Question: b. Using NPV analysis, should the company purchase the machine? Assume its cost of capital is 10%. Show all your workings. c. What is the

b. Using NPV analysis, should the company purchase the machine? Assume its cost of capital is 10%. Show all your workings.

c. What is the payback period for this project? If the company’s payback cut-off is 4 years, should the project be accepted? Show all your workings.

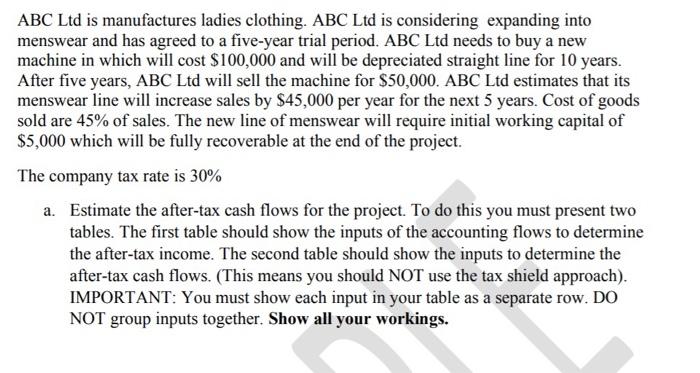

ABC Ltd is manufactures ladies clothing. ABC Ltd is considering expanding into menswear and has agreed to a five-year trial period. ABC Ltd needs to buy a new machine in which will cost $100,000 and will be depreciated straight line for 10 years. After five years, ABC Ltd will sell the machine for $50,000. ABC Ltd estimates that its menswear line will increase sales by $45,000 per year for the next 5 years. Cost of goods sold are 45% of sales. The new line of menswear will require initial working capital of $5,000 which will be fully recoverable at the end of the project. The company tax rate is 30% a. Estimate the after-tax cash flows for the project. To do this you must present two tables. The first table should show the inputs of the accounting flows to determine the after-tax income. The second table should show the inputs to determine the after-tax cash flows. (This means you should NOT use the tax shield approach). IMPORTANT: You must show each input in your table as a separate row. DO NOT group inputs together. Show all your workings.

Step by Step Solution

There are 3 Steps involved in it

Year 0 1 2 3 4 5 cost of machine 100000 investment in working capital 5000 sales 45000 45000 45000 4... View full answer

Get step-by-step solutions from verified subject matter experts