Question: b) Summer Sdn Bhd, is considering replacing its existing machine which was originally purchased 2 years ago at a cost of $80,000. The machine is

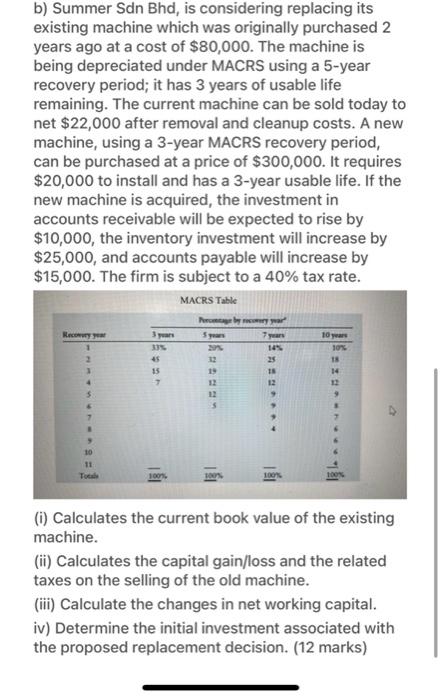

b) Summer Sdn Bhd, is considering replacing its existing machine which was originally purchased 2 years ago at a cost of $80,000. The machine is being depreciated under MACRS using a 5-year recovery period; it has 3 years of usable life remaining. The current machine can be sold today to net $ 22,000 after removal and cleanup costs. A new machine, using a 3-year MACRS recovery period, can be purchased at a price of $300,000. It requires $20,000 to install and has a 3-year usable life. If the new machine is acquired, the investment in accounts receivable will be expected to rise by $10,000, the inventory investment will increase by $25,000, and accounts payable will increase by $15,000. The firm is subject to a 40% tax rate. MACRS Table Recowy 1 2 115 3 years 335 45 15 7 bar yar 14 25 19 TS 12 10 years 100 18 14 5 9 7 10 11 Tocal 1001 100% (i) Calculates the current book value of the existing machine. (ii) Calculates the capital gain/loss and the related taxes on the selling of the old machine. (iii) Calculate the changes in net working capital. iv) Determine the initial investment associated with the proposed replacement decision. (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts