Question: b. Prepare the adjusting entry for manufacturing overhead, assuming the balance is allocated entirely to Cost of Goods Sold. c. Determine the gross profit to

b. Prepare the adjusting entry for manufacturing overhead, assuming the balance is allocated entirely to Cost of Goods Sold.

b. Prepare the adjusting entry for manufacturing overhead, assuming the balance is allocated entirely to Cost of Goods Sold.

c. Determine the gross profit to be reported for 2017.

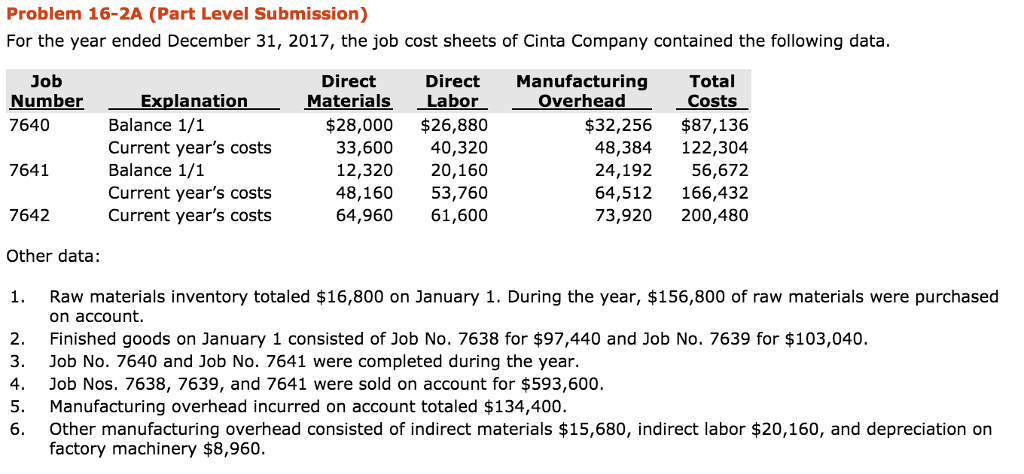

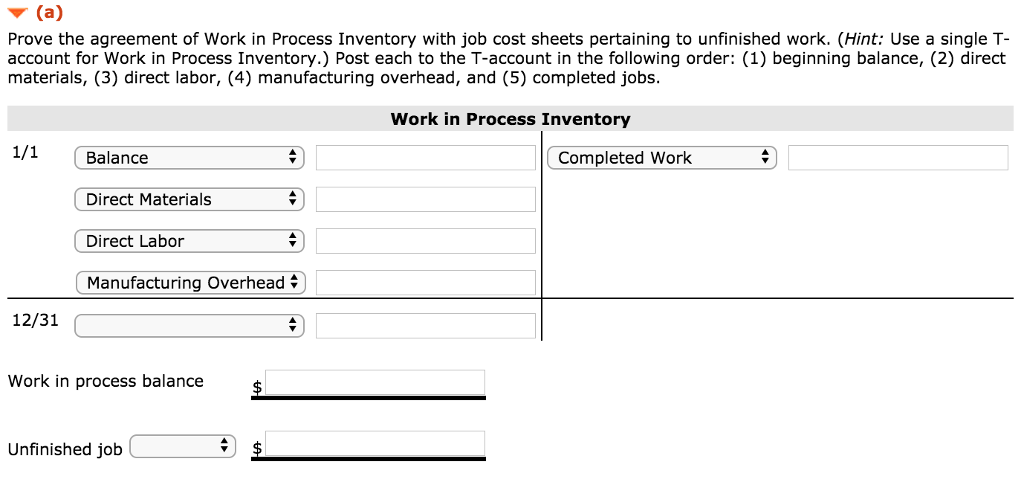

Problem 16-2A (Part Level Submission For the year ended December 31, 2017, the job cost sheets of Cinta Company contained the following data Job Number 7640 Direct Materials Labor irect Manufacturing Total Costs Explanation Overhead Balance 1/1 Current year's costs Balance 1/1 Current year's costs Current year's costs $28,000 $26,880 33,600 40,320 12,32020,160 48,16053,760 64,96061,600 $32,256 $87,136 48,384 122,304 24,19256,672 64,512 166,432 73,920 200,480 7641 7642 Other data: 1. Raw materials inventory totaled $16,800 on January 1. During the year, $156,800 of raw materials were purchased 2. 3. 4. 5. 6. on account. Finished goods on January 1 consisted of Job No. 7638 for $97,440 and Job No. 7639 for $103,040. Job No. 7640 and Job No. 7641 were completed during the year. Job Nos. 7638, 7639, and 7641 were sold on account for $593,600 Manufacturing overhead incurred on account totaled $134,400 Other manufacturing overhead consisted of indirect materials $15,680, indirect labor $20,160, and depreciation on factory machinery $8,960

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts