Question: b ) Prepare the journal entry to record pension expense for the last five months of 2 0 2 0 . Enter an appropriate description,

b Prepare the journal entry to record pension expense for the last five months of Enter an appropriate description, and enter the date in the format ddmmm ieJan

Marking:

You have not included the 'Pension expense' account in this journal entry. This will cost you marks.

You have not included the 'Accrued pension contributions' account in this journal entry. This will cost you marks.

The following accounts should not have been included in this journal entry: Income tax expense, Income tax payable. Any amounts entered for these accounts will not be evaluated.

c Assume that salaries in total $ Calculate Swan Furnace Cleaners' pension expense.

Marking:

Contribution for

Your answer was: $

The correct answer was: $

Contribution for Salary total Interest

$

$

You will lose marks for this part.

Interest on accrued pension contributions

Your answer was: $

The correct answer was: $

Interest on accrued pension contributions Accrued pension contributions Interest on liability

$

$

You will lose marks for this part.

Total pension expense

Your answer was: $

The correct answer was: $

Total pension expense Contribution for Interest on accrued pension contributions

$$

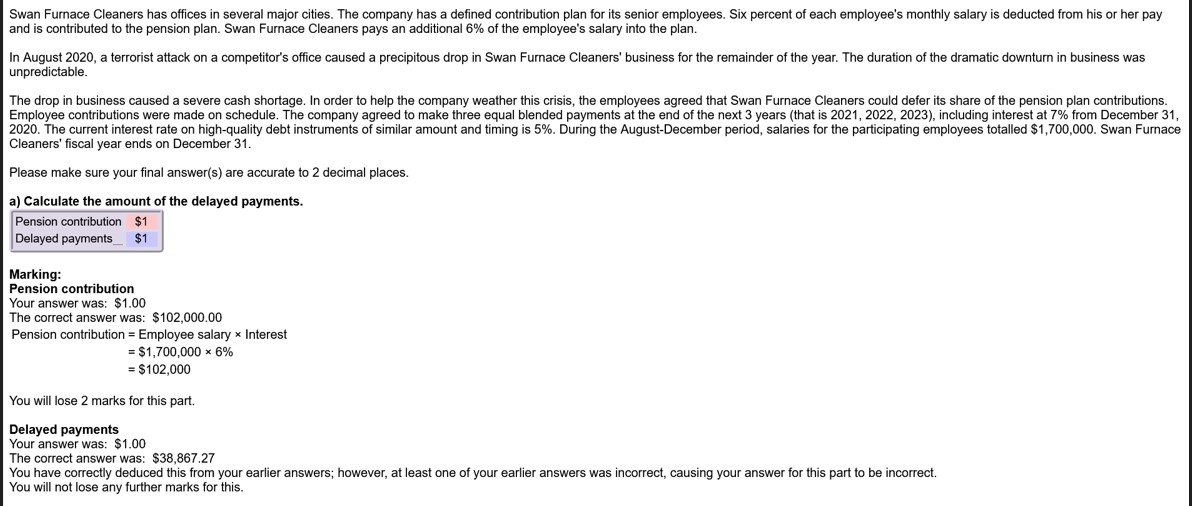

$Swan Furnace Cleaners has offices in several major cities. The company has a defined contribution plan for its senior employees. Six percent of each employee's monthly salary is deducted from his or her pay

and is contributed to the pension plan. Swan Furnace Cleaners pays an additional of the employee's salary into the plan.

In August a terrorist attack on a competitor's office caused a precipitous drop in Swan Furnace Cleaners' business for the remainder of the year. The duration of the dramatic downturn in business was

unpredictable.

The drop in business caused a severe cash shortage. In order to help the company weather this crisis, the employees agreed that Swan Furnace Cleaners could defer its share of the pension plan contributions.

Employee contributions were made on schedule. The company agreed to make three equal blended payments at the end of the next years that is including interest at from December

The current interest rate on highquality debt instruments of similar amount and timing is During the AugustDecember period, salaries for the participating employees totalled $ Swan Furnace

Cleaners' fiscal year ends on December

Please make sure your final answers are accurate to decimal places.

a Calculate the amount of the delayed payments.

Pension contribution $

Delayed payments $

Marking:

Pension contribution

Your answer was: $

The correct answer was: $

Pension contribution Employee salary Interest

$

$

You will lose marks for this part.

Delayed payments

Your answer was: $

The correct answer was: $

You have correctly deduced this from your earlier answers; however, at least one of your earlier answers was incorrect, causing your answer for this part to be incorrect.

You will not lose any further marks for this.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock