Shoes Running Shoes Revenues $5,800,000 $6,900,000 $4,200,000 Cost of goods sold (2,814,000) (3,016,000) $2,784,000 (3,381,000) $3,519,000 Gross profit $1,386,000 Selling and administrative expenses (2,436,000) (2,484,000) (2,142,000) Operating income $348,000 $1,035,000 $(756,000) In addition, you have determined the following information with respect to allocated fixed costs: Golf Cross Training Shoes Running Shoes Shoes Fixed costs: Cost of goods sold $928,000 $897,000 $798,000 Selling and administrative expenses 696,000 828,000 588,000 These fixed costs are used to support all three product lines and will not change with the elimination of any one product. In addition, you have determined that the effects of inventory may be ignored. The management of the company has deemed the profit performance of the running shoe line as unacceptable. As a result, it has decided to eliminate the running shoe line. Management does not expect to be able to increase sales in the other two lines. However, as a result of eliminating the running shoe line, management expects the profits of the company to increase by $756,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts