Question: B1. Financial statement analysis A. B. C. D. E. Provides useful information to shareholders but not to debt holders. Is limited to internal use by

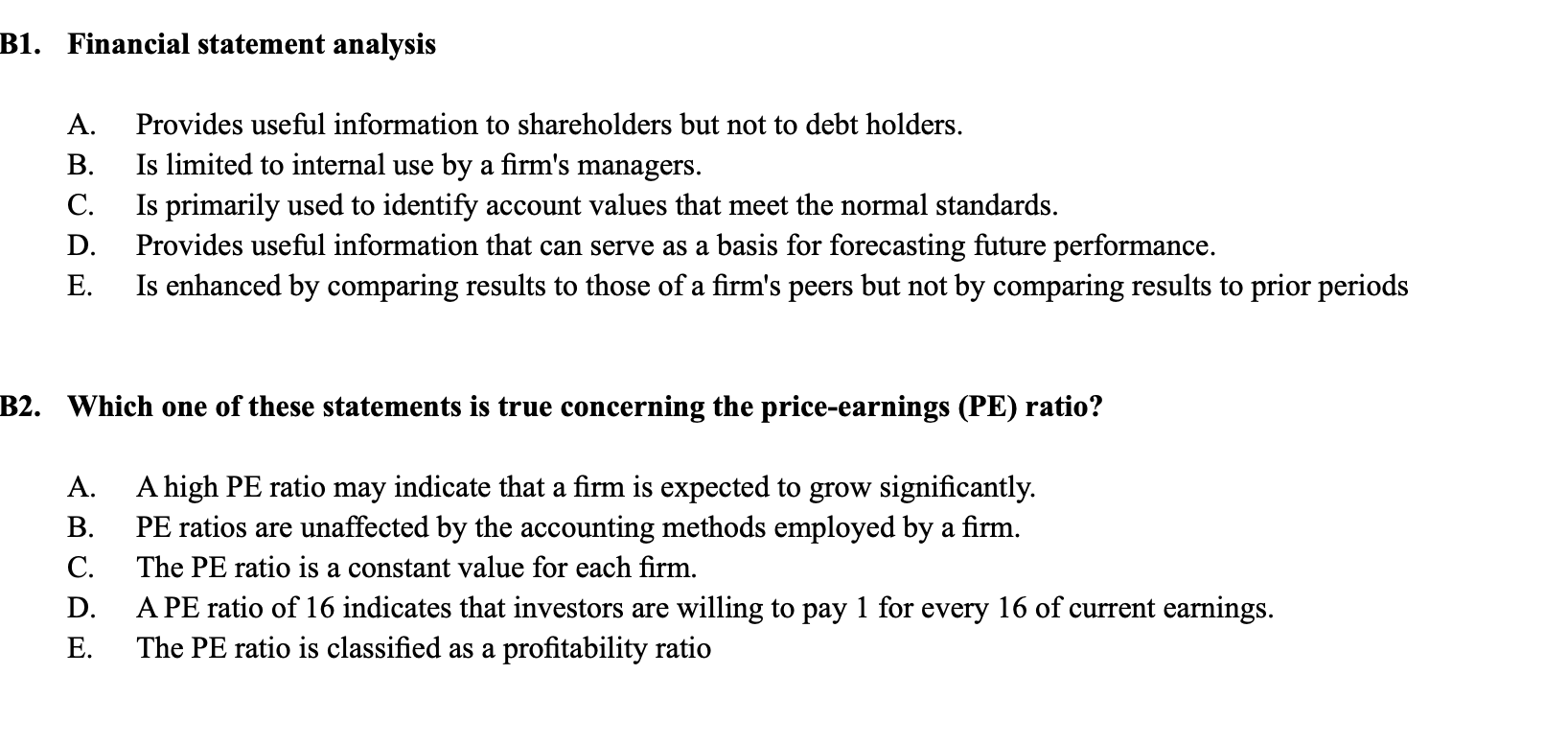

B1. Financial statement analysis A. B. C. D. E. Provides useful information to shareholders but not to debt holders. Is limited to internal use by a firm's managers. Is primarily used to identify account values that meet the normal standards. Provides useful information that can serve as a basis for forecasting future performance. Is enhanced by comparing results to those of a firm's peers but not by comparing results to prior periods B2. Which one of these statements is true concerning the price-earnings (PE) ratio? A. B. C. D. E. A high PE ratio may indicate that a firm is expected to grow significantly. PE ratios are unaffected by the accounting methods employed by a firm. The PE ratio is a constant value for each firm. A PE ratio of 16 indicates that investors are willing to pay 1 for every 16 of current earnings. The PE ratio is classified as a profitability ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts