Question: (b) X Your answer is incorrect. Assuming a 20% tax rate, how many cakes will Sarah Allen have to sell if she wants to earn

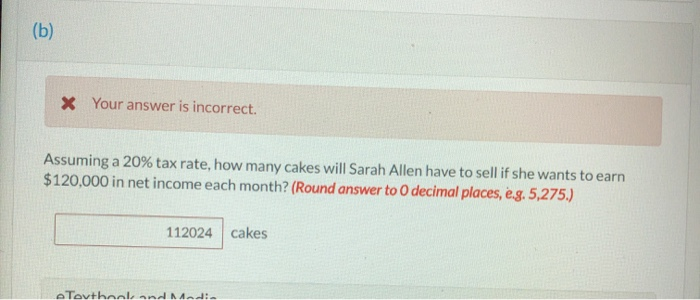

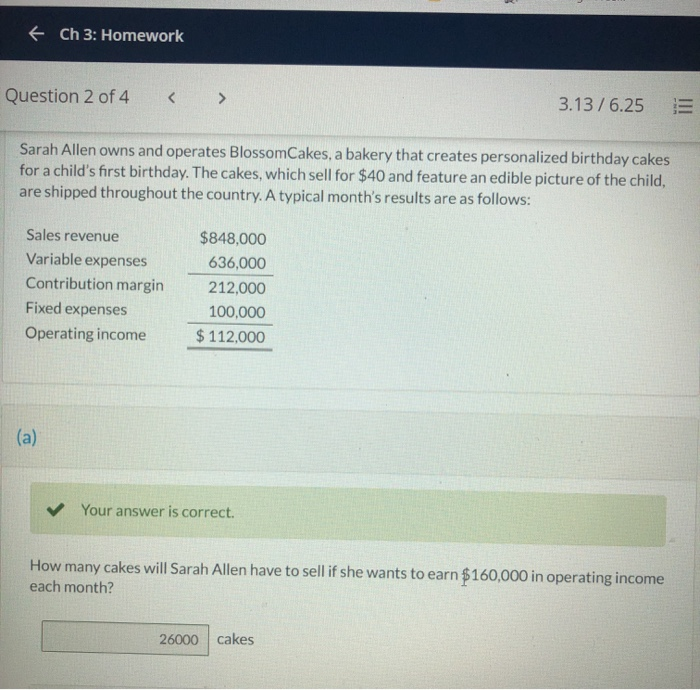

(b) X Your answer is incorrect. Assuming a 20% tax rate, how many cakes will Sarah Allen have to sell if she wants to earn $120,000 in net income each month? (Round answer to 0 decimal places, e.g. 5,275.) 112024 cakes Tovthonland Midi f Ch 3: Homework Question 2 of 4 3.13/ 6.25 Sarah Allen owns and operates Blossom Cakes, a bakery that creates personalized birthday cakes for a child's first birthday. The cakes, which sell for $40 and feature an edible picture of the child, are shipped throughout the country. A typical month's results are as follows: Sales revenue Variable expenses Contribution margin Fixed expenses Operating income $848,000 636,000 212,000 100,000 $ 112.000 (a) Your answer is correct. How many cakes will Sarah Allen have to sell if she wants to earn $160,000 in operating income each month? 26000 cakes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts