Question: B. Questions and Problems 1. During its first taxable year, the calendar year, Partnership ABCD has the follow- ing results: Income Gross Receipts- domestic

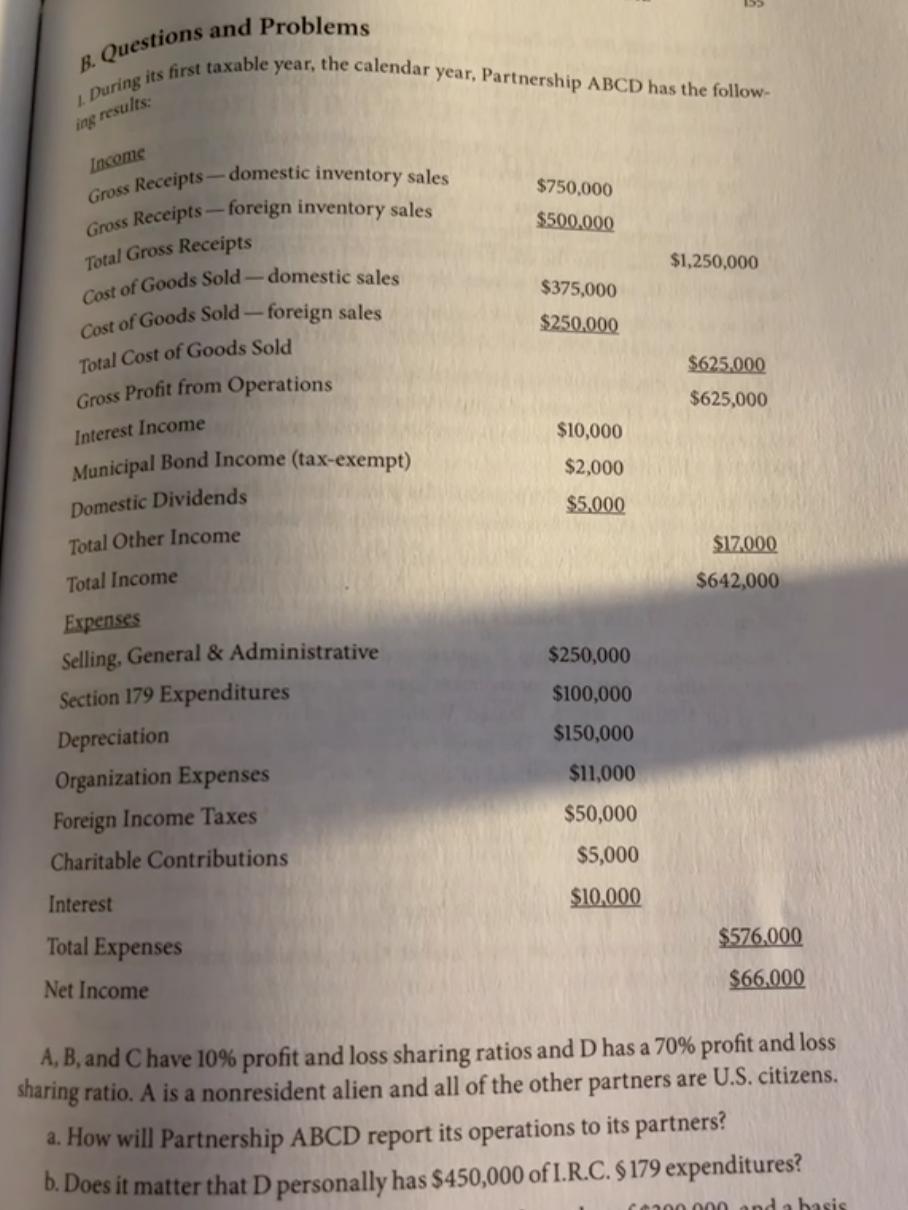

B. Questions and Problems 1. During its first taxable year, the calendar year, Partnership ABCD has the follow- ing results: Income Gross Receipts- domestic inventory sales Gross Receipts-foreign inventory sales Total Gross Receipts Cost of Goods Sold-domestic sales Cost of Goods Sold-foreign sales Total Cost of Goods Sold Gross Profit from Operations Interest Income Municipal Bond Income (tax-exempt) Domestic Dividends Total Other Income Total Income Expenses Selling, General & Administrative Section 179 Expenditures Depreciation Organization Expenses Foreign Income Taxes Charitable Contributions Interest Total Expenses Net Income $750,000 $500,000 $375,000 $250,000 $10,000 $2,000 $5,000 $250,000 $100,000 $150,000 $11,000 $50,000 $5,000 $10,000 $1,250,000 $625.000 $625,000 $17,000 $642,000 $576,000 $66.000 A, B, and C have 10% profit and loss sharing ratios and D has a 70% profit and loss sharing ratio. A is a nonresident alien and all of the other partners are U.S. citizens. a. How will Partnership ABCD report its operations to its partners? b. Does it matter that D personally has $450,000 of I.R.C. $ 179 expenditures? 60300.000 and a basis

Step by Step Solution

There are 3 Steps involved in it

1 The partnership should report the operations by only sharing profits to the customers as per the r... View full answer

Get step-by-step solutions from verified subject matter experts