Question: | B Sakai : FIX G how to m x m Thinkerte x a www.ama x Question ation.com/ext/map/index.html?_con=con&external_browser=0&launchUn=https%253A%25 -SPRING 2021-SIX HOURS A Saved Based on

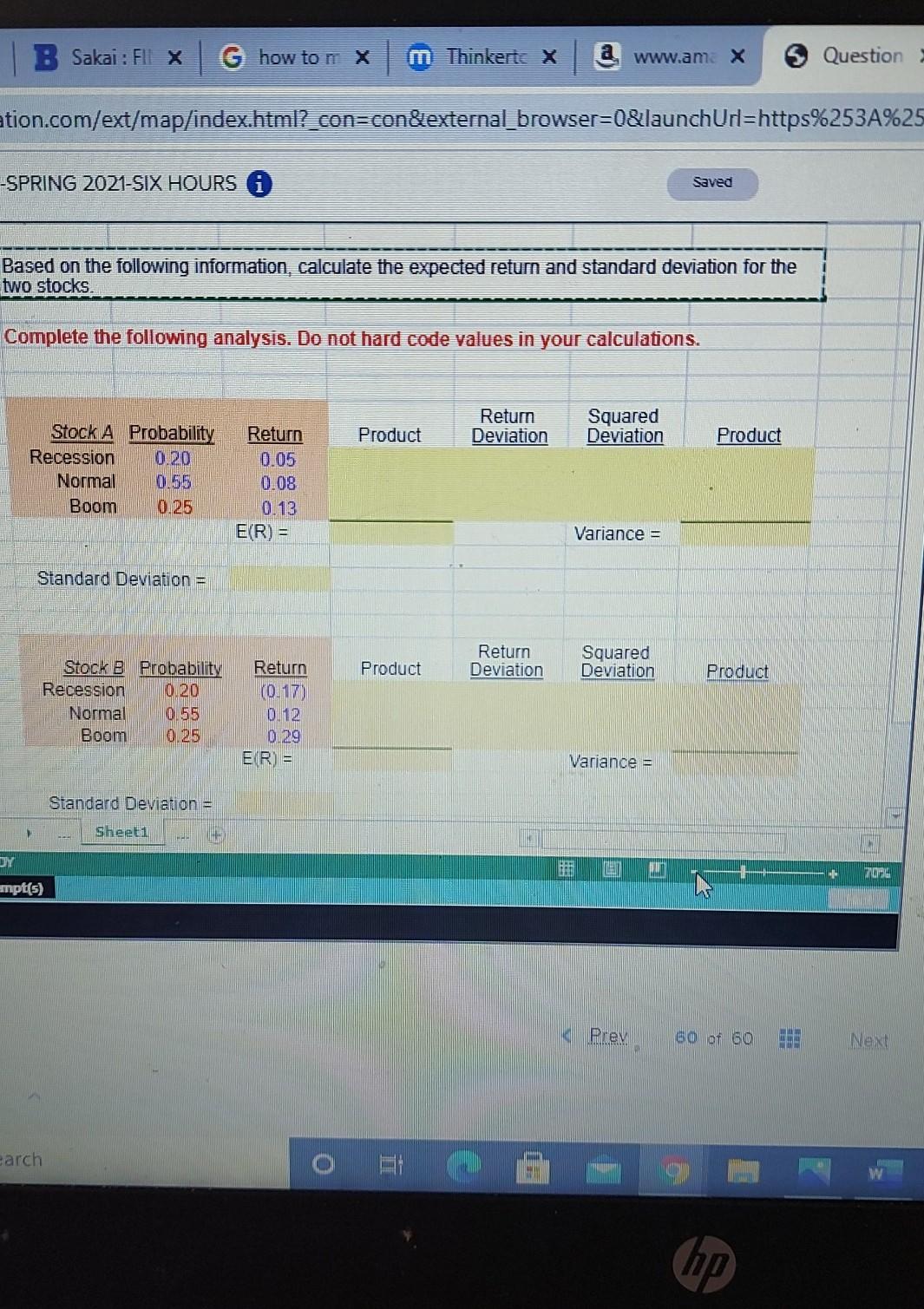

| B Sakai : FIX G how to m x m Thinkerte x a www.ama x Question ation.com/ext/map/index.html?_con=con&external_browser=0&launchUn=https%253A%25 -SPRING 2021-SIX HOURS A Saved Based on the following information, calculate the expected return and standard deviation for the two stocks. Complete the following analysis. Do not hard code values in your calculations. Return Deviation Product Squared Deviation Product Stock A Probability Recession 0.20 Normal Boom 0.25 Return 0.05 0.08 0.13 E(R) = Variance = Standard Deviation = Product Return Deviation Squared Deviation Product Stock B Probability Recession 0.20 Normal 0.55 Boom 0.25 Return (0.17) 0.12 0.29 E(R) = Variance = Standard Deviation = Sheet1 DY ampt(s) Prev SOot 60 Next earch hp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts