Question: B through D only Embassy Publishing Company received a six-chapter manuscript for a new college textbook. The editor of the college division is familiar with

B through D only

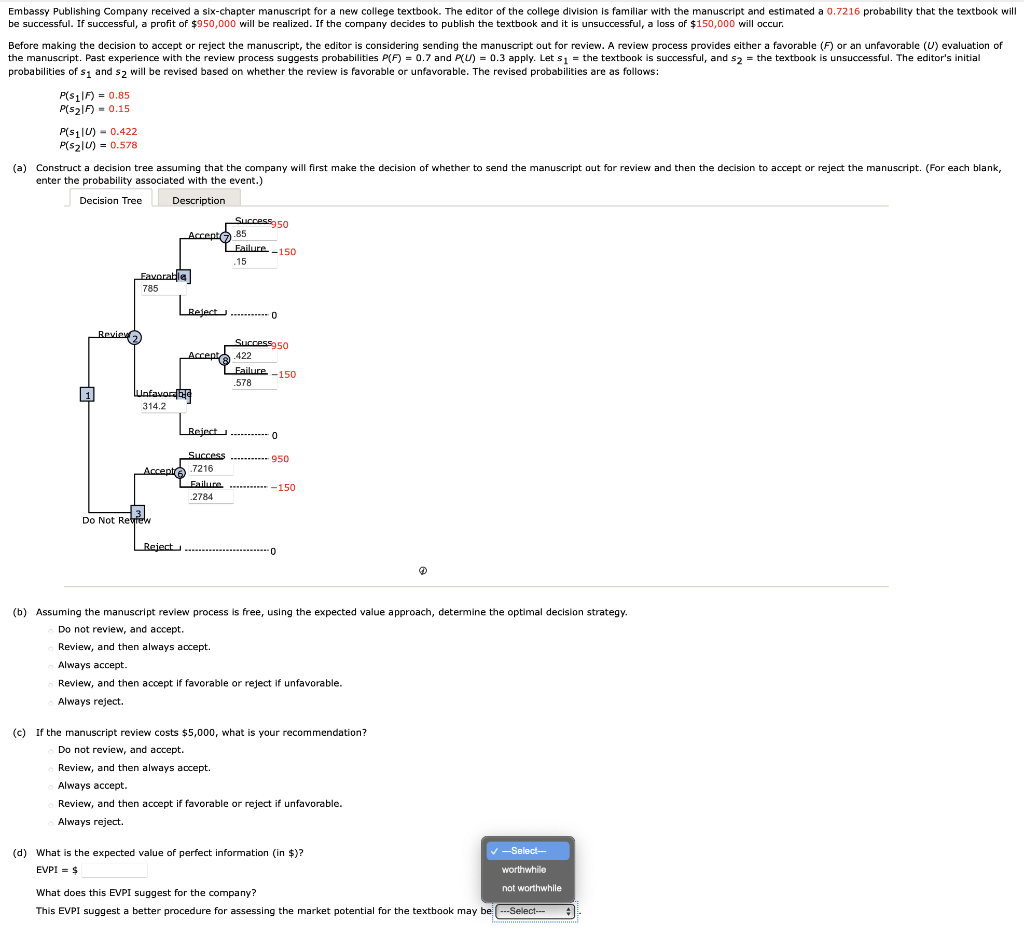

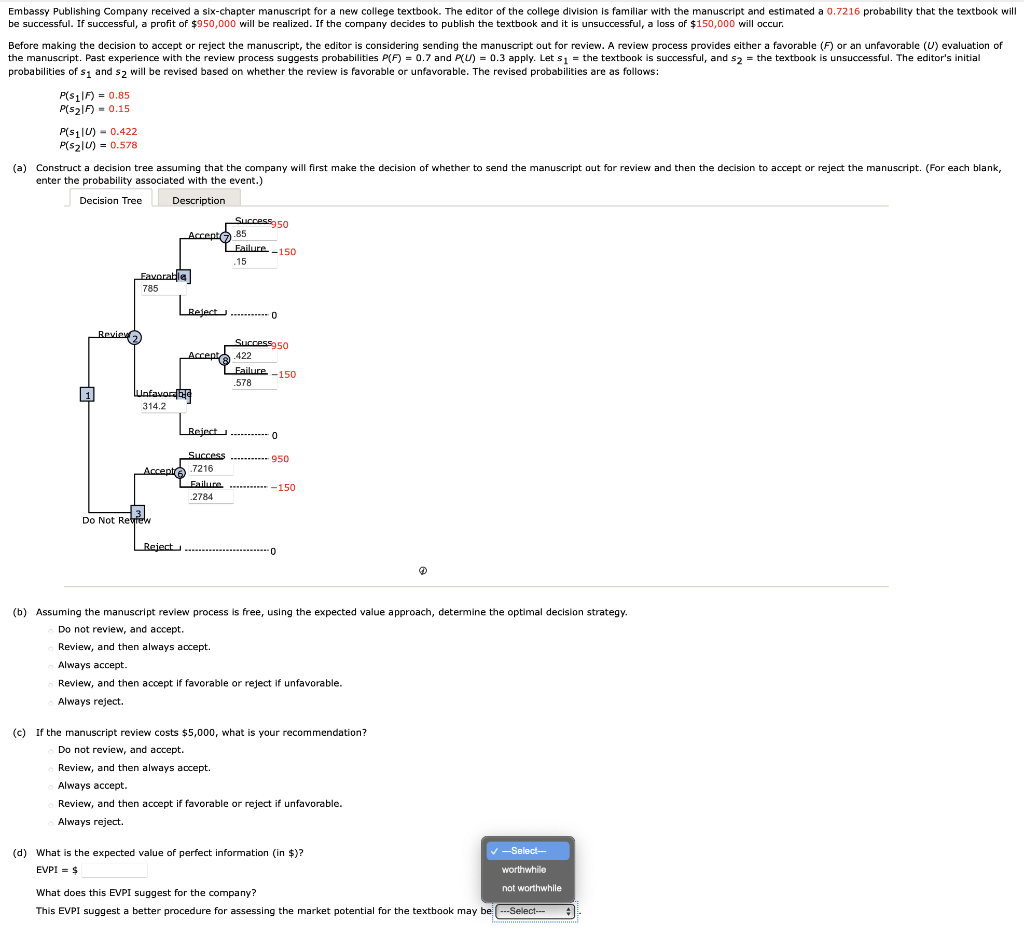

Embassy Publishing Company received a six-chapter manuscript for a new college textbook. The editor of the college division is familiar with the manuscript and estimated a 0.7216 probability that the textbook will be successful. If successful, a profit of $950,000 will be realized. If the company decides to publish the textbook and it is unsuccessful, a loss of $150,000 will occur. Before making the decision to accept or reject the manuscript, the editor is considering sending the manuscript out for review. A review process provides either a favorable (F) or an unfavorable (U) evaluation of the manuscript. Past experience with the review process suggests probabilities P(F) = 0.7 and PLU) = 0.3 apply. Let 51 = the textbook is successful, and s2 = the textbook is unsuccessful. The editor's initial probabilities of S1 and s2 will be revised based on whether the review is favorable or unfavorable. The revised probabilities are as follows: Pls11F) = 0.85 Pls21F) - 0.15 P($1U) - 0.422 P/s2 U) = 0.578 (a) Construct a decision tree assuming that the company will first make the decision of whether to send the manuscript out for review and then the decision to accept or reject the manuscript. (For each blank, enter the probability associated with the event.) Decision Tree Description Success950 Accept).85 Failure. - 150 .15 Favorable 785 Beject........... Leelect Review Success 50 Accepte.422 Failure - 150 .578 1 lunfavorable 314.2 Reject--- 0 Success 950 Accept7216 Lailure - 150 .2784 Do Not Review Reject 0 (b) Assuming the manuscript review process is free, using the expected value approach, determine the optimal decision strategy. Do not review, and accept. Review, and then always accept. . Always accept Review, and then accept if favorable or reject if unfavorable. Always reject. (c) If the manuscript review costs $5,000, what is your recommendation? Do not review, and accept. Review, and then always accept. Always accept. Review, and then accept if favorable or reject if unfavorable. Always reject. . (d) What is the expected value of perfect information (in $)? --Select- EVPI = $ worthwhile not worthwhile What does this EVPI suggest for the company? This EVPI suggest a better procedure for assessing the market potential for the textbook may be ---Select-- Embassy Publishing Company received a six-chapter manuscript for a new college textbook. The editor of the college division is familiar with the manuscript and estimated a 0.7216 probability that the textbook will be successful. If successful, a profit of $950,000 will be realized. If the company decides to publish the textbook and it is unsuccessful, a loss of $150,000 will occur. Before making the decision to accept or reject the manuscript, the editor is considering sending the manuscript out for review. A review process provides either a favorable (F) or an unfavorable (U) evaluation of the manuscript. Past experience with the review process suggests probabilities P(F) = 0.7 and PLU) = 0.3 apply. Let 51 = the textbook is successful, and s2 = the textbook is unsuccessful. The editor's initial probabilities of S1 and s2 will be revised based on whether the review is favorable or unfavorable. The revised probabilities are as follows: Pls11F) = 0.85 Pls21F) - 0.15 P($1U) - 0.422 P/s2 U) = 0.578 (a) Construct a decision tree assuming that the company will first make the decision of whether to send the manuscript out for review and then the decision to accept or reject the manuscript. (For each blank, enter the probability associated with the event.) Decision Tree Description Success950 Accept).85 Failure. - 150 .15 Favorable 785 Beject........... Leelect Review Success 50 Accepte.422 Failure - 150 .578 1 lunfavorable 314.2 Reject--- 0 Success 950 Accept7216 Lailure - 150 .2784 Do Not Review Reject 0 (b) Assuming the manuscript review process is free, using the expected value approach, determine the optimal decision strategy. Do not review, and accept. Review, and then always accept. . Always accept Review, and then accept if favorable or reject if unfavorable. Always reject. (c) If the manuscript review costs $5,000, what is your recommendation? Do not review, and accept. Review, and then always accept. Always accept. Review, and then accept if favorable or reject if unfavorable. Always reject. . (d) What is the expected value of perfect information (in $)? --Select- EVPI = $ worthwhile not worthwhile What does this EVPI suggest for the company? This EVPI suggest a better procedure for assessing the market potential for the textbook may be ---Select