Question: b . What amount should be reported as accumulated depreciation for the consolidated entity at December 3 1 , ( 2 0 times

b What amount should be reported as accumulated depreciation for the consolidated entity at December times assuming Peace does not make the optional accumulated depreciation consolidation entry

Accumulated depreciation

$

c If Symbol reported capital stock outstanding of $ and retained earnings of $ on January X what amount did Peace pay to acquire its ownership of Symbol?

d What balance does Peace report as its investment in Symbol at December X

Investment balance

e What amount of intercorporate sales of inventory occurred in X

Intercorporate sales

$

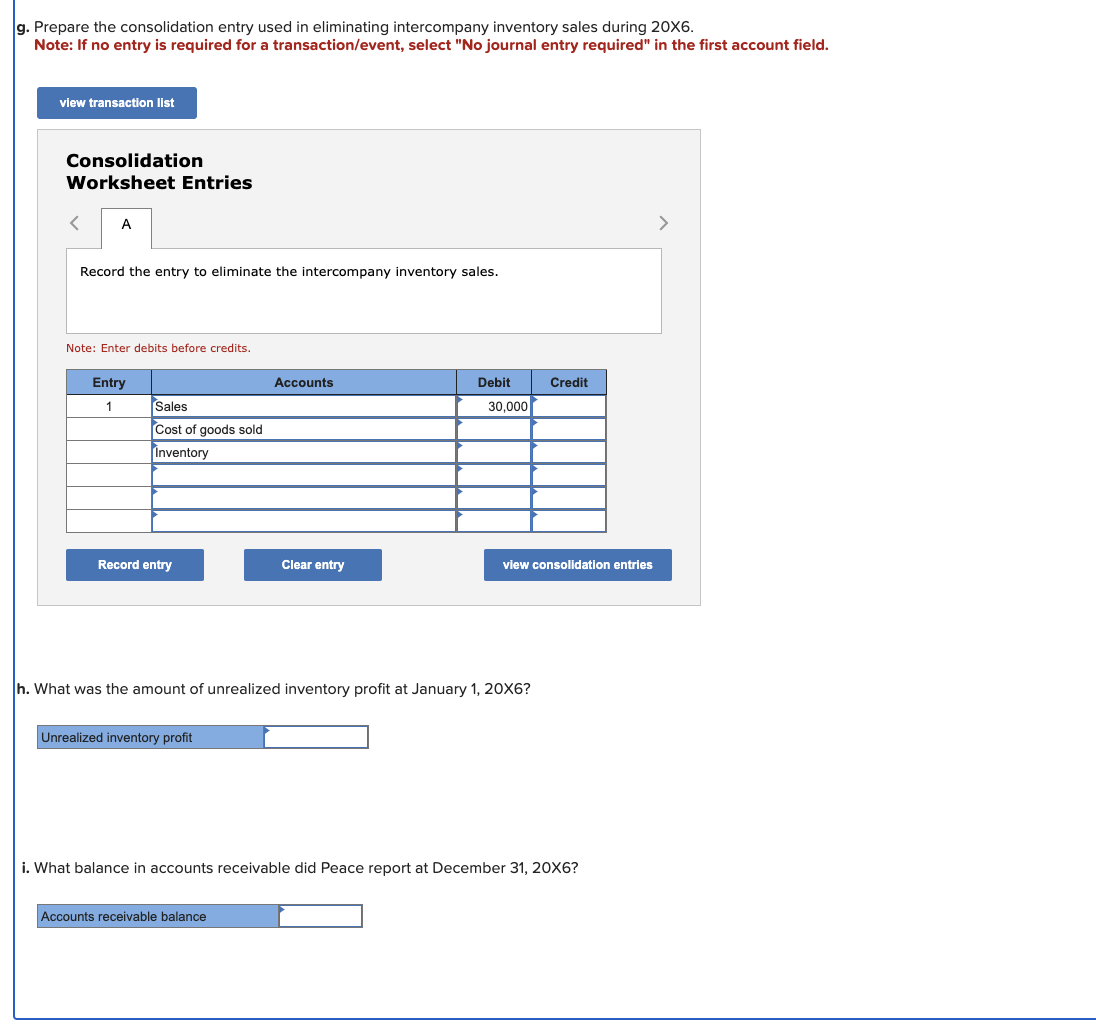

f What amount of unrealized inventory profit exists at December X g Prepare the consolidation entry used in eliminating intercompany inventory sales during X

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

Consolidation Worksheet Entries

A

Record the entry to eliminate the intercompany inventory sales.

Note: Enter debits before credits.

h What was the amount of unrealized inventory profit at January X

Unrealized inventory profit

i What balance in accounts receivable did Peace report at December X

Accounts receivable balance

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock