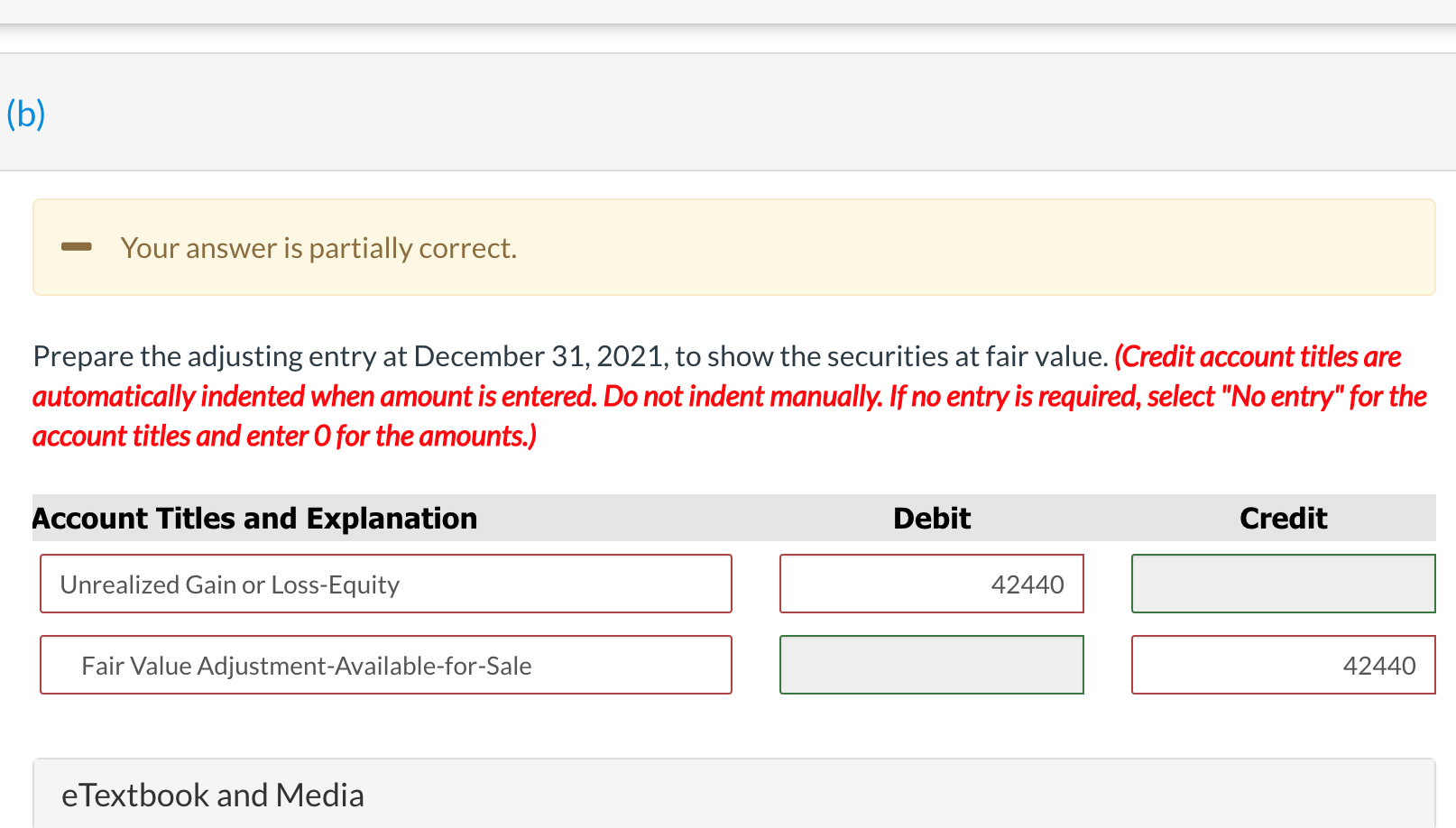

Question: (b) - Your answer is partially correct. Prepare the adjusting entry at December 31, 2021, to show the securities at fair value. (Credit account titles

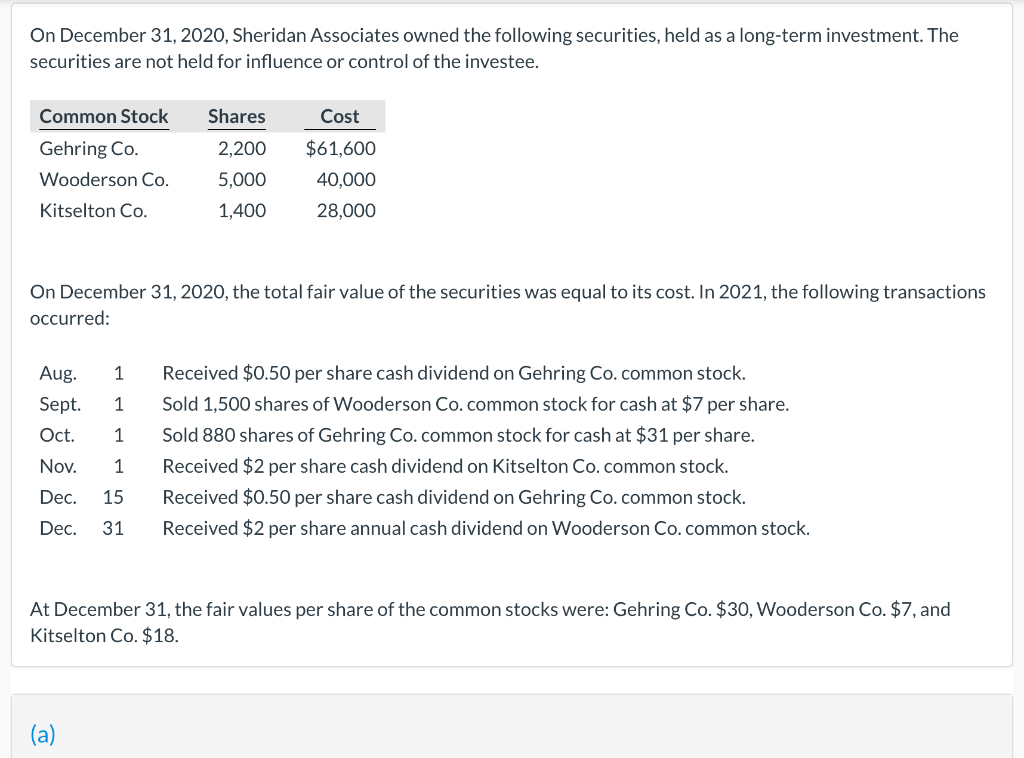

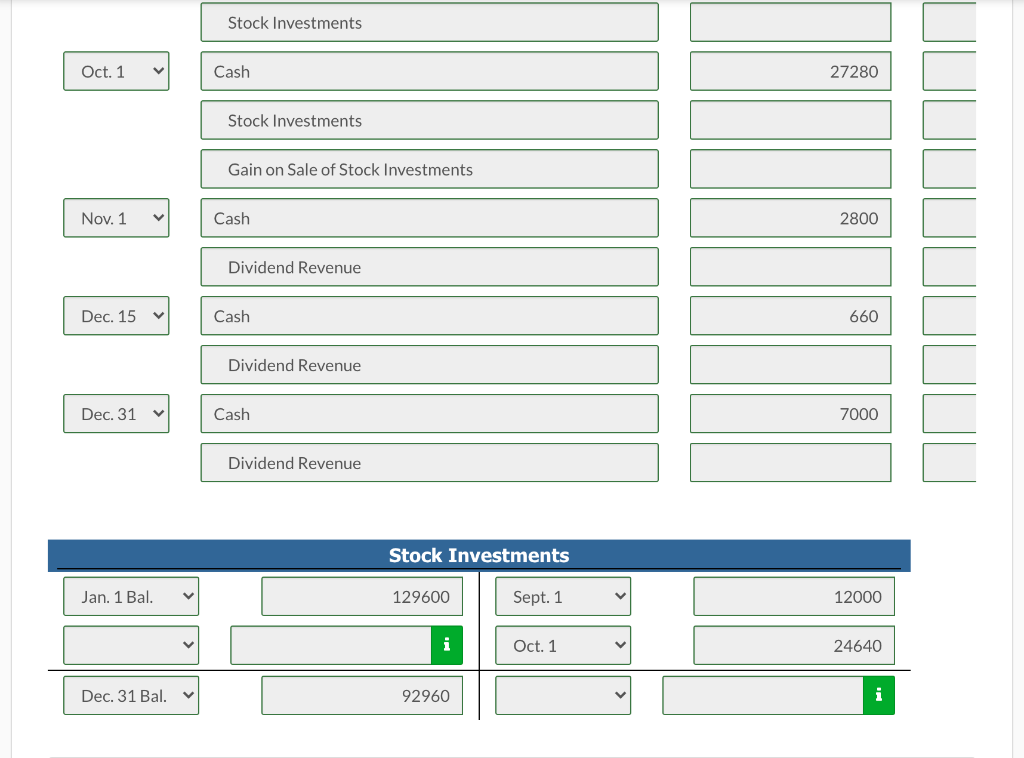

(b) - Your answer is partially correct. Prepare the adjusting entry at December 31, 2021, to show the securities at fair value. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit Unrealized Gain or Loss-Equity 42440 Fair Value Adjustment-Available-for-Sale 42440 e Textbook and Media On December 31, 2020, Sheridan Associates owned the following securities, held as a long-term investment. The securities are not held for influence or control of the investee. Cost Common Stock Gehring Co. Wooderson Co. Shares 2,200 5,000 1,400 $61,600 40,000 28,000 Kitselton Co. On December 31, 2020, the total fair value of the securities was equal to its cost. In 2021, the following transactions occurred: 1 Aug. Sept. Oct. 1 1 Received $0.50 per share cash dividend on Gehring Co.common stock. Sold 1,500 shares of Wooderson Co. common stock for cash at $7 per share. Sold 880 shares of Gehring Co. common stock for cash at $31 per share. Received $2 per share cash dividend on Kitselton Co. common stock. Received $0.50 per share cash dividend on Gehring Co.common stock. Received $2 per share annual cash dividend on Wooderson Co. common stock. Nov. 1 Dec. 15 Dec. 31 At December 31, the fair values per share of the common stocks were: Gehring Co. $30, Wooderson Co. $7, and Kitselton Co. $18. (a) Stock Investments Oct. 1 Cash 27280 Stock Investments Gain on Sale of Stock Investments Nov. 1 Cash 2800 Dividend Revenue Dec. 15 Cash 660 Dividend Revenue Dec. 31 Cash 7000 Revenue Stock Investments Jan. 1 Bal. 129600 Sept. 1 12000 i Oct. 1 24640 Dec. 31 Bal. 92960

Step by Step Solution

There are 3 Steps involved in it

To adjust the securities to fair value at December 31 2021 we should follow these steps Remaining Sh... View full answer

Get step-by-step solutions from verified subject matter experts