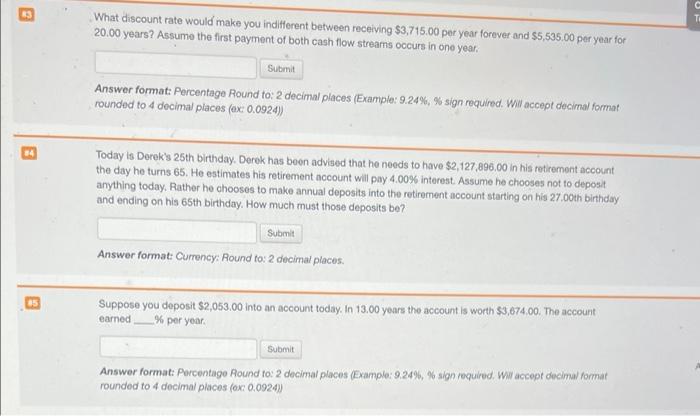

Question: B TO What discount rate would make you indifferent between receiving $3,715.00 per year forever and $5,535.00 per year for 20.00 years? Assume the first

B TO What discount rate would make you indifferent between receiving $3,715.00 per year forever and $5,535.00 per year for 20.00 years? Assume the first payment of both cash flow streams occurs in one year, Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex 0.0924)) 34 Today is Derek's 25th birthday. Derek has been advised that he needs to have $2,127,896.00 in his retirement account the day he turns 65. He estimates his retirement account will pay 4.00% interest. Assume he chooses not to deposit anything today. Rather he chooses to make annual deposits into the retirement account starting on his 27.00th birthday and ending on his 65th birthday. How much must those deposits be? Submit Answer format: Currency: Round to: 2 decimal places. a Suppose you deposit $2,053,00 into an account today. In 13.00 years the account is worth $3,674,00. The account earned___% per year Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Ww accopt duci format rounded to 4 decimal places (ox 0.0924)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts