Question: b. same list for classified under heading On January 2, 2022, Kokomo Corp. invested $2,524,500 in Laramie Inc. for 25% of its outstanding common shares.

same list for classified under heading

same list for classified under heading

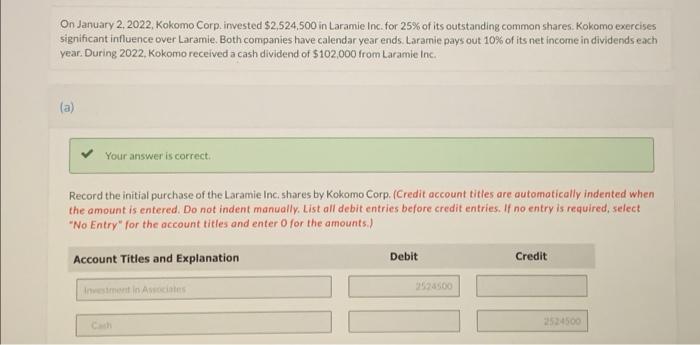

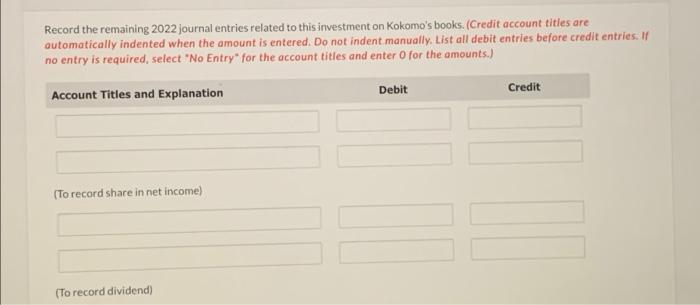

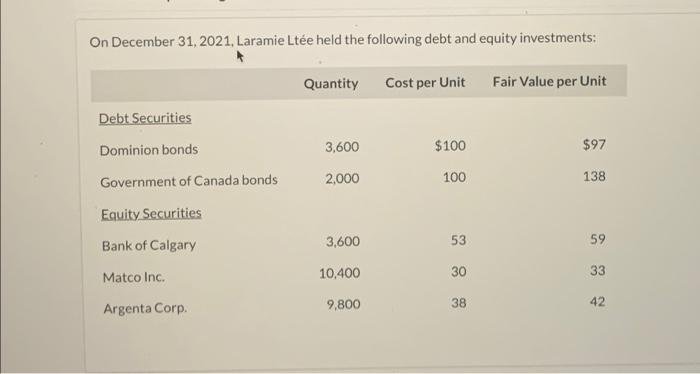

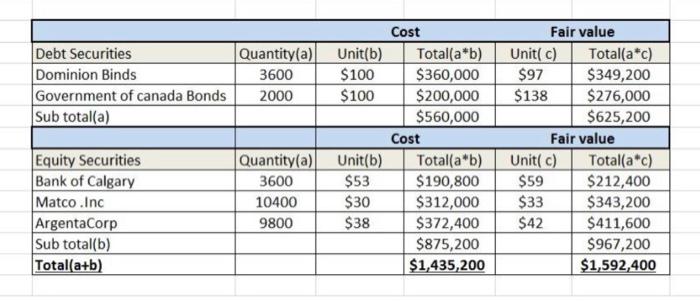

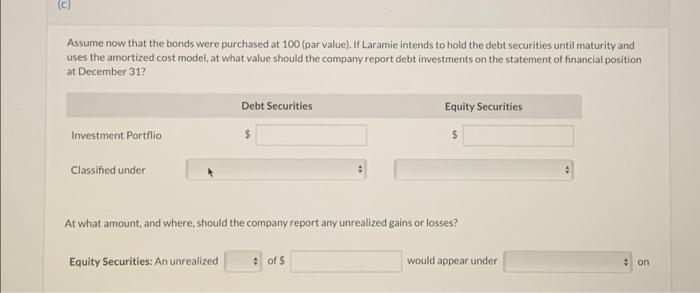

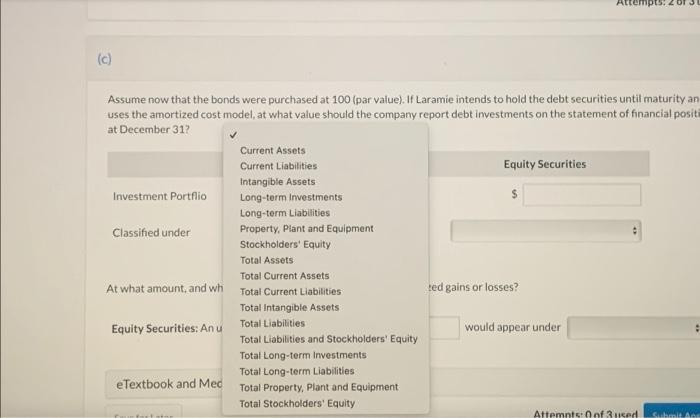

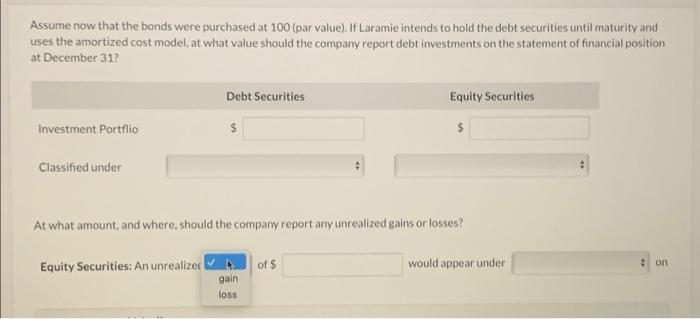

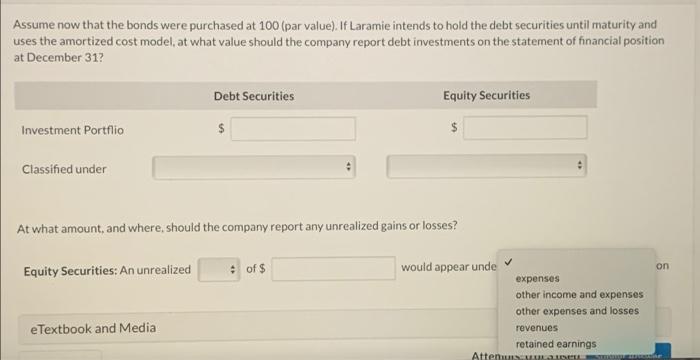

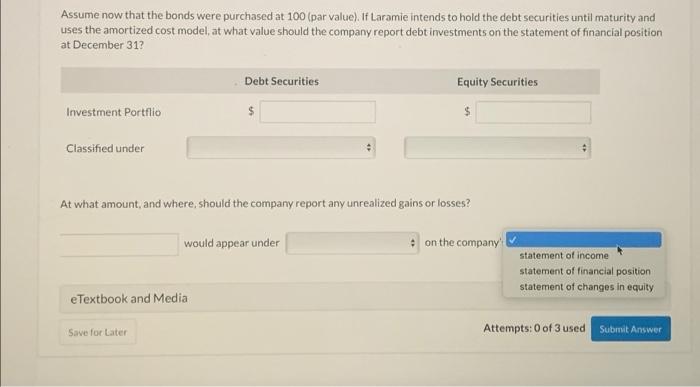

On January 2, 2022, Kokomo Corp. invested $2,524,500 in Laramie Inc. for 25% of its outstanding common shares. Kokomo exercises significant influence over Laramie. Both companies have calendar year ends. Laramie pays out 10% of its net income in dividends each year. During 2022. Kokomo received a cash dividend of $102,000 from Laramie Inc. (a) Your answer is correct Record the initial purchase of the Laramie Inc. shares by Kokomo Corp. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit 3524500 Record the remaining 2022 journal entries related to this investment on Kokomo's books. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Debit Credit Account Titles and Explanation (To record share in net income) (To record dividend) On December 31, 2021, Laramie Lte held the following debt and equity investments: Quantity Cost per Unit Fair Value per Unit Debt Securities 3,600 $100 $97 Dominion bonds Government of Canada bonds 2,000 100 138 Equity Securities 3,600 53 59 Bank of Calgary 10,400 Matco Inc. 30 33 9,800 38 42 Argenta Corp Debt Securities Quantity(a) Dominion Binds 3600 Government of canada Bonds 2000 Sub total(a) Cost Unit(b) Total(a*b) $100 $360,000 $100 $200,000 $560,000 Cost Unit(b) Total(a*b) $53 $190,800 $30 $312,000 $38 $372,400 $875,200 $1,435,200 Fair value Unit(c) Total(a*c) $97 $349,200 $138 $276,000 $625,200 Fair value Unit(c) Total(a*c) $59 $212,400 $33 $343,200 $42 $411,600 $967,200 $1,592,400 Equity Securities Bank of Calgary Matco Inc ArgentaCorp Sub total(b) Total(a+b) Quantity(a) 3600 10400 9800 (c) Assume now that the bonds were purchased at 100 (par value). If Laramie intends to hold the debt securities until maturity and uses the amortized cost model, at what value should the company report debt investments on the statement of financial position at December 312 Debt Securities Equity Securities Investment Portflio $ Classified under At what amount, and where should the company report any unrealized gains or losses? Equity Securities: An unrealized of $ would appear under on Os (c) Assume now that the bonds were purchased at 100 (par value). If Laramie intends to hold the debt securities until maturity an uses the amortized cost model, at what value should the company report debt investments on the statement of financial positi at December 317 Current Assets Current Liabilities Equity Securities Intangible Assets Investment Portflio Long-term Investments $ Long-term Liabilities Classified under Property, Plant and Equipment Stockholders' Equity Total Assets Total Current Assets At what amount, and wh Total Current Liabilities ed gains or losses? Total Intangible Assets Equity Securities: Anu Total Liabilities would appear under Total Liabilities and Stockholders' Equity Total Long-term Investments Total Long-term Liabilities e Textbook and Med Total Property, plant and Equipment Total Stockholders' Equity Attemnts: 0 of 3 uced . Cube AS Assume now that the bonds were purchased at 100 (par value). If Laramie intends to hold the debt securities until maturity and uses the amortized cost model, at what value should the company report debt investments on the statement of financial position at December 312 Debt Securities Equity Securities Investment Portflio $ Classified under At what amount, and where should the company report any unrealized gains or losses? Equity Securities: An unrealize of $ would appear under on gain loss Assume now that the bonds were purchased at 100 (par value). If Laramie intends to hold the debt securities until maturity and uses the amortized cost model, at what value should the company report debt investments on the statement of financial position at December 317 Debt Securities Equity Securities Investment Portflio $ $ Classified under At what amount, and where should the company report any unrealized gains or losses? Equity Securities: An unrealized of $ on would appear unde expenses other income and expenses other expenses and losses revenues retained earnings Attenus e Textbook and Media Assume now that the bonds were purchased at 100 (par value). If Laramie intends to hold the debt securities until maturity and uses the amortized cost model, at what value should the company report debt investments on the statement of financial position at December 312 Debt Securities Equity Securities Irivestment Portflio $ $ Classified under At what amount, and where should the company report any unrealized gains or losses? would appear under on the company statement of income statement of financial position statement of changes in equity e Textbook and Media Save for Later Attempts:0 of 3 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts