Question: B- The ROR for each option, answer the below questions: The ROR for server1 over 3 years operation equal = The ROR for server2 over

B-

The ROR for each option, answer the below questions:

The ROR for server1 over 3 years operation equal =

The ROR for server2 over 4 years operation equal =

The ROR for server3 over 5 years operation equal =

Based on the ROR for each option which option we should select?

c-

Use incremental ROR analysis between server 2 and server 3 to decide which is the best option at MARR = 12%. Answer the below questions

As per the Descartes rule of signs for the NCF between servers 2&3, what is the maximum number of real_number Delta_i* that exist?

As per the Norstroms criterion, is there a one real-positive Delta_i* exist ( enter yes or no) ?

What is the value of Delta_i* between server 2 & 3 if exist ?

Based on the incremental analysis which option we should select if incremental analysis is applicable ?

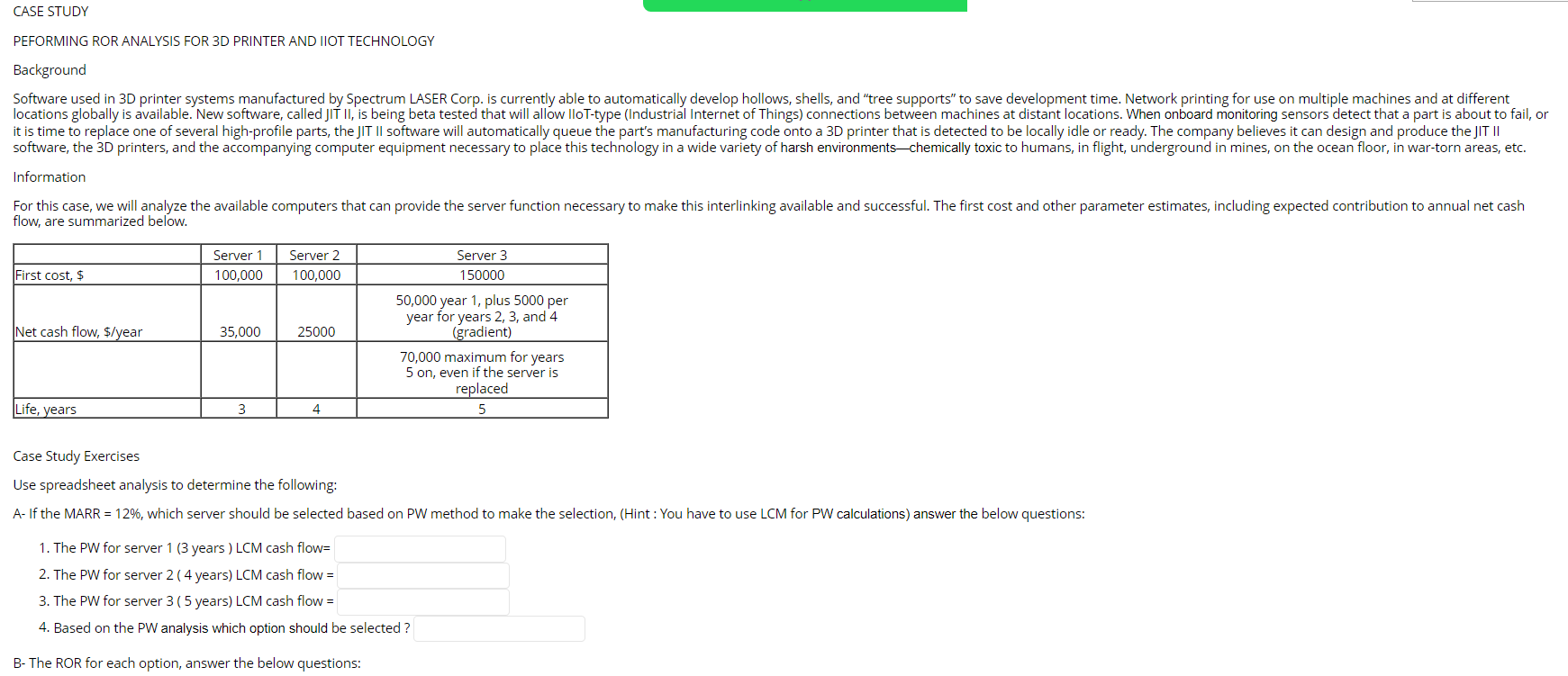

PEFORMING ROR ANALYSIS FOR 3D PRINTER AND IIOT TECHNOLOGY Background Information flow, are summarized below. Case Study Exercises Use spreadsheet analysis to determine the following: A- If the MARR =12%, which server should be selected based on PW method to make the selection, (Hint : You have to use LCM for PW calculations) answer the below questions: 1. The PW for server 1 ( 3 years ) LCM cash flow 2. The PW for server 2 ( 4 years) LCM cash flow = 3. The PW for server 3 ( 5 years) LCM cash flow = 4. Based on the PW analysis which option should be selected ? B- The ROR for each option, answer the below questions: PEFORMING ROR ANALYSIS FOR 3D PRINTER AND IIOT TECHNOLOGY Background Information flow, are summarized below. Case Study Exercises Use spreadsheet analysis to determine the following: A- If the MARR =12%, which server should be selected based on PW method to make the selection, (Hint : You have to use LCM for PW calculations) answer the below questions: 1. The PW for server 1 ( 3 years ) LCM cash flow 2. The PW for server 2 ( 4 years) LCM cash flow = 3. The PW for server 3 ( 5 years) LCM cash flow = 4. Based on the PW analysis which option should be selected ? B- The ROR for each option, answer the below questions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts