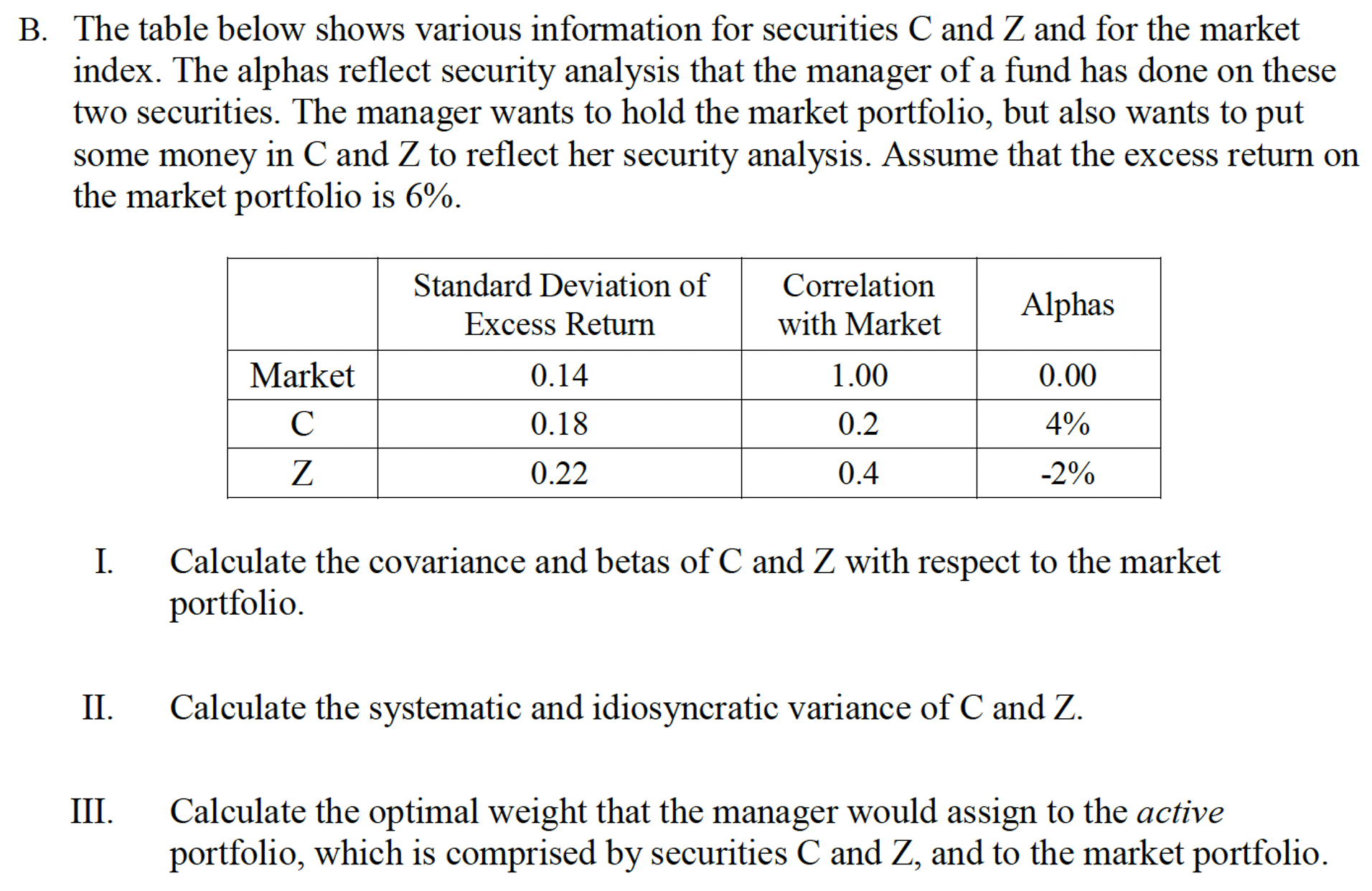

Question: B . The table below shows various information for securities C and Z and for the market index. The alphas reflect security analysis that the

B The table below shows various information for securities and and for the market

index. The alphas reflect security analysis that the manager of a fund has done on these

two securities The manager wants to hold the market portfolio, but also wants to put

some money in and to reflect her security analysis. Assume that the excess return on

the market portfolio is

I. Calculate the covariance and betas of and with respect to the market

portfolio.

II Calculate the systematic and idiosyncratic variance of and

III. Calculate the optimal weight that the manager would assign to the active

portfolio, which is comprised by securities and and to the market portfolio.

Please answer questions and provide detailed explanations on part III, as it is the one im struggling with. Thank you

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock