Question: b. Solve using solver. Provide your final tableau showing the problem set up and the final solution. c. How should the investment be diversified to

b. Solve using solver. Provide your final tableau showing the problem set up and the final solution.

c. How should the investment be diversified to make the most return?

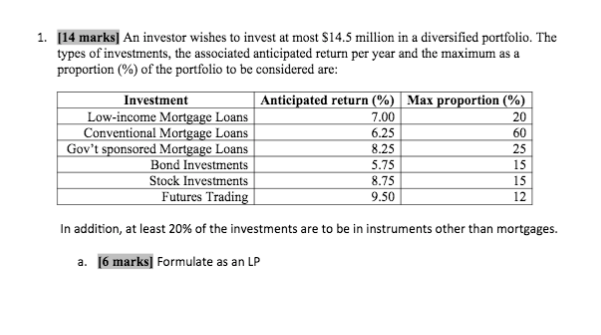

1. [14 marks] An investor wishes to invest at most $14.5 million in a diversified portfolio. The types of investments, the associated anticipated return per year and the maximum as a proportion (%) of the portfolio to be considered are: Investment Anticipated return (%) Max proportion (%) Low-income Mortgage Loans 7.00 20 Conventional Mortgage Loans 6.25 60 Gov't sponsored Mortgage Loans 8.25 25 Bond Investments 5.75 15 Stock Investments 8.75 15 Futures Trading 9.50 12 In addition, at least 20% of the investments are to be in instruments other than mortgages. a. [6 marks] Formulate as an LP 1. [14 marks] An investor wishes to invest at most $14.5 million in a diversified portfolio. The types of investments, the associated anticipated return per year and the maximum as a proportion (%) of the portfolio to be considered are: Investment Anticipated return (%) Max proportion (%) Low-income Mortgage Loans 7.00 20 Conventional Mortgage Loans 6.25 60 Gov't sponsored Mortgage Loans 8.25 25 Bond Investments 5.75 15 Stock Investments 8.75 15 Futures Trading 9.50 12 In addition, at least 20% of the investments are to be in instruments other than mortgages. a. [6 marks] Formulate as an LP

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts