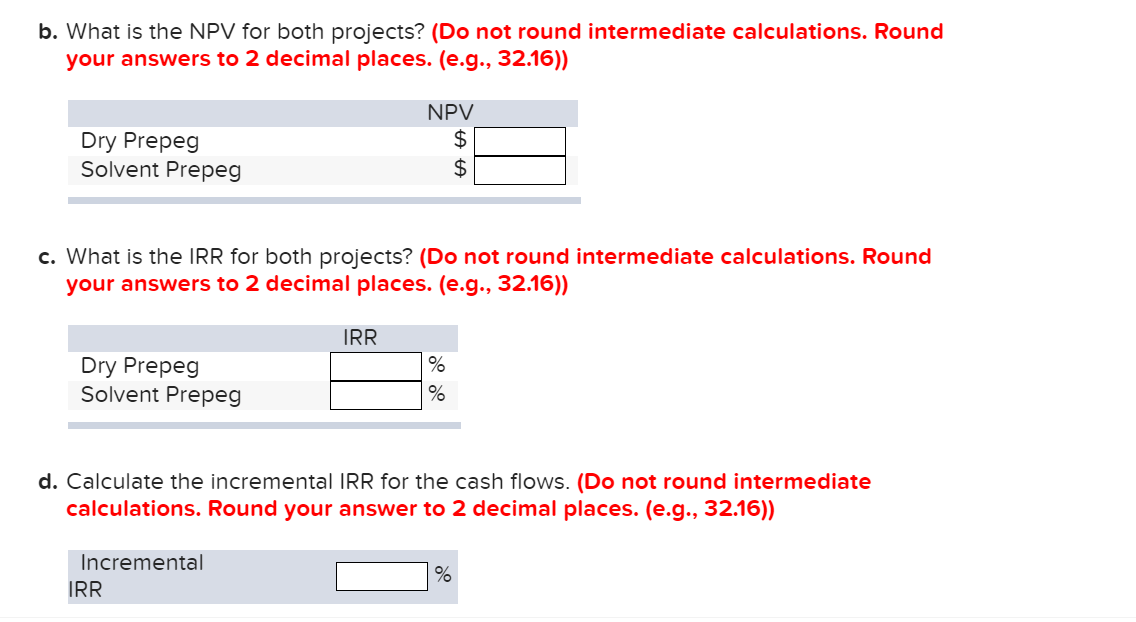

Question: b. What is the NPV for both projects? (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) Dry Prepeg Solvent

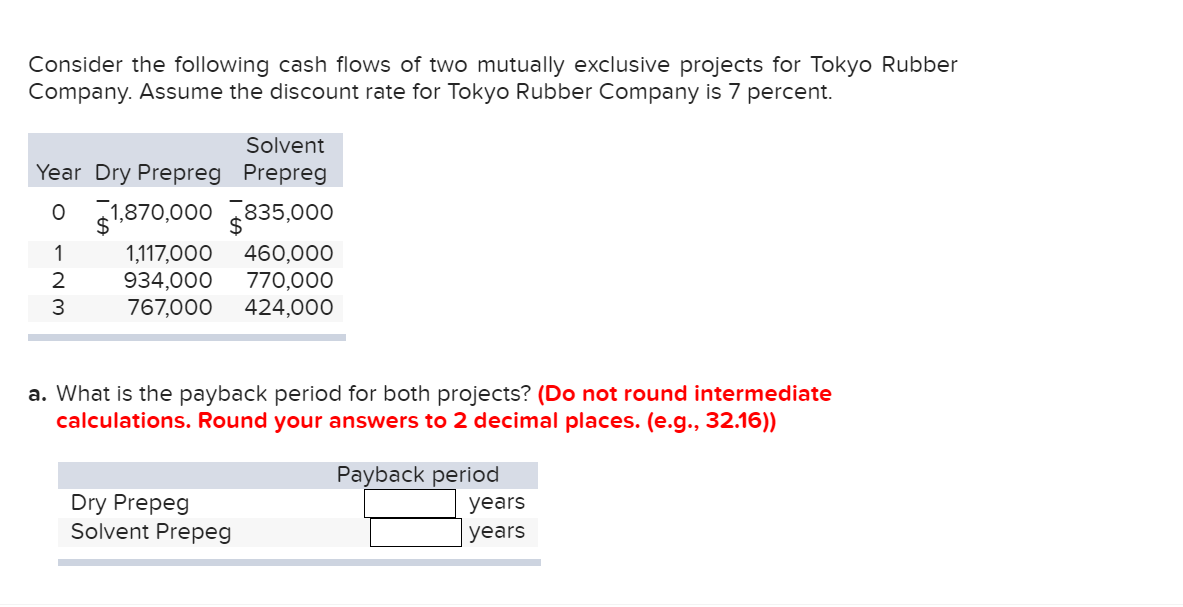

b. What is the NPV for both projects? (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) Dry Prepeg Solvent Prepeg NPV $ $ c. What is the IRR for both projects? (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) IRR Dry Prepeg Solvent Prepeg % % d. Calculate the incremental IRR for the cash flows. (Do not round intermediate calculations. Round your answer to 2 decimal places. (e.g., 32.16)) Incremental IRR % Consider the following cash flows of two mutually exclusive projects for Tokyo Rubber Company. Assume the discount rate for Tokyo Rubber Company is 7 percent. Solvent Year Dry Prepreg Prepreg 0 1,870,000 5835,000 $ 1 1,117,000 460,000 934,000 770,000 767,000 424,000 WN - a. What is the payback period for both projects? (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) Dry Prepeg Solvent Prepeg Payback period years years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts