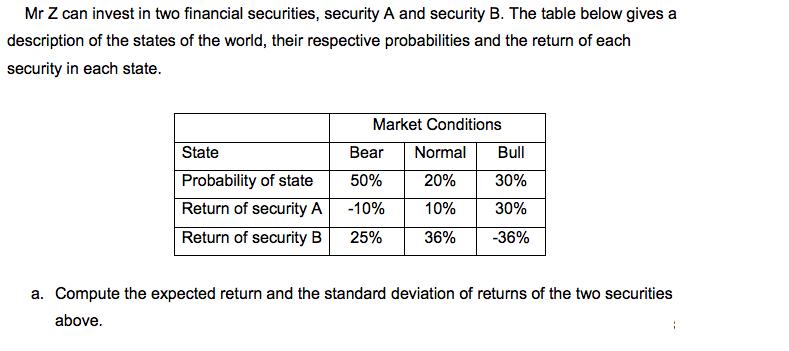

Question: Mr Z can invest in two financial securities, security A and security B. The table below gives a description of the states of the

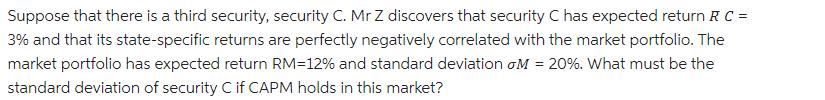

Mr Z can invest in two financial securities, security A and security B. The table below gives a description of the states of the world, their respective probabilities and the return of each security in each state. Market Conditions State Bear Normal Bull Probability of state 50% 20% 30% Return of security A -10% 10% 30% Return of security B 25% 36% -36% a. Compute the expected return and the standard deviation of returns of the two securities above. Suppose that there is a third security, security C. Mr Z discovers that security C has expected return R C = 3% and that its state-specific returns are perfectly negatively correlated with the market portfolio. The market portfolio has expected return RM=12% and standard deviation oM = 20%. What must be the standard deviation of security C if CAPM holds in this market?

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Answer In order to calculate the answer we have to assume that the ... View full answer

Get step-by-step solutions from verified subject matter experts