Question: (B) Using Residual Income Model (RIM) Step 1: Let us use the eamings from 2018 - 2022 to find the arithmetic average earnings growth rate

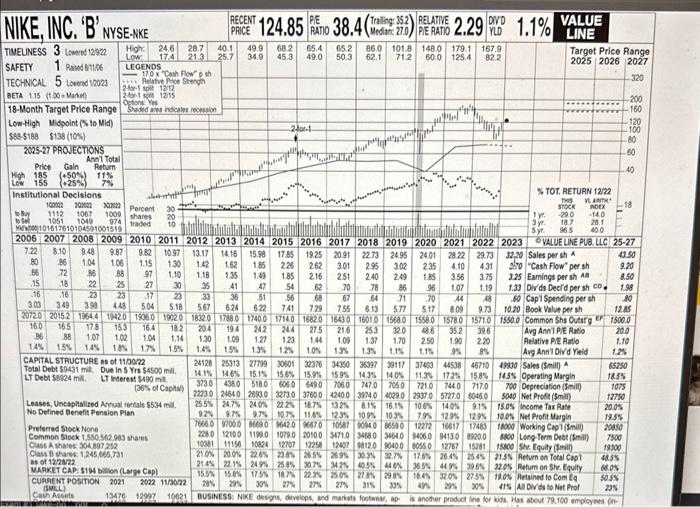

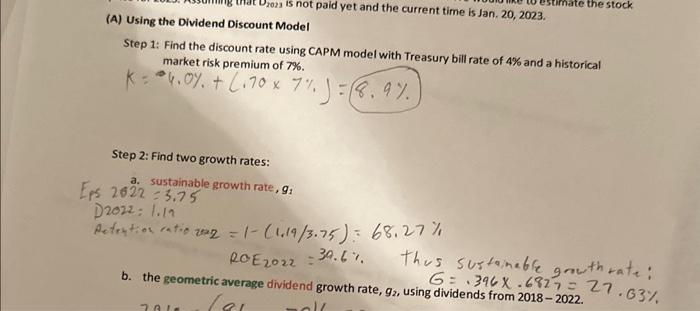

(B) Using Residual Income Model (RIM) Step 1: Let us use the eamings from 2018 - 2022 to find the arithmetic average earnings growth rate as g3. Step 2: Use discount rate found from the CAPM (Part (A) Step 1) and g3 (Part (B) Step1), the arithmetic average earnings growth rate, to fine the P2023. NIKE, INC. 'B' NYSE-NKE (A) Using the Dividend Discount Model Step 1: Find the discount rate using CAPM model with Treasury bill rate of 4% and a historical k=4.0%,+8.707%,8=9% Step 2: Find two growth rates: a. sustainable growth rate, gi 2622=3,75 2022=1.11 Lefrition catio ve2 =1(1.19/3.75)=68.27% ROE2022=39.6% Thus sustainate 9 auth tate: b. the geometric average dividend growth rate, g2, using dividends from 6=6820182022. 27.63% (B) Using Residual Income Model (RIM) Step 1: Let us use the eamings from 2018 - 2022 to find the arithmetic average earnings growth rate as g3. Step 2: Use discount rate found from the CAPM (Part (A) Step 1) and g3 (Part (B) Step1), the arithmetic average earnings growth rate, to fine the P2023. NIKE, INC. 'B' NYSE-NKE (A) Using the Dividend Discount Model Step 1: Find the discount rate using CAPM model with Treasury bill rate of 4% and a historical k=4.0%,+8.707%,8=9% Step 2: Find two growth rates: a. sustainable growth rate, gi 2622=3,75 2022=1.11 Lefrition catio ve2 =1(1.19/3.75)=68.27% ROE2022=39.6% Thus sustainate 9 auth tate: b. the geometric average dividend growth rate, g2, using dividends from 6=6820182022. 27.63%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts