Question: b. We should discount this Terminal Value back to Year 0. Determine the NPV of the project . Remember to net out any initial cash

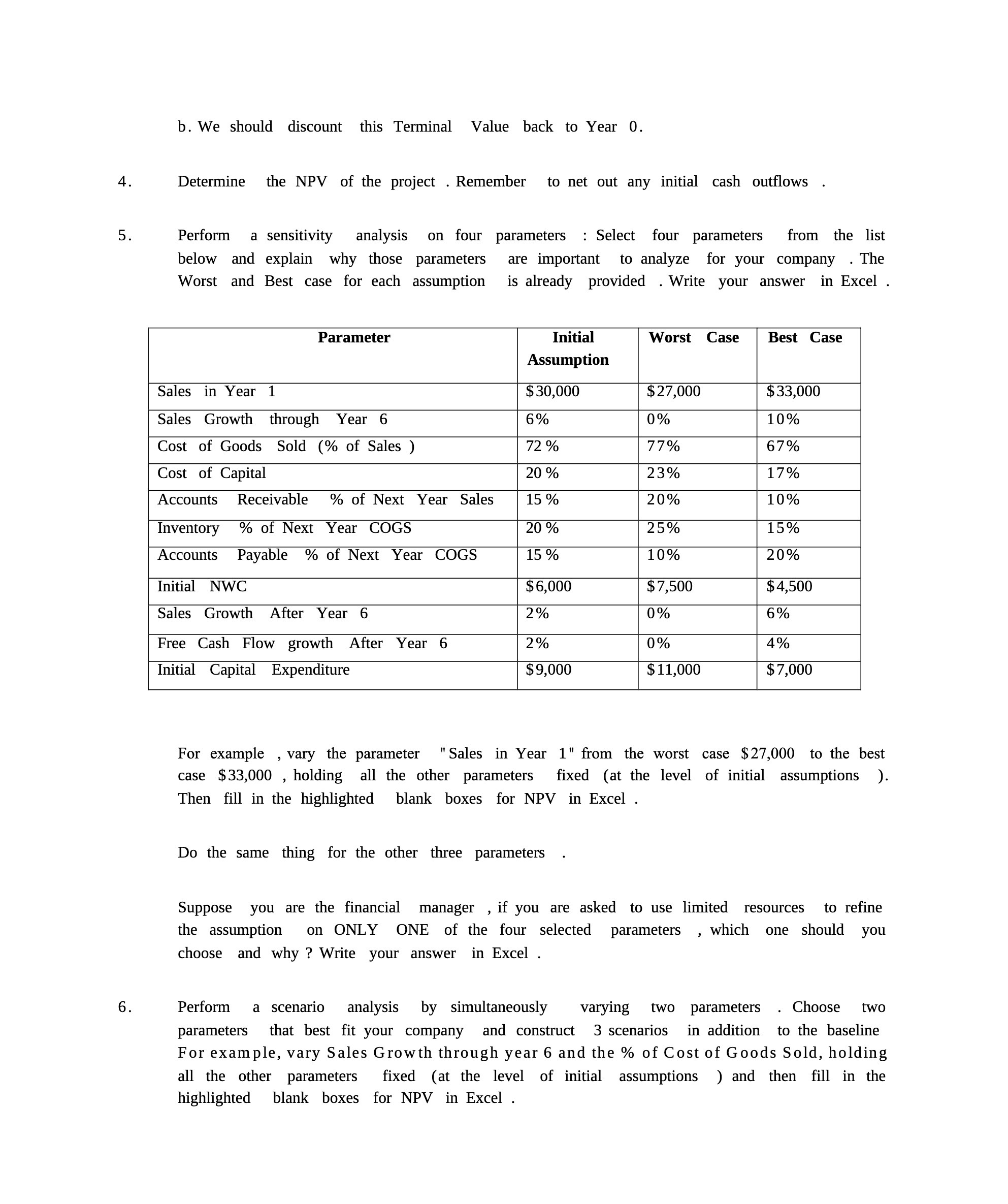

b. We should discount this Terminal Value back to Year 0. Determine the NPV of the project . Remember to net out any initial cash outows Perform a sensitivity analysis on four parameters : Select four parameters from the list below and explain why those parameters are important to analyze for your company . The Worst and Best case for each assumption is already provided . Write your answer in Excel . Parameter Initial Worst Case Best Case Assumption Sales in Year 1 $ 30,000 $ 27,000 $ 33,000 Sales Growth through Year 6 6% 0% 1 0% Cost of Goods Sold (% of Sales ) 72 % 77% 67% Cost of Capital 20 % 2 3 % 1 7% Accounts Receivable % of Next Year Sales 15 % 2 0 % 1 0% Inventory % of Next Year COGS 20 % 2 5 % 1 5% Accounts Payable % of Next Year COGS 15 % 10% 20% Initial NWC $ 6,000 $ 7,500 $ 4,500 Sales Growth After Year 6 2 % 0% 6% Free Cash Flow growth After Year 6 2 % 0% 4% Initial Capital Expenditure $ 9,000 $ 11,000 $ 7,000 For example ,vary the parameter case $33,000 , holding all the other parameters " Sales in Year 1" from the worst case $27,000 to the best fixed (at the level of initial assumptions ). Then fill in the highlighted blank boxes for NPV in Excel . Do the same thing for the other three parameters Suppose you are the financial manager , if you are asked to use limited to refine on ONLY ONE of the four selected parameters choose and why ? Write your answer in Excel , resources the assumption ,which one should you Perform a scenario analysis by simultaneously varying two parameters .Choose two parameters in addition For example, vary Sales Growth through year 6 and the % of Cost of Goods Sold, holding all the other parameters fixed (at the level of initial ) and then fill in the highlighted blank boxes for NPV in Excel . that best fit your company and construct 3 scenarios to the baseline assumptions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts