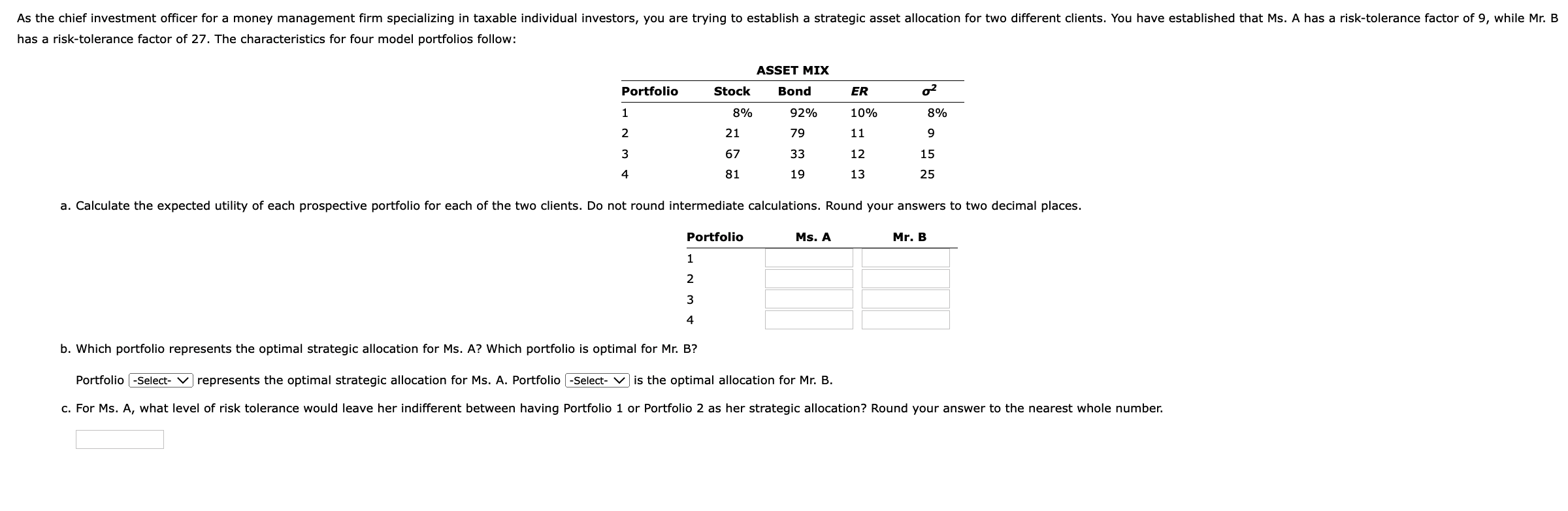

Question: b. Which portfolio represents the optimal strategic allocation for Ms. A? Which portfolio is optimal for Mr. B? Portfolio represents the optimal strategic allocation for

b. Which portfolio represents the optimal strategic allocation for Ms. A? Which portfolio is optimal for Mr. B? Portfolio represents the optimal strategic allocation for Ms. A. Portfolio is the optimal allocation for Mr. B. b. Which portfolio represents the optimal strategic allocation for Ms. A? Which portfolio is optimal for Mr. B? Portfoli presents the optimal strategic allocation for Ms. A. Portfolio is the optimal allocation for Mr. B. C. I risk tolerance would leave her indifferent between having Portfolio 1 or Portfolio 2 as her strategic allocation? Round your answer to the nearest whole number. b. Which portfolio represents the optimal strategic allocation for Ms. A? Which portfolio is optimal for Mr. B? Portfolio -Select- represents the optimal strategic allocation for Ms. A. Portfoli c. For Ms. A, what level of risk tolerance would leave her indifferent between havi the optimal allocation for Mr. B. 'ortfolio 2 as her strategic allocation? Round your answer to the nearest whole number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts