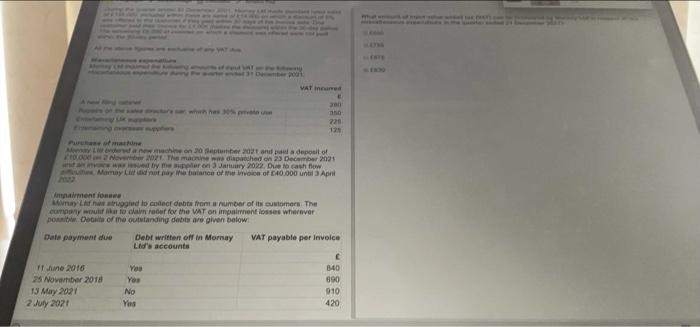

Question: b VAT incurred E when has 30% privalo u 200 050- 220 125 Purchase of machine Meenay Lt ordered a new machine on 20 September

VAT incurred E when has 30% privalo u 200 050- 220 125 Purchase of machine Meenay Lt ordered a new machine on 20 September 2021 and paid a deposit of 0.0002 November 2021. The machine was dispatched on 23 December 2021 dance was issued by the supplier on 3 January 2022. Due to cash flow Mamay Lidt did not pay the balance of the invoice of 40.000 until 3 Apri impairment fonas Momay Ltd has struggled to collect debts from a number of its customers. The company would like to claim redef for the VAT on impairment losses wherever possible Details of the outstanding debts are given below Date payment due Debt written off in Mornay VAT payable per invoice Ltd's accounts C Yes 11 June 2016 25 November 2018 May 2021 13 2 July 2021 You December pan No Yes 840 690 910 420 LLENTE SEX30 VAT incurred E when has 30% privalo u 200 050- 220 125 Purchase of machine Meenay Lt ordered a new machine on 20 September 2021 and paid a deposit of 0.0002 November 2021. The machine was dispatched on 23 December 2021 dance was issued by the supplier on 3 January 2022. Due to cash flow Mamay Lidt did not pay the balance of the invoice of 40.000 until 3 Apri impairment fonas Momay Ltd has struggled to collect debts from a number of its customers. The company would like to claim redef for the VAT on impairment losses wherever possible Details of the outstanding debts are given below Date payment due Debt written off in Mornay VAT payable per invoice Ltd's accounts C Yes 11 June 2016 25 November 2018 May 2021 13 2 July 2021 You December pan No Yes 840 690 910 420 LLENTE SEX30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts