Question: B. The client decides to enter into a one-year equity swap where the counterparty agrees to pay the investor the total return to the stock

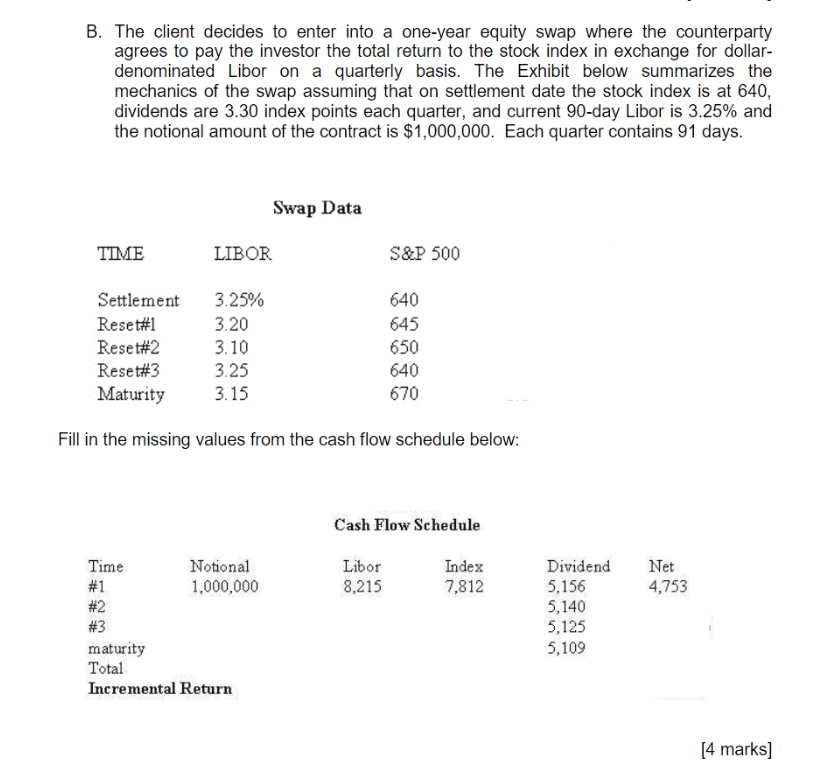

B. The client decides to enter into a one-year equity swap where the counterparty agrees to pay the investor the total return to the stock index in exchange for dollar- denominated Libor on a quarterly basis. The Exhibit below summarizes the mechanics of the swap assuming that on settlement date the stock index is at 640, dividends are 3.30 index points each quarter, and current 90-day Libor is 3.25% and the notional amount of the contract is $1,000,000. Each quarter contains 91 days. Swap Data TIME LIBOR S&P 500 Settlement 3.25% 640 Reset#1 3.20 645 Reset#2 3.10 650 Reset#3 3.25 640 Maturity 3.15 670 Fill in the missing values from the cash flow schedule below: Cash Flow Schedule Time Notional Libor Index #1 1,000,000 8,215 7,812 #2 #3 maturity Total Incremental Return Dividend 5,156 5,140 5,125 5,109 Net 4,753 [4 marks] B. The client decides to enter into a one-year equity swap where the counterparty agrees to pay the investor the total return to the stock index in exchange for dollar- denominated Libor on a quarterly basis. The Exhibit below summarizes the mechanics of the swap assuming that on settlement date the stock index is at 640, dividends are 3.30 index points each quarter, and current 90-day Libor is 3.25% and the notional amount of the contract is $1,000,000. Each quarter contains 91 days. Swap Data TIME LIBOR S&P 500 Settlement 3.25% 640 Reset#1 3.20 645 Reset#2 3.10 650 Reset#3 3.25 640 Maturity 3.15 670 Fill in the missing values from the cash flow schedule below: Cash Flow Schedule Time Notional Libor Index #1 1,000,000 8,215 7,812 #2 #3 maturity Total Incremental Return Dividend 5,156 5,140 5,125 5,109 Net 4,753 [4 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts