Question: b. What would Timberline's maximum depreciation deduction be for 2022 assuming no bonus depreciation? Note: Round your intermediate calculations and final answer to the nearest

b. What would Timberline's maximum depreciation deduction be for 2022 assuming no bonus depreciation?

Note: Round your intermediate calculations and final answer to the nearest whole dollar amount.

c. What would Timberline's maximum depreciation deduction be for 2022 if the machinery cost $3,740,000 instead of $464,000 and assuming no bonus depreciation?

Note: Round your intermediate calculations and final answer to the nearest whole dollar amount.

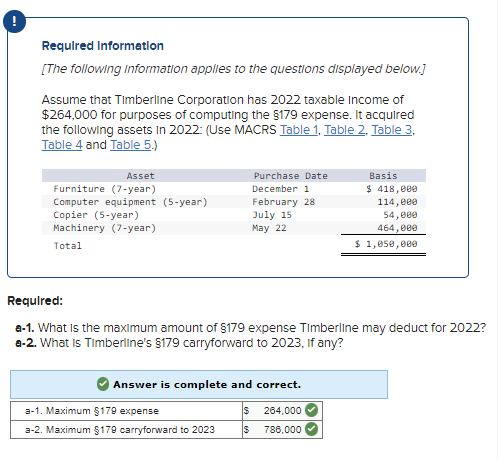

Required Information [The following information applles to the questions displayed below.] Assume that TImberline Corporation has 2022 taxable Income of $264,000 for purposes of computing the $179 expense. It acquired the following assets in 2022: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) Required: a-1. What is the maximum amount of 179 expense Timberline may deduct for 2022 ? a.2. What is Timberline's $179 carryforward to 2023 , If any

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts