Question: b) When the cornet company was formed three division three years ago, the president of the company told the division managers that an annual bonus

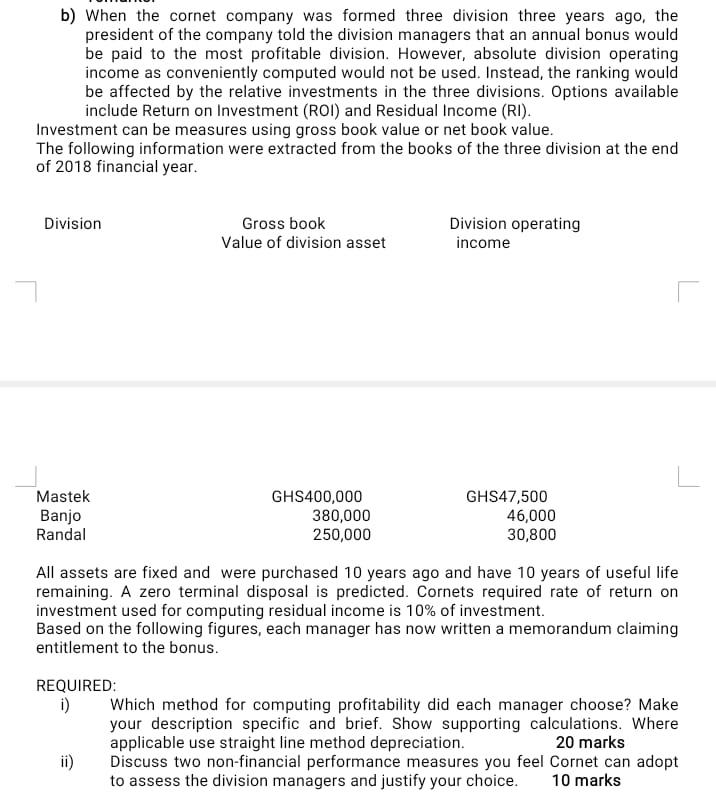

b) When the cornet company was formed three division three years ago, the president of the company told the division managers that an annual bonus would be paid to the most profitable division. However, absolute division operating income as conveniently computed would not be used. Instead, the ranking would be affected by the relative investments in the three divisions. Options available include Return on Investment (ROI) and Residual Income (RI). Investment can be measures using gross book value or net book value. The following information were extracted from the books of the three division at the end of 2018 financial year. DivisionGrossbookincomeDivisionoperating All assets are fixed and were purchased 10 years ago and have 10 years of useful life remaining. A zero terminal disposal is predicted. Cornets required rate of return on investment used for computing residual income is 10% of investment. Based on the following figures, each manager has now written a memorandum claiming entitlement to the bonus. REQUIRED: i) Which method for computing profitability did each manager choose? Make your description specific and brief. Show supporting calculations. Where applicable use straight line method depreciation. 20 marks ii) Discuss two non-financial performance measures you feel Cornet can adopt to assess the division managers and justify your choice. 10 marks b) When the cornet company was formed three division three years ago, the president of the company told the division managers that an annual bonus would be paid to the most profitable division. However, absolute division operating income as conveniently computed would not be used. Instead, the ranking would be affected by the relative investments in the three divisions. Options available include Return on Investment (ROI) and Residual Income (RI). Investment can be measures using gross book value or net book value. The following information were extracted from the books of the three division at the end of 2018 financial year. DivisionGrossbookincomeDivisionoperating All assets are fixed and were purchased 10 years ago and have 10 years of useful life remaining. A zero terminal disposal is predicted. Cornets required rate of return on investment used for computing residual income is 10% of investment. Based on the following figures, each manager has now written a memorandum claiming entitlement to the bonus. REQUIRED: i) Which method for computing profitability did each manager choose? Make your description specific and brief. Show supporting calculations. Where applicable use straight line method depreciation. 20 marks ii) Discuss two non-financial performance measures you feel Cornet can adopt to assess the division managers and justify your choice. 10 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts