Question: b. Refer to your net worth statement and utic formulas. L06-3 5. Calculating the Debt Payments-to-Income Ratio. Kim Lee is trying to decide whether she

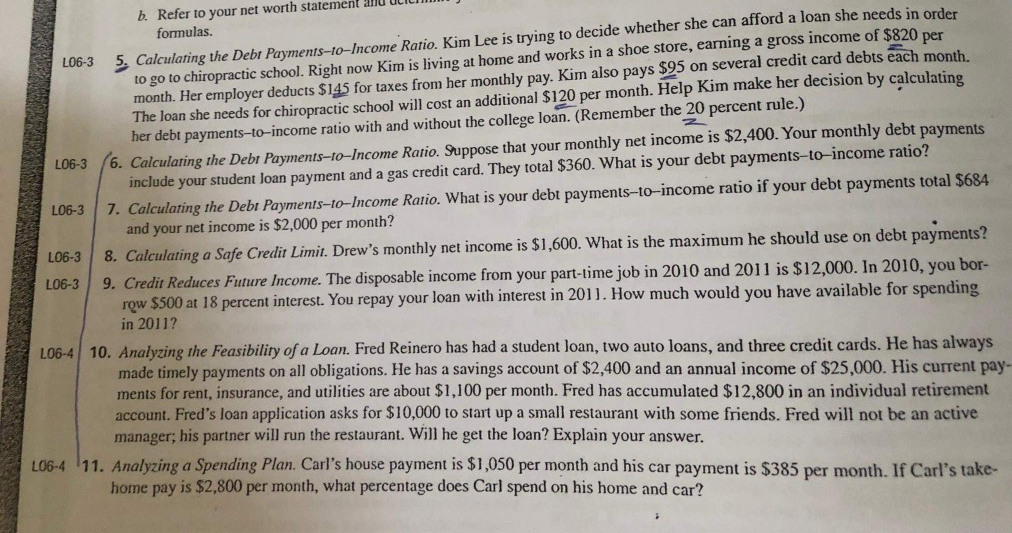

b. Refer to your net worth statement and utic formulas. L06-3 5. Calculating the Debt Payments-to-Income Ratio. Kim Lee is trying to decide whether she can afford a loan she needs in order to go to chiropractic school. Right now Kim is living at home and works in a shoe store, earning a gross income of $820 per month. Her employer deducts $145 for taxes from her monthly pay. Kim also pays $95 on several credit card debts each month The loan she needs for chiropractic school will cost an additional $120 per month. Help Kim make her decision by calculating her debt payments-to-income ratio with and without the college loan. (Remember the 20 percent rule.) L06-3 66. Calculating the D. 6. Calculating the Debt Payments-to-Income Ratio. Suppose that your monthly net income is $2,400. Your monthly debt payments include your student loan payment and a gas credit card. They total $360. What is your debt payments-to-income ratio? L06-3 7. Calculating the Debt Payments-to-Income Ratio. What is your debt payments-to-income ratio if your debt payments total $684 and your net income is $2,000 per month? L06- 3 8. Calculating a Safe Credit Limit. Drew's monthly net income is $1,600. What is the maximum he should use on debt payments? L06-3 9. Credit Reduces Future Income. The disposable income from your part-time job in 2010 and 2011 is $12,000. In 2010, you bor- row $500 at 18 percent interest. You repay your loan with interest in 2011. How much would you have available for spending in 2011? L06-4 10. Analyzing the Feasibility of a Loan. Fred Reinero has had a student loan, two auto loans, and three credit cards. He has always made timely payments on all obligations. He has a savings account of $2,400 and an annual income of $25,000. His current pay- ments for rent, insurance, and utilities are about $1,100 per month. Fred has accumulated $12.800 in an individual retirement account. Fred's loan application asks for $10,000 to start up a small restaurant with some friends. Fred will not be an active manager; his partner will run the restaurant. Will he get the loan? Explain your answer. 106-4 11. Analyzing a Spending Plan. Carl's house payment is $1,050 per month and his car payment is $385 per month. If Carl's take- home pay is $2,800 per month, what percentage does Carl spend on his home and car? b. Refer to your net worth statement and utic formulas. L06-3 5. Calculating the Debt Payments-to-Income Ratio. Kim Lee is trying to decide whether she can afford a loan she needs in order to go to chiropractic school. Right now Kim is living at home and works in a shoe store, earning a gross income of $820 per month. Her employer deducts $145 for taxes from her monthly pay. Kim also pays $95 on several credit card debts each month The loan she needs for chiropractic school will cost an additional $120 per month. Help Kim make her decision by calculating her debt payments-to-income ratio with and without the college loan. (Remember the 20 percent rule.) L06-3 66. Calculating the D. 6. Calculating the Debt Payments-to-Income Ratio. Suppose that your monthly net income is $2,400. Your monthly debt payments include your student loan payment and a gas credit card. They total $360. What is your debt payments-to-income ratio? L06-3 7. Calculating the Debt Payments-to-Income Ratio. What is your debt payments-to-income ratio if your debt payments total $684 and your net income is $2,000 per month? L06- 3 8. Calculating a Safe Credit Limit. Drew's monthly net income is $1,600. What is the maximum he should use on debt payments? L06-3 9. Credit Reduces Future Income. The disposable income from your part-time job in 2010 and 2011 is $12,000. In 2010, you bor- row $500 at 18 percent interest. You repay your loan with interest in 2011. How much would you have available for spending in 2011? L06-4 10. Analyzing the Feasibility of a Loan. Fred Reinero has had a student loan, two auto loans, and three credit cards. He has always made timely payments on all obligations. He has a savings account of $2,400 and an annual income of $25,000. His current pay- ments for rent, insurance, and utilities are about $1,100 per month. Fred has accumulated $12.800 in an individual retirement account. Fred's loan application asks for $10,000 to start up a small restaurant with some friends. Fred will not be an active manager; his partner will run the restaurant. Will he get the loan? Explain your answer. 106-4 11. Analyzing a Spending Plan. Carl's house payment is $1,050 per month and his car payment is $385 per month. If Carl's take- home pay is $2,800 per month, what percentage does Carl spend on his home and car

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts